TDS deduction from income does not mean that TDS compliances have come to an end for a person. The persons are required to comply with compliances related to tax deduction at source.

What is TDS deduction?

TDS deduction is said to be when a person, who is liable to make payment of specified nature to any other person deducts tax at source. Having said this, the tax deduction at source amount is be remitted into the account of the Central Government.

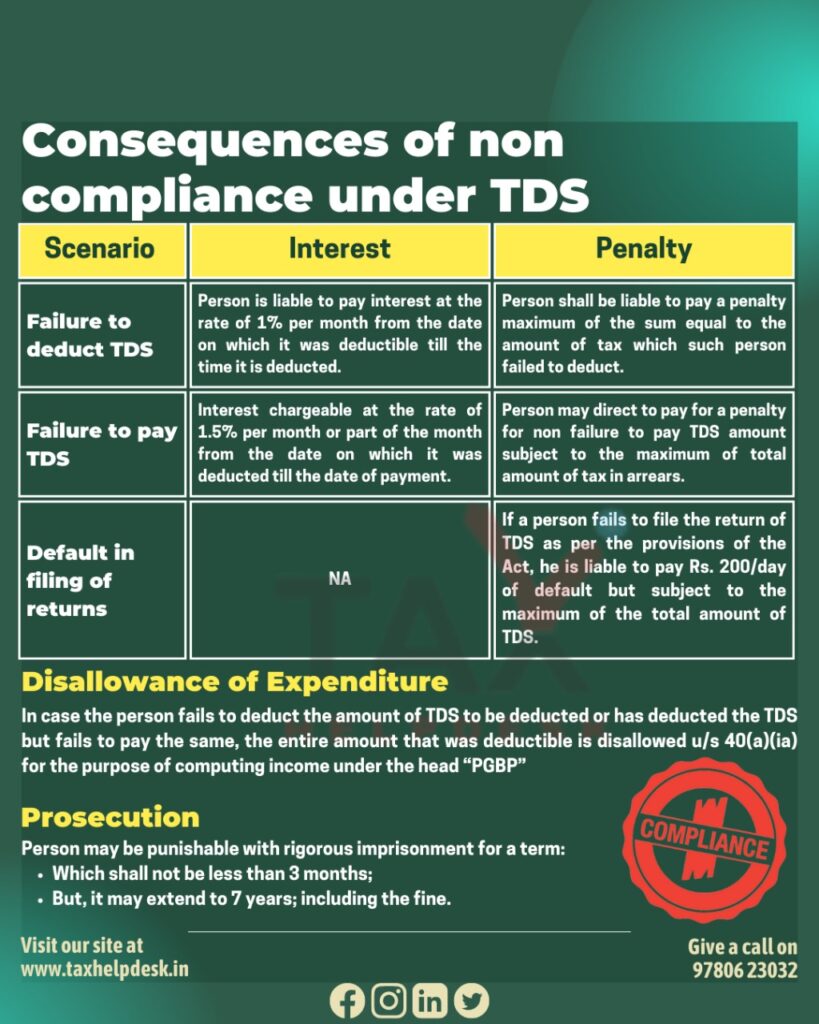

Interest and Penalties related to TDS non compliance

Interest and penalty can be levied if a person in case the

– Person liable to deduct TDS does not deduct TDS at all

– Person has deducted the TDS but failed to pay whole or part of tax to the credit of Government

– Person has defaulted in filing of TDS Returns (no interest is levied in this case)

Also Read: TDS deduction on Salary

The first two points are related to default in payment of TDS. Therefore, the interest and penalty for both of them are same, which is as follows:

Consequences if default is made in payment of TDS

A deductor would face the following consequences if he fails to deduct TDS or after deducting the same fails to deposit it to the credit of Central Government’s account:

Disallowance of expenditure: As per Section 40(a)(i) of the Income Tax Act, any sum (other than salary) payable outside India or to a non-resident, which is chargeable to tax in India in the hands of the recipient, shall not be allowed to be deducted if it is paid without deduction of tax at source or if tax is deducted but is not deposited with the Central Government till the due date of filing of return.

However, if tax is deducted or deposited in the subsequent year, as the case may be, the expenditure shall be allowed as deduction in that year.

Similarly, as per Section 40(a)(ia), any sum payable to a resident, which is subject to deduction of tax at source, would attract 30% disallowance if it is paid without deduction of tax at source or if tax is deducted but is not deposited with the Central Government till the due date of filing of return.

Also Read: Types of TDS Certificates

However, where in respect of any such sum, tax is deducted or deposited in subsequent year, as the case may be, the expenditure so disallowed shall be allowed as deduction in that year.

Levy of interest: As per Section 201 of the Income Tax Act, if a deductor fails to deduct tax at source or after the deducting the same fails to deposit it to the account of Central Government then he shall be deemed to be an assessee-in-default and liable to pay simple interest as follows:

(i) at one per cent for every month or part of a month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is deducted; and

(ii) at one and one-half per cent for every month or part of a month on the amount of such tax from the date on which such tax was deducted to the date on which such tax is actually paid.

Levy of Penalty: Penalty of an amount equal to tax not deducted could be imposed under Section 271C. Penalty shall be charged under Section 221, if deductor fails to deduct and pay tax to the credit of Central Government. The penalty shall be levied to the extent the Assessing Officer directs, however, the total amount of penalty shall not exceed the amount of tax in arrears.

Prosecution: If a person fails to pay to the credit of the Central Government the tax deducted at source by him he shall be punishable with rigorous imprisonment for a term which shall not be less than three months but which may extend to seven years and with fine.

Cases where the person will not be subject to interest and penalty even if he has defaulted in payment of TDS

The cases where the person will not be subject to interest and penalty and interest even if he has defaulted in payment of TDS are as follows:

– He has furnished his income tax return under section 139;

– He has taken into account such sum for computing income in such return of income;

– He has paid the tax due on the income declared by him in such return of income, and

– The deductor furnishes a certificate to this effect in Form No.26A from a chartered accountant.

TDS deduction payment due date for every quarter

| Month of Deduction | Quarter ending | Due date for TDS Payment through Challan for Government Deductor | Due Date for TDS Return Filing for all Deductors |

|---|---|---|---|

| April | 30th June | 7th May | 31st July |

| May | 30th June | 7th June | 31st July |

| June | 30th June | 7th July | 31st July |

| July | 30th September | 7th August | 31st October |

| August | 30th September | 7th September | 31st October |

| September | 30th September | 7th October | 31st October |

| October | 31st December | 7th November | 31st January |

| November | 31st December | 7th December | 31st January |

| December | 31st December | 7th Jan | 31st January |

| January | 31st March | 7th Feb | 31st May |

| February | 31st March | 7th March | 31st May |

| March | 31st March | 7th April | 30th April (other deductors) | 31st May |

If you want to know more about TDS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Comprehensive Guide on Consequences of non TDS ...