Under Section 194C, a person making payment to a resident contractor or subcontractor for carrying out any work is required to deduct TDS.

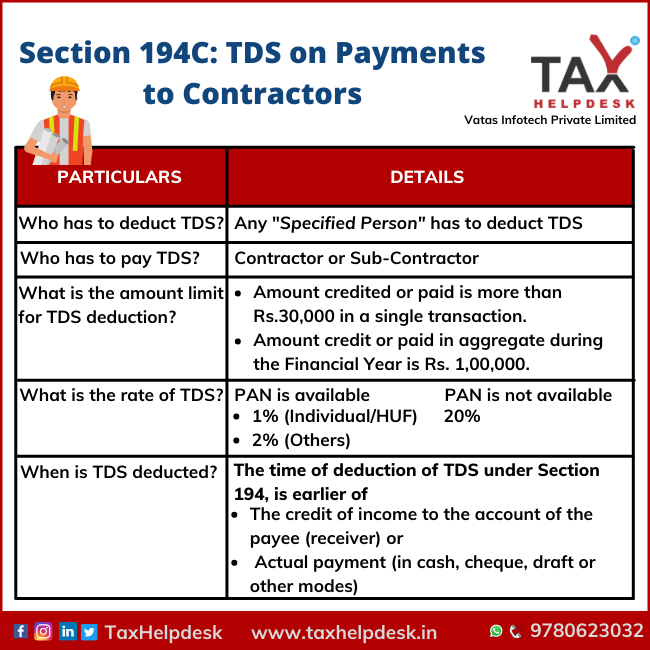

Who has to deduct TDS?

TDS is to be deducted by any “specified person” making payment to a resident contractor for carrying out work.

“Specified person” here means:

– Central or State Government

– Local Authority

– Corporation established by or under a Central, State or Provisional Act.

– Company

– Co-operative society

– Trust

– University

– Registered Society

– Firm

– University or deemed university

– Any person, being an individual or a Hindu undivided family or an association of persons or a body of individuals, except if such person, has total sales, gross receipts or turnover from business or profession carried on by him exceeding one crore rupees in case of business or fifty lakh rupees in case of profession] during the financial year immediately preceding the financial year in which such sum is credited or paid to the account of the contractor.

What is work for the purpose of Section 194C?

As per Section 194C, work includes the following:

– Advertising

– Broadcasting and telecasting (including the production of programmes)

– Carriage of goods and passengers using any mode of transport (except railways)

– Catering

– Manufacturing or supply of a product as per the specification of a customer by using the material purchased from him/her. But does not include manufacturing or supplying a product according to the specification of a customer by using material purchased from other than such customer.

Amount Limit for Deduction of TDS

The TDS has to be deducted in case, when the one time payment amount exceeds Rs.30,000 or Rs.1,00,000 in aggregate during the year.

TDS shall be deducted under Section 194C in the following cases:

| Particulars | Amount |

|---|---|

| Single payment of a contract | Exceeds Rs. 30,000 |

| Aggregate payment of a contract | Exceeds Rs. 1,00,000 |

Also Read: Know Types Of TDS Certificates

Rate at which TDS is deducted?

The rate of tax deduction under Section 194C, in case PAN of contractor/subcontractor is available is-

– 1% (when payment is given to Individual/HUF) or

– 2% (when given to others).

In case, the PAN of contractor/subcontractor is not available, the TDS rate is 20%

Section 194C TDS Rate Chart:

| Particulars | Rate of TDS (if PAN available) | Rate of TDS (if PAN not available) |

|---|---|---|

| Payment given to resident Individual/HUF | 1% | 20% |

| Payment given to Trust, Company, Firm, Cooperative Society, Registered Society, Government, Local Authority, University, Cooperation | 2% | 20% |

| Contractor in transport business* | Nil | 20% |

| Sub-Contractor in transport business* | Nil | 20% |

*Payment is made to a goods transport agency (in the business of plying, hiring or leasing goods) which owns 10 or fewer carriages at any time during the previous year. Also, the contractor has to submit a declaration of above along with PAN.

Time at which the TDS is deducted

The time of deduction of TDS under Section 194, is earlier of

– The credit of income to the account of the payee (receiver) or

– Actual payment (in cash, cheque, draft or other modes)

Illustrations

Illustration 1:

| Particulars | Whether TDS under Section 194C is to be deducted or not? | Reasons |

|---|---|---|

| Single contract of Rs. 10,000 in the year | No TDS to be deducted | The single contract value does not exceed Rs. 30,000 |

| Single contract of Rs. 30,000 in the year | No TDS to be deducted | The single contract value does not exceed Rs. 30,000 |

| Two contracts of Rs. 30,000 each in the year | No TDS to be deducted | The aggregate payment of the contract does not exceed Rs. 1,00,000 |

| Three contracts of Rs. 50,000 each in the year | TDS is to be deducted @Rs. 1,50,000 | The aggregate payment of the contract exceeds Rs. 1,00,000. Therefore, the TDS is to be deducted on full amount. |

| Single contract of Rs. 50,000 | TDS is to be deducted | The single contract value exceeds Rs. 30,000 |

| Four contracts of Rs. 20,000 each | No TDS is to be deducted | The aggregate payment of the contract does not exceed Rs. 1,00,000 |

| Five contracts of Rs. 30,000 each | TDS is to be deducted @Rs. 1,50,000 | The aggregate payment of the contract exceeds Rs. 1,00,000. Therefore, the TDS is to be deducted on full amount. |

| Five contracts of Rs. 20,000 each | No TDS is to be deducted | The aggregate payment of the contract does not exceed Rs. 1,00,000 |

Illustration 2:

T&L Private Company Limited has made following payment to D&G Private Company Limited on various dates for work done under contract

| Date of Payment | Amount | Whether TDS under Section 194C is to be deducted or not? | Reasons |

|---|---|---|---|

| 12.04.2023 | Rs. 20,000 | No TDS is to be deducted | The value does not exceed Rs. 30,000 |

| 17.04.2023 | Rs. 35,000 | TDS is to be deducted | The value exceeds Rs. 30,000 |

| 22.04.2023 | Rs. 25,000 | TDS is to be deducted | The deduction of TDS has already started |

| 30.04.2023 | Rs. 40,000 | TDS is to be deducted on total amount i.e., Rs. 1,20,000 | The aggregate value of the amount exceeds Rs. 1,00,000. Therefore TDS will be deducted on the whole amount including Rs. 20,000. |

Illustration 3: K&M Private Company Limited has made following payment to P&G Private Company Limited on various dates for work done under contract

| Date of Payment | Amount | Whether TDS under Section 194C is to be deducted or not? | Reasons |

|---|---|---|---|

| 12.04.2023 | Rs. 10,000 | No TDS is to be deducted | The value does not exceed Rs. 30,000 |

| 17.04.2023 | Rs. 15,000 | No TDS is to be deducted | The value does not exceed Rs. 30,000 |

| 22.04.2023 | Rs. 20,000 | No TDS is to be deducted | The value does not exceed Rs. 30,000 |

| 30.04.2023 | Rs. 25,000 | No TDS is to be deducted | The aggregate value of the amount does not exceed Rs. 1,00,000. |

Illustration 4: H&M Private Company Limited has made following payment to D&C Private Company Limited on various dates for work done under contract

| Date of Payment | Amount | Whether TDS under Section 194C is to be deducted or not? | Reasons |

|---|---|---|---|

| 12.04.2023 | Rs. 1,20,000 | TDS is to be deducted | Aggregate value of the amount exceeds Rs. 1,00,000 |

| 17.04.2023 | Rs. 15,000 | TDS is to be deducted | The deduction of TDS has already started. |

Special Considerations by Government on 194C Applicability

CBDT has made some special announcements relating to implications of section 194C which are as follows:

Payment to Travel Agents: Any payment paid by passengers to travel agents or airlines (on purchasing tickets) will not be liable to TDS under Section 194C. No TDS will be deducted in case, where money is paid by the agent to airlines. But TDS will be deducted when such payment is made for the chartered hiring of bus, plane or any other mode of transport.

Payment for Couriers: Any payment to couriers will be liable to TDS as it involves the carriage of goods.

Also Read: TDS On Purchase Of Goods Under Section 194Q

Payment for Serving food in restaurants: TDS will not be deducted on payment made for serving food in a restaurant in the normal course of business.

TDS Deduction on GST Amount: If any amount representing GST in an invoice is indicated separately, then TDS will be levied only on value excluding such GST.

Time Limit to deposit TDS under Section 194C

| Period | Due Date |

|---|---|

| April – February | Within 7 days from the end of the month in which the tax is deducted. |

| March | On or before 30th April |

Due date for filing of TDS Returns under Section 194C

| Quarter | Quarter Period | Last date of filing |

|---|---|---|

| Q1 | 1st April – 30th June | 31st July |

| Q2 | 1st July – 30th September | 31st October |

| Q3 | 1st October – 31st December | 31st January |

| Q4 | 1st January – 31st March | 31st May |

FAQs

Contractor means any person who enters into a contract with the

– Central/State government;

– Corporation;

– Company;

– Local Authority or a

– Cooperative society

to conduct any form of work (including the supply of manpower).

Subcontractor means a person who enters into a contract with a contractor for:

– Conducting either all or part of work, which the contractor has agreed to complete

– Supplying manpower for all or part of work taken by the contractor.

TDS under section 194C is not required to be deducted in following cases:

- The amount of payment made to the contractor in a single contract which does not exceed Rs.30,000 or Rs. 1,00,000 aggregate in year.

- When any amount is paid to the contractor by an individual or HUF for carrying out work in the nature of personal use.

- When payment is made to a goods transport agency (in the business of plying, hiring or leasing goods) which owns 10 or fewer carriages at any time during the previous year. Also, the contractor has to submit a declaration of above along with PAN.

- If payment is made to a non-resident contractor or sub-contractor.

Levy of Interest : If the specified person does not deduct TDS or deducts TDS but does not deposit it to the government on time, then interest @1.5% is required to be paid on such amount.

Disallowance of expenses : Further, the person is not eligible to claim the deduction of expenses from Profits and Gains from Business & Profession income, if TDS is not deducted on time. The amount of disallowed expenses shall be 30% of payment

However, if TDS is deposited in subsequent years, then expense will be allowed in the year of payment of TDS.

If you want to know more about TDS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!