We all know that through investing in Public Provident Fund scheme (PPF), one can claim deduction of upto Rs. 1.5 lacs under Section 80C of the Income Tax Act. But we really do not know what this PPF is and how can you save your money from taxes through PPF. Read this blog to know all the things related to PPF.

What is Public provident fund scheme?

The PPF scheme was launched in the year 1968 by the National Savings Institute under the Ministry of Finance. The main objective of the scheme is to promote small savings among individuals and provide returns on their savings. The PPF scheme offers an attractive rate of interest and no tax is required to be paid on the interest income generated on PPF amount.

Who can open PPF Account?

The PPF account can be opened by resident individuals or HUFs. The non residents cannot open a PPF and therefore, are not eligible to claim deduction of PPF under Section 80C.

Also Read: 10 Ways To Save Your Taxes!

Where to open the PPF Account?

The PPF could be opened either at a nationalized bank or post office. However, now some private banks are also providing the facility of opening a PPF Account.

What are the documents required to open PPF Account?

The documents required for opening of PPF Account are:

– Application form for opening of PPF Account

– Identity proof such as Aadhaar Card, PAN Card, etc

– Nomination form

– Address proof

– Signature proof

– 2 passport size photos

How is the interest on PPF amount calculated?

The interest on PPF amount is calculated annually on compounded basis. Further, this interest amount is calculated on the lowest balance invested between the fifth and the last date of the month. This is why it is advisable to invest your amount in the month of April, to claim the full deduction on PPF amount.

Also Read: Everything You Need To Know About Tax Saving Fixed Deposits

When can you withdraw money or close a PPF Account?

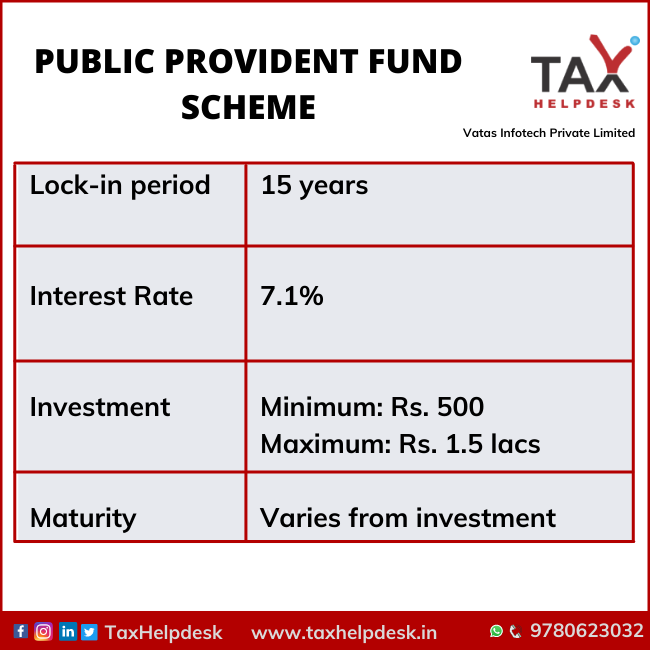

As a general rule, the money from Public Provident Fund scheme Account cannot be withdrawn before the completion of 15 years from the opening of PPF Account. Once the tenure of 15 years is completed, the person can withdraw money or close his PPF Account. Having stated that, the premature withdrawal of PPF amount of up to 50% of the account balance is allowed once, on completion of 5 years of the opening of PPF Account.

The minimum and the maximum amount that can be invested in PPF are Rs. 500 and Rs. 1.5 lacs respectively in a financial year.

Yes, there is a lock-in period of 15 years for investing in PPF. However, under certain conditions, premature withdrawal of PPF amount can be allowed on completion of 5 years.

Yes, once the account has been opened, you need to deposit money in PPF Account during each year till the completion of 15 years.

No, the PPF Account cannot be opened jointly. It can be opened only in the name of individual.

Yes, there is a clause of nomination in PPF Account and the name of nominee can be provided either at the time of opening of account or subsequently at any point of time before the completion of 15 years.

If you want to know more about PPF or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!