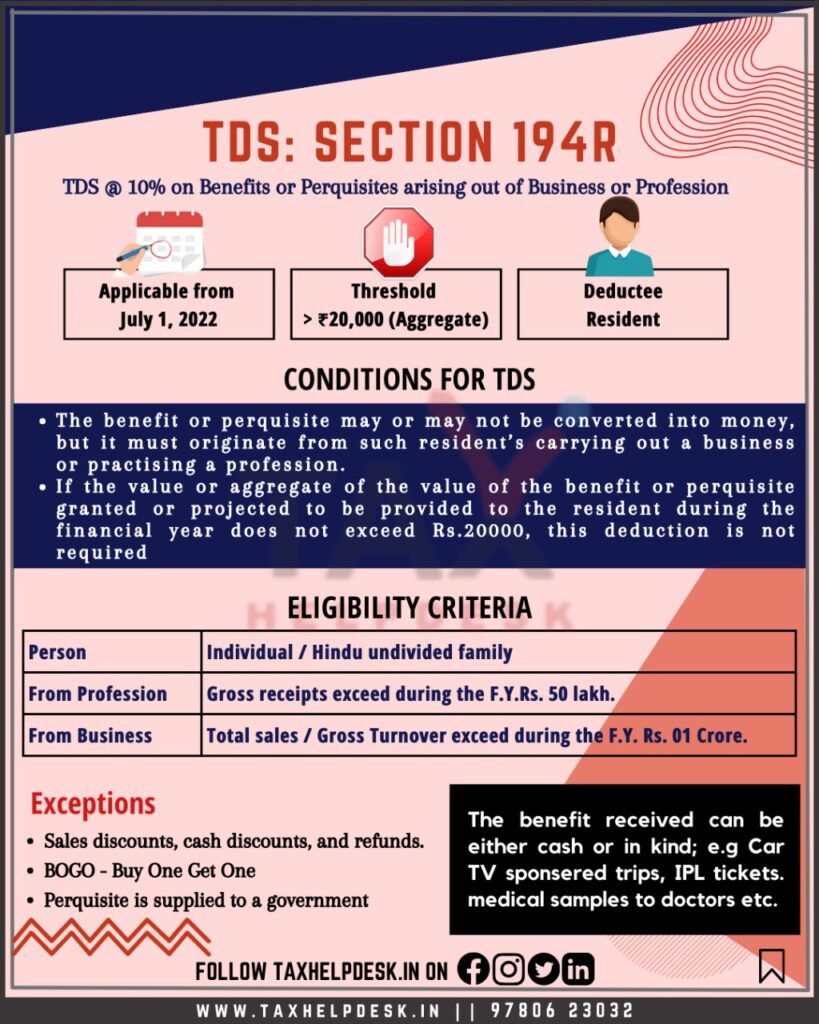

The newly inserted TDS Section 194R was introduced in the Income Tax Act through the Finance Act, 2022. The provisions of this Section shall come into effect from July 1, 2022.

What is TDS Section 194R?

The new TDS Section 194R deals with the deduction of tax on benefit or perquisite in respect of business or profession. Therefore, there shall be deduction of tax by any person providing any benefit or perquisite to a resident, arising from the business or profession of such resident.

Also Read: Know About The TDS Rates For FY 2022-23 Easily Explained

Threshold limit for deduction of TDS under Section 194R

There shall be deduction of tax @10% under the TDS Section 194R, if the aggregate value of the benefit or perquisite exceeds Rs. 20,000 in a year.

Applicability of TDS Section 194R

As per Section 194R, the provisions apply to individuals carrying on business or profession. Further, the value of benefit or perquisite must exceed the threshold limit of Rs. 20,000 in aggregate. In addition to this, in the case of business, the turnover must exceed Rs. 1 crore. On the other hand, in the case of the profession, the turnover must exceed Rs. 50 lacs in a financial year.

Also Read: Understand TDS Deduction: If Person Is Resident In India

Note

Section 194R applies even if the benefit or perquisite is in cash or kind or partly in cash and partly in kind. Therefore, benefits in the form of cars, sponsored trips, IPL tickets, free medical samples to doctors, etc., are all covered under this Section. However, if the person does not retain these benefits with him, then there shall be no deduction of TDS under Section 194R.

Exceptions to Section 194R

There is no deduction of TDS on the following:

Firstly, sales discount

Secondly, cash discounts

Thirdly, benefits or perquisites to a Government entity, like a Government hospital, not carrying business or profession

Fourthly, any individual who is not carrying any business or profession

Lastly, on any benefits or perquisites are given till 30th June, 2022.

Also Read: Comprehensive Guide On Consequences Of Non-TDS Deduction Compliances

However, to calculate the turnover of business or profession, the period from April 1, 2022 to March 31, 2022 shall be taken into consideration for FY 2022-23.

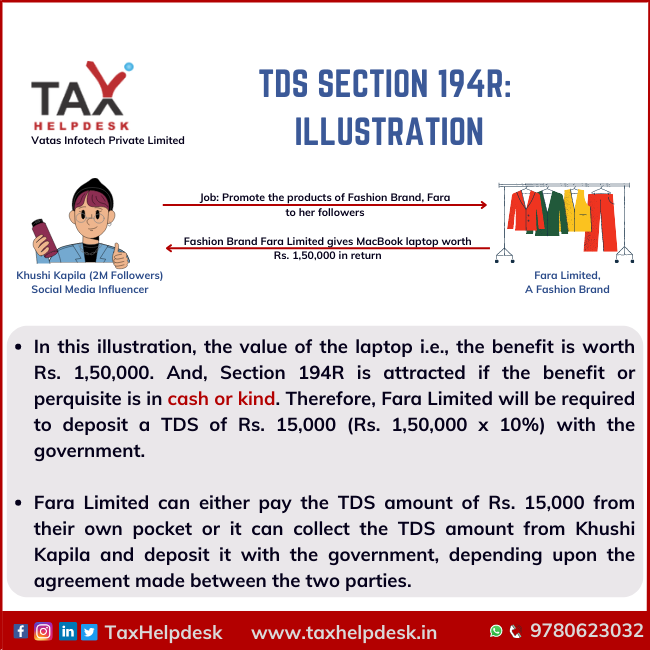

Illustration

Khushi Kapila is a social media influencer having 2 million followers on Instagram. She has to promote the products of Fara Limited, a fashion brand. Accordingly, the brand Fara Limited gives Khushi Kapila a free Macbook laptop worth Rs. 1.5 lacs. The TDS deduction under Section 194R shall be as follows:

Is Section 194R applicable to salaried individuals?

As stated above, the provisions of the TDS Section 194R apply to an individual who is carrying on business or profession. Therefore, the provisions of Section 194R do not apply to individuals having income from salary. In addition to this, there is a deduction of TDS on salary under Section 192 for the individuals having income from salary.

Are capital assets covered under Section 194R?

As per the guidelines by the CBDT vide Circular No. 12 of 2022 on 16th June, 2022, the payer/deductor need not check the taxability of the sum in the hands of the recipient. Additionally, the nature of assets given as benefits or perquisites is not relevant. Therefore, even the capital assets in the form of benefits or perquisites are covered within the scope of Section 194R.

Stay updated with the latest Income Tax, GST, and Legal and Financial updates on Instagram and Facebook.