Area up to 12 nautical miles in the sea consider a part of the nearest coastal State for the purpose of GST registration. This is where the nearest point of appropriate base line is located. Area beyond 12 nautical miles and up to 200 nautical miles, which don’t cover under any Union Territory consider as a separate Union territory for the GST law.

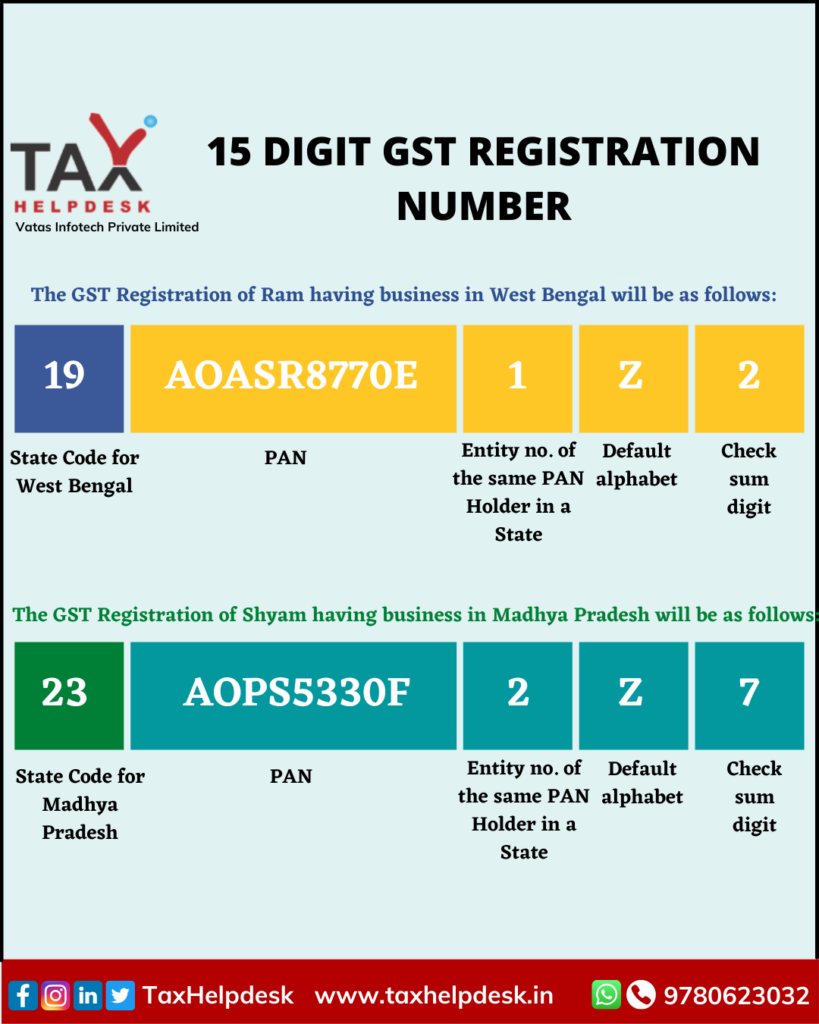

GST Registration Number or GSTIN

In Goods and services tax (GST) registration, the supplier is allotted a 15-digit GST identification number called “GSTIN”. A certificate of registration incorporating there in this GSTIN is made available to the applicant on the GSTN common portal. The first 2 digits of the GSTIN is the State code, next 10 digits are the PAN of the legal entity. Furthermore, the next two digits are for entity code, and the last digit is check sum number. Registration under GST is not tax specific which means that there is a single registration for all the taxes i.e. CGST, SGST/UTGST, IGST and cesses.

Also Read: Know Documents Required For GST Registration

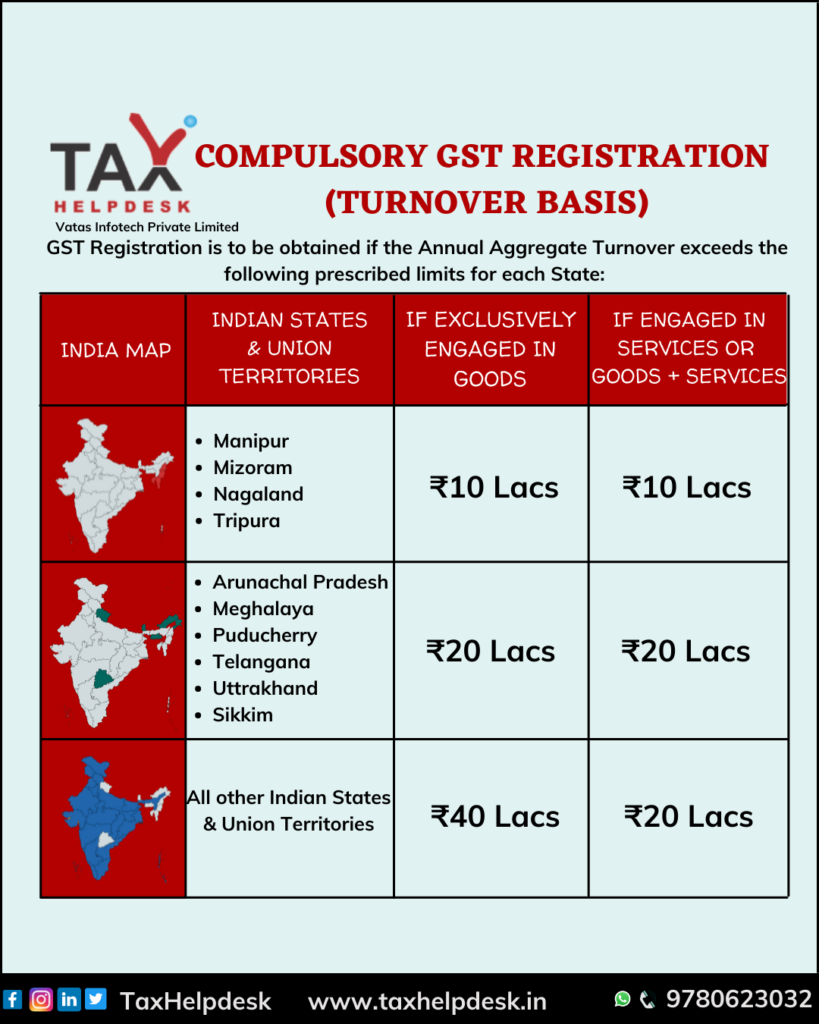

When to apply for GST Registration?

Businesses having Annual Aggregate Turnover (AATO) of more than the prescribed limit. This limit is as per their business in the relevant State need to obtain GST Registration. The specific limit as per the State is as follows:

Now, comes the main questions:

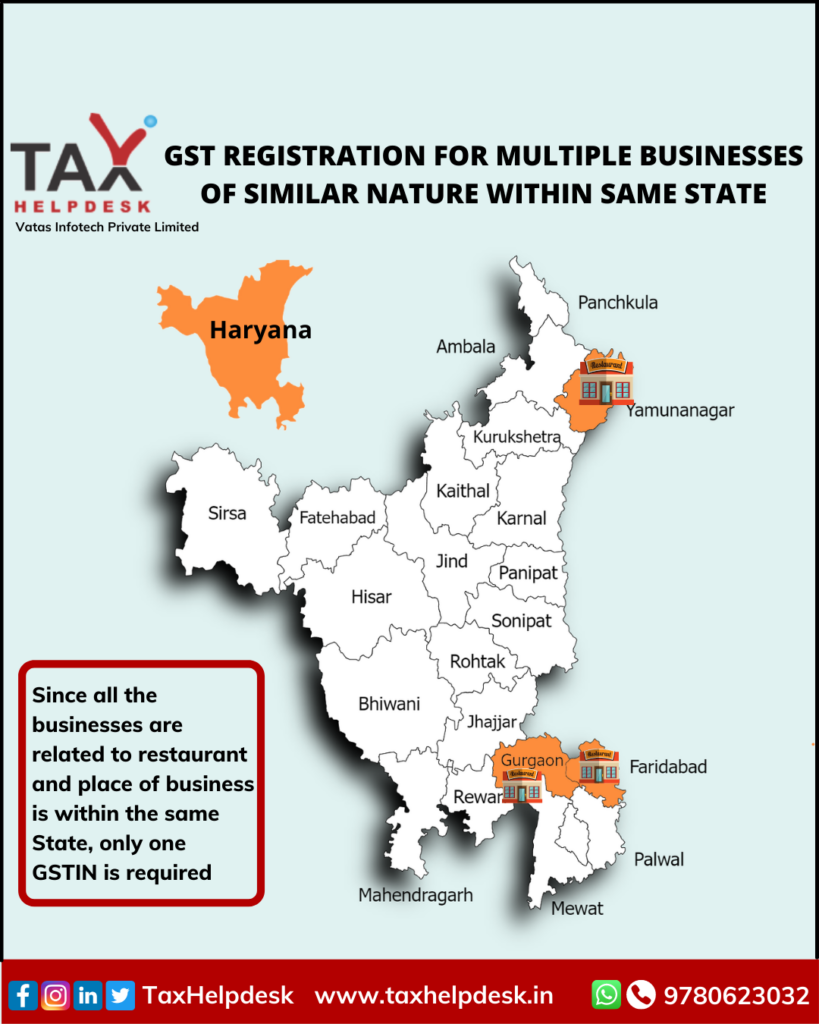

Do you need to obtain multiple GST Registrations if you operate the businesses in a single State?

The person not require to obtain multiple GST Registrations, if he operates businesses of similar nature in a single State. In that case, his one GSTIN will suffice for other businesses also, which are within the same State.

Also Read: Qualifications For GST Registration

For instance, Suresh is having multiple restaurants at Yamunanagar, Gurgaon and Faridabad which are in the State of Haryana. He will require to obtain only one GST Registration number. Since his nature of business is same and place of businesses are within the same State.

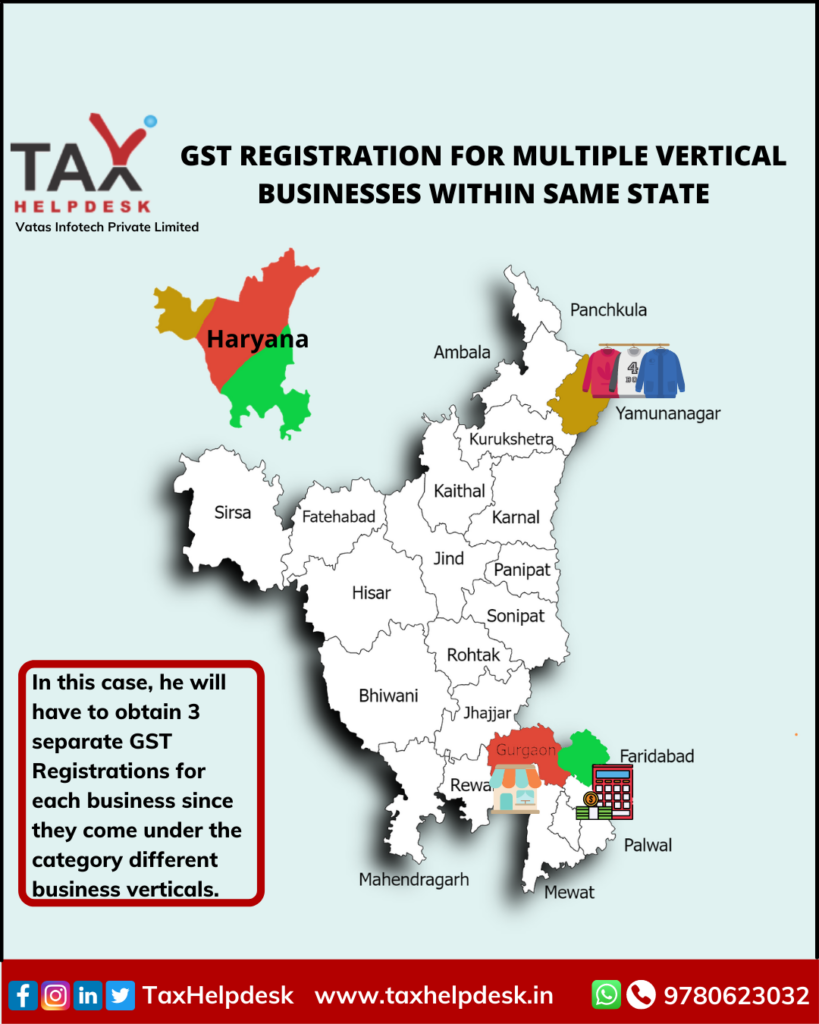

However, is the person is having multiple and different business verticals within the same state. Then he need to obtain different GSTIN for each different business even if they are within the same state. Business verticals are distinguishable components of an enterprise that is involve in the supply of individual goods or services or a group of goods or services. These are subject to risks and returns that are different from those of the other business verticals.

For instance, Ramesh is having business of textiles in Yamunanagar, restaurant in Gurgaon and accounting firm in Faridabad which are in the State of Rajasthan. In this case, he will have to obtain 3 separate GST Registrations for each business since they come under the category different business verticals.

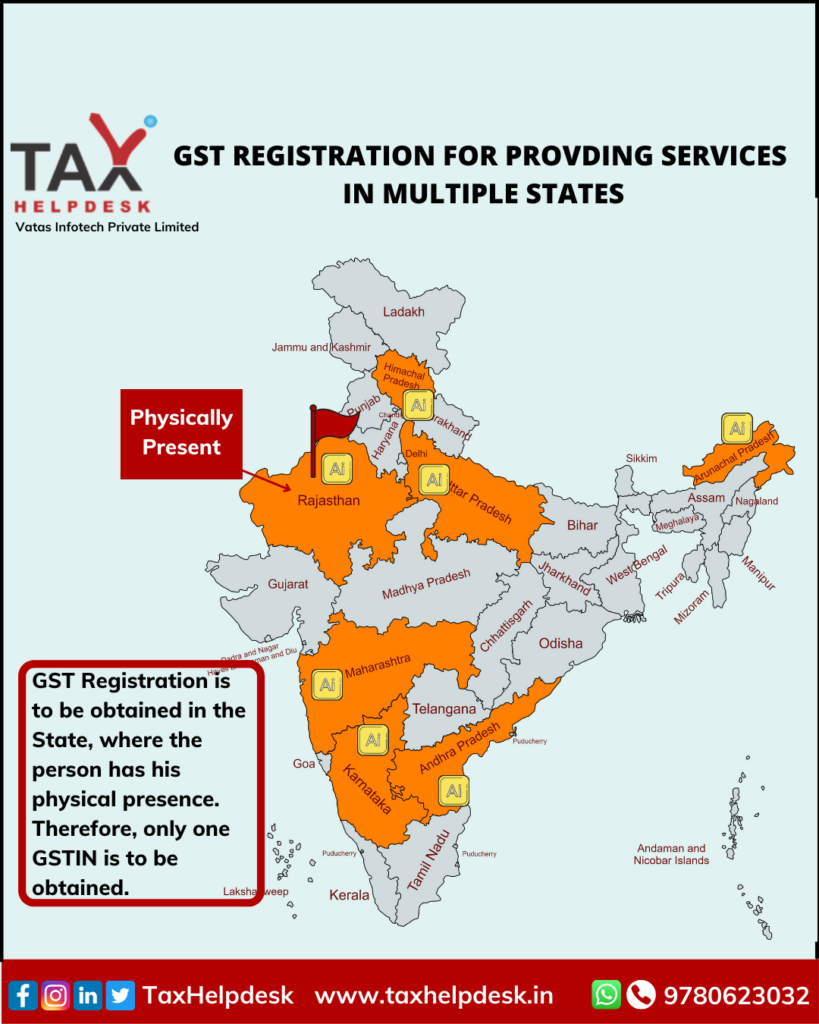

Are multiple GST Registrations required to be obtained in case of providing services in multiple states?

If the person is a service provider, who is providing services in multiple states without any physical presence there. Then he need to obtain multiple GST Registration for each State. He need to get GST Registration only for that State in which he has his physical presence or headquarter.

For instance, Rohan is running a software company in Rajasthan and he provides his software services through online platform in various parts of India. In such a case, he need to obtain only one GSTIN i.e., in the state of Rajasthan (where he is physically present).

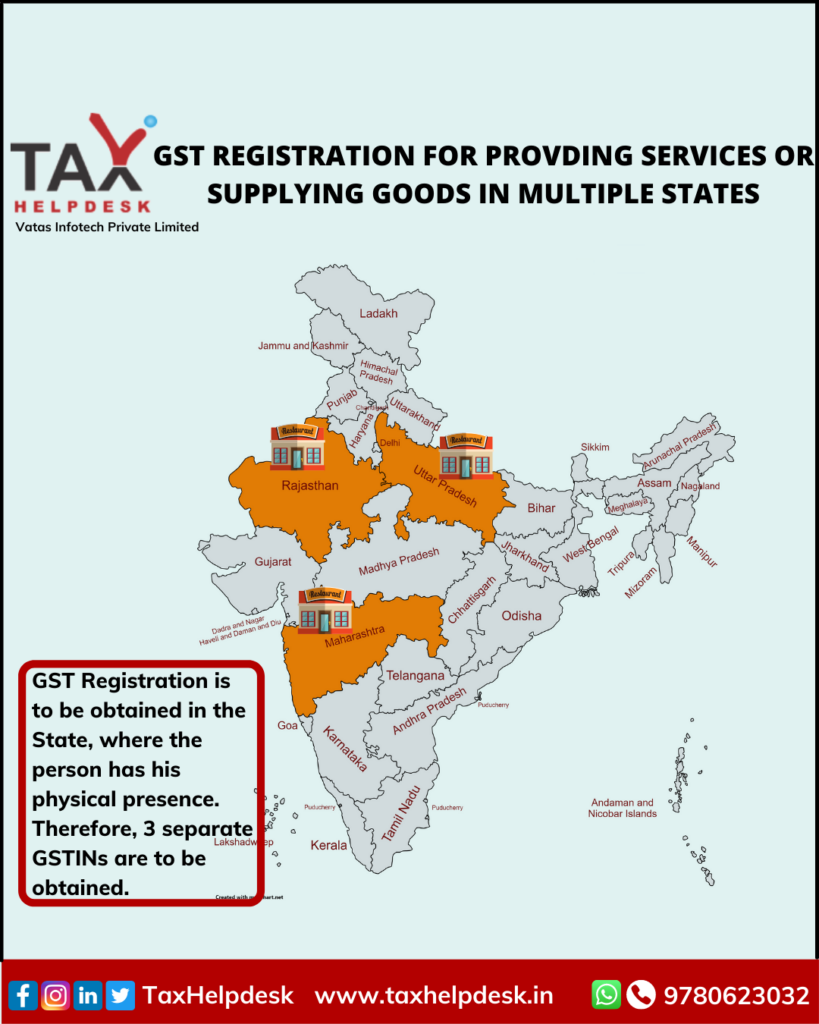

But if the person has presence in other states as service provider or goods supplier. Then he will be required to obtain GST Registration in all the States he operates at. Therefore, he will have to obtain individual Goods and services tax Registration in all the States, where he has his place of business.

Take for example, Sohan is having his restaurants in Jaipur (Rajasthan), Lucknow (Uttar Pradesh) and Mumbai (Maharashtra). Since, he is operating his business in 3 different States, he need to obtain different Goods and services tax Registrations for each States.

If you want to know more about Goods and services tax in India or take GST consultation from TaxHelpdesk experts, then leave a message below in the comment box or drop us a message on any of these platforms: WhatsApp, Facebook, Instagram, LinkedIn and Twitter. For tax related information and updates, you can also join our WhatsApp group and Telegram Channel.

Disclaimer: The maps have been used for pictorial purposes only.

The views of the author are persona and Taxhelpdesk does not owe any liability.