Investments under Section 80C have dual objectives – firstly, to make investments and secondly, to save taxes. Accordingly, the taxes so saved and investments so made can be used in the future.

Various investments under Section 80C

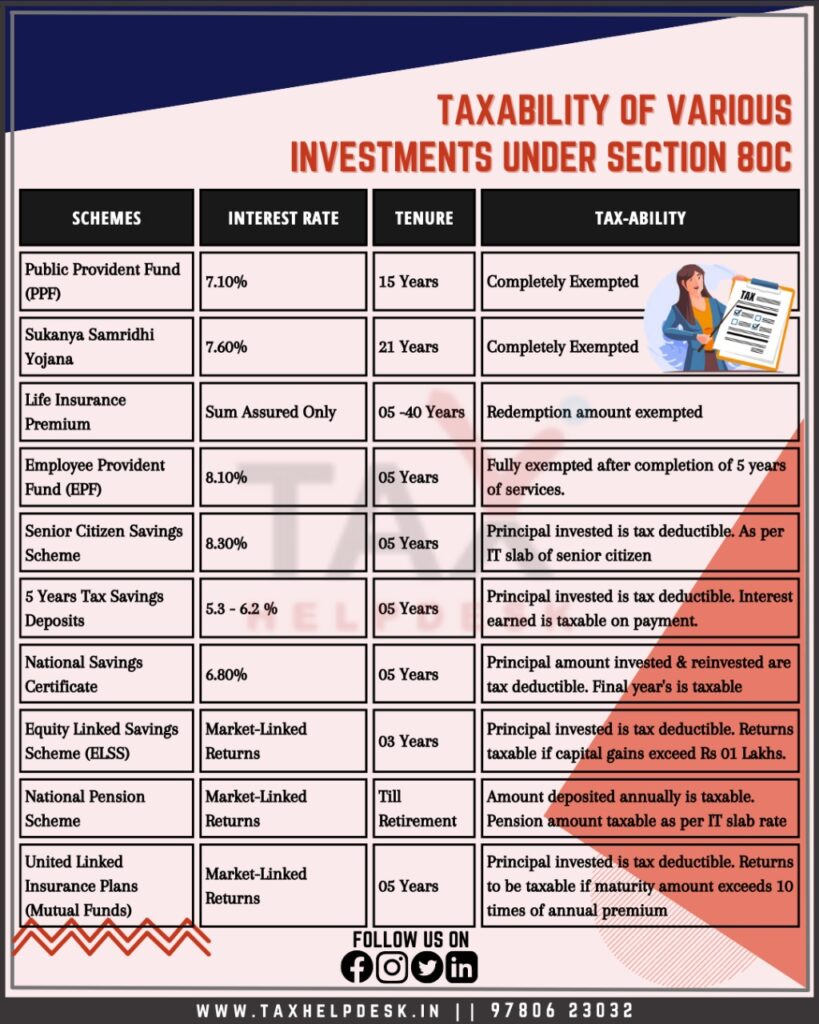

There are various investments under Section 80C through which an assessee can reduce its tax liability of up to Rs. 1.5 lacs. These investments are as follows:

Public Provident Fund Scheme

Public Provident Fund or PPF Scheme is a long-term investment plan backed by the Government of India. Further, one can make investments in PPF by opening an account and making a minimum deposit of Rs. 500 to a maximum of Rs. 1.5 lacs. In addition to this, the PPF Scheme has a lock-in period of 15 years and the current interest rate is 7.1%. Apart from this, the contribution, as well as interest amount on PPF, is free from tax.

Also Read: Ways to Save Taxes in 2022

Sukanya Samridhi Yojana

Sukanya Samridhi Yojana or SSY is one of the most effective investments under Section 80C. It is so because it is a government scheme that aims at the development of the girl child. And, it was launched in 2015 as part of the ‘Beti Bachao, Beti Padhao’ campaign. Accordingly, one with the girl child can open an SSY account in the post offices as well as certain banks in India. The minimum deposit is Rs. 250 and the maximum deposit is Rs. 1.5 lacs. This account is operational till the girl child attains the age of 21 years. However, there is an option of partial withdrawal after the girl turns 18 years to meet the education expenses of the girl child.

Also Read: A Quick Look At Deductions Under Section 80C To Section 80U

Life Insurance Premiums

Life Insurance Premiums, commonly known as LIC Premiums are the top-most popular investments under Section 80C. The reason is that the life insurance premiums not only provide life coverage to the individual but also protect his family and accordingly, give them financial independence. Furthermore, through life insurance premiums, one can claim a maximum deduction of Rs. 1.5 lacs. However, the amount of deduction depends upon the date of the policy, which is as follows:

| Particulars | Life Insurance Premium | Premium Criteria |

|---|---|---|

| Section 10(10D) | The insurance policy issued on or after 1st April 2003 but on or before 31st March 2012 | The premium payable, exceeds 20% of the actual capital sum assured, for any of the years (during the term of the policy). |

| Section 10(10D) | The insurance policy issued on or after 1st April 2012 | The premium payable, exceeds 10% of the actual capital sum assured, for any of the years (during the term of the policy). |

Employee Provident Fund Scheme

Employee Provident Fund or EPF Scheme is a long-term retirement scheme, which is available to individuals having income from salary. Under this scheme, both employer and employee make an equal contribution of 12% of the employee’s basic salary plus dearness allowance. Consequently, when the employee retires, the total amount so accumulated along with the interest is payable to the employee as a lump-sum amount. Further, the contribution is tax-exempt under Section 80C.

Senior Citizens Savings Scheme

The Senior Citizens Savings Scheme is also eligible for deduction under Section 80C. And, a senior citizen of the age 60 years and above can open this account. Moreover, a citizen of 55 years of age but less than 60 years attaining VRS or superannuation can also open this account within one month of receiving the amount. Further, the lock-in period of Senior Citizens Savings Scheme is 5 years and the current rate of interest applicable is 8.30%.

Also Read: Things You Should Do To Save Your Taxes

5 Years Tax Savings Fixed Deposits

The 5 Years Tax Saving Fixed Deposits are similar to the fixed deposits. However, the only and main difference is that you can claim a deduction of up to Rs. 1.5 lacs under Section 80C on these tax saver FDs. Apart from this, the tax saver FDs are safe instruments for investing and the rate of interest on these FDs varies from bank to bank. However, the current rate of interest is between 5.3% – 6.2%

Also Read: Deductions On Interest On Deposits In Savings Account: Section 80TTA

National Savings Certificate

National Savings Certificate or NSC is yet another investment option under Section 80C, which is backed by the government of India. Accordingly, there is a guarantee on returns. The current rate of interest applicable on NSC is 6.80% and it has a lock-in period of 5 years.

Equity Linked Savings Scheme

Equity Linked Savings Scheme or ELSS is a mutual funds scheme that invests at least 80% of the assets in the stock market. These are also known as tax saving mutual funds because they are eligible for deductions under Section 80C. Additionally, they have a lock-in period of only 3 years and the returns vary as per the market standards.

Also Read: Tax Exemption In Salary: Everything That You Need To Know

National Pension Scheme

National Pension Scheme or NPS is a scheme that allows working professionals as well as earners from the other sectors to benefit from a pension, post-retirement. Accordingly, any Indian between the age of 18 to 60 can open an NPS account. Investments up to Rs. 1.5 lakh in this scheme are eligible for tax deductions under Section 80C of the Income Tax Act. Apart from this, a person can also avail an additional tax benefit on investments of Rs. 50,000 under Section 80CCD(1B). Further, the lock-in period is till the age of retirement and the current rate of interest applicable is 7.10%.

Also Read: Taxability of Pension: All You Need to Know

Unit Linked Insurance Plans

Unit Linked Insurance Plans or ULIPs are the effective investments under Section 80C that provide investors with investments as well as insurance in a single package. Under the ULIPs, a portion of the investment is in life insurance and the remaining is either in equities, debt, or a mixture of both.

Also Read: All You Need To Understand About Mutual Fund Taxation SIP

Consequently, under Section 80C, the ULIP premium amount is eligible for a tax deduction of up to Rs. 1.5 lakh every year. Additionally, at the time of maturity, the returns on the policy are exempt from income tax under Section 10(10D).

If you want to know more about tax-saving options, then leave a comment below. For more information, follow us on Facebook, Twitter, Instagram, and LinkedIn.