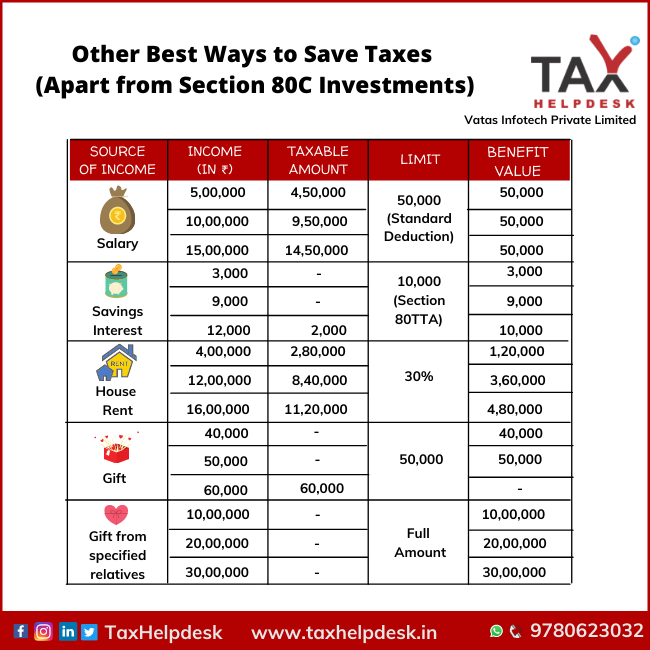

Best ways to save taxes (other than Section 80C)

As per the Income Tax laws of India, anything received by person in monetary terms is treated as an income of that person. The income of source could be salary, …

Best ways to save taxes (other than Section 80C) Read More »