Tax collected at source or TCS is a tax payable by the seller, who in turn collects it from lessor or buyer. The transactions related to tax collected at source are dealt under Section 206C of the Income Tax Act.

Who can collect tax at source?

The sellers are authorized collect tax at source. Further, under the Income Tax Act, following are persons which have been classified as sellers for TCS:

– Central Government

– State Government

– Local Authority

– Statutory Corporation or Authority

– Company

– Partnership firms

– Co-operative societies

– Any person/HUF who has a total sales/gross receipts that exceeds the specified monetary restricts as mentioned under the Section 44AB in the last year.

Also Read: Section 194C: TDS On Payments To Contractors

From whom tax is to be collected at source?

The sellers are authorized collect tax at source. Further, under the Income Tax Act, following are persons which have been classified as sellers for TCS:

– Central Government

– State Government

– Local Authority

– Statutory Corporation or Authority

– Company

– Partnership firms

– Co-operative societies

– Any person/HUF who has a total sales/gross receipts that exceeds the specified monetary restricts as mentioned under the Section 44AB in the last year.

Also Read: A Comprehensive Guide: TDS On Rent (Section 194I)

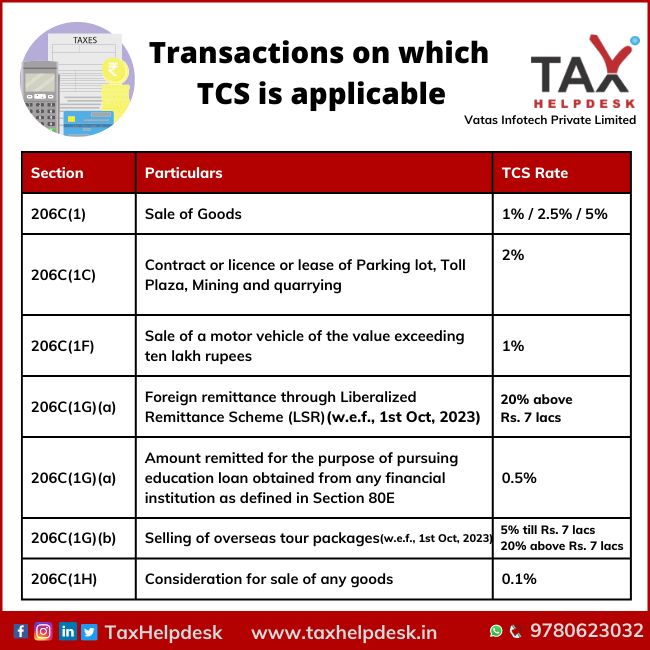

Transactions on which TCS is applicable?

I – Sale of Goods [Section 206C(1)]

The tax is to be collected at source by seller for certain goods that are utilized for trading purposes. These certain goods with applicable tax rates are as follows:

| Section | Applicability | Sale of Goods | TCS Rate | When is TCS to be collected? |

|---|---|---|---|---|

| 206C(1) | Applicable to all persons including individuals & HUFs* | Alcoholic liquor for human consumption | 1% |

At the time of debiting the amount payable by the buyer OR At the time of receipt of such amount from buyer, Whichever is earlier |

| Tendu leaves | 5% | |||

| Timber obtained under a forest lease | 2.5% | |||

| Timber obtained by any mode other than a forest lease | 2.5% | |||

| Any other forest produce (not being timber/tendu leaves) | 2.5% | |||

| Scrap | 1% | |||

| Minerals, being coal or lignite or iron ore | 1% |

Note:

– No TCS is to be collected if the goods are to be utilised for the purposes of manufacturing, processing or producing articles or things or for the purposes of generation of power

– Seller means the Central Government, a State Government or any local authority or corporation or authority established by or under a Central, State or Provincial Act, or any company or firm or co-operative society and also includes an individual or a Hindu undivided family whose total sales, gross receipts or turnover from the business or profession carried on by him exceed [one crore rupees in case of business or fifty lakh rupees in case of profession]during the financial year immediately preceding the financial year in which the goods of the nature specified in the Table above are sold.

II – Contract or licence or lease etc [Section 206C(1C)]

The seller has to collect tax on granting of lease or license or for entering into contract for transferring any right or interest in whole or in part in any parking lot or toll plaza or mine or quarry, to another person, other than a public sector company. The applicable tax rates for the same are as follows:

| Section | Applicability | Contract or licence or lease etc | TCS Rate | When is TCS to be collected? |

|---|---|---|---|---|

| 206C(1C) | Applicable to all persons other than Public Sector Company | Parking lot | 2% |

At the time of debiting the amount payable by the licensee or lessee OR At the time of receipt of such amount from the licensee or lessee, Whichever is earlier |

| Toll Plaza | 2% | |||

| Mining and quarrying | 2% |

Also Read: Section 194C: TDS On Payments To Contractors

III – Sale of a motor vehicle of the value exceeding Rs. 10 lacs [Section 206C(1F)]

As per this provision, if the seller receives any amount as consideration for sale of motor vehicle exceeding Rs. 10 lacs, then tax is to be collected at source. The TCS rates for sale of motor vehicle (value > Rs. 10 lacs) are as follows

| Section | Particulars | Applicability | TCS Rate | When is TCS to be collected? |

|---|---|---|---|---|

| 206C(1F) | Sale of a motor vehicle of the value exceeding ten lakh rupees | Applicable to all persons except Government, High Commission, etc* | 1% |

At the time of debiting the amount payable by the buyer OR At the time of receipt of such amount from buyer, Whichever is earlier |

Note:

Following persons are outside the ambit of Section 206C(1F):

– Central Government, a State Government and an embassy, a High Commission, legation, commission, consulate and the trade representation of a foreign State

– Local authority

– Public sector company which is engaged in the business of carrying passengers.

IV – Foreign remittance through Liberalized Remittance Scheme (LSR) [Section 206C(1G)(a)]

The tax collected at source is to be done by authorized dealer for the remittances made out of India under the Liberalized Remittance Scheme of the RBI. The applicable tax rates on remittances are as follows:

| Section | Particulars | Applicability | TCS Rate | When is TCS to be collected? |

|---|---|---|---|---|

| 206C(1G)(a) | Foreign remittance through Liberalized Remittance Scheme (LSR) | Applicable in case the amount exceeds Rs. 7 lacs |

20% (Union Budget, 2023)(w.e.f., 01.07.2023) |

At the time of debiting the amount payable by the buyer OR At the time of receipt of such amount from buyer, Whichever is earlier |

| 206C(1G)(a) | Amount remitted for the purpose of pursuing education loan obtained from any financial institution as defined in Section 80E | Applicable in case the amount exceeds Rs. 7 lacs | 0.5% |

At the time of debiting the amount payable by the buyer OR At the time of receipt of such amount from buyer, Whichever is earlier |

The above provisions are not applicable, if the buyer is:

– Liable to deduct TDS

– Central Government, a State Government, an embassy, a High Commission, a legation, a commission, a consulate, the trade representation of a foreign State, a local authority

Also Read: TDS on Foreign Remittances

V – Selling of overseas tour packages [Section 206C(1G)(b)]

Overseas tour package means any tour package which offers visit to a country or countries or territory or territories outside India. It also includes expenses for travel or hotel stay or boarding or lodging or any other expenditure of similar nature. Having stated that, the seller who sells these packages has to collect tax at source. The applicable tax rates for these packages are as follows:

| Section | Particulars | Applicability | TCS Rate | When is TCS to be collected? |

|---|---|---|---|---|

| 206C(1G)(b) | Selling of overseas tour packages | Applicable in case the amount exceeds Rs. 7 lacs |

5% till Rs. 7 lacs 20% above Rs.7 lacs (w.e.f., 1st October, 2023) |

At the time of debiting the amount payable by the buyer OR At the time of receipt of such amount from buyer, Whichever is earlier |

VI – Consideration for sale of any goods [Section 206C(1H)]

Section 206C(1H) states that any seller who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeds Rs. 50 lacs in any previous year has to collect tax at source. The applicable tax rates for consideration of sale of any goods are as follows:

| Section | Particulars | Applicability | TCS Rate | When is TCS to be collected? |

|---|---|---|---|---|

| 206C(1H) | Consideration for sale of any goods | Applicable in case the value exceeds Rs. 50 lacs (Seller has total sales, gross receipts or turnover from business above Rs. 10 crore in previous FY) | 0.1% | At the time of receipt of such amount |

Note:

The goods are other than the goods being exported out of India or goods covered above.

Due dates for filing TCS Return

| Quarter | Period | Due Date of Filing |

|---|---|---|

| 1st Quarter | 1st April to 30th June | 15th July |

| 2nd Quarter | 1st July to 30th September | 15th Ocitober |

| 3rd Quarter | 1st October to 31st December | 15th January |

| 4th Quarter | 1st January to 31st March | 15th May |

Interest and late fees under TCS

| Section | Particulars | Interest and late fees |

|---|---|---|

| Section 206C(7) | Interest for non-collection or non-deposit of TCS | 1% per month or part of month |

| Section 271H | Penalty for non-furnishing of TCS return |

Minimum penalty – Rs. 10,000 Maximum penalty Rs. 1 lac |

| Section 276BB | Punishment for non-deposit of TCS | Fine and imprisonment for a minimum period of 3 months and a maximum period up to 7 years |

If you want to know more about TCS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Important Aspects: Transactions on which TCS is...