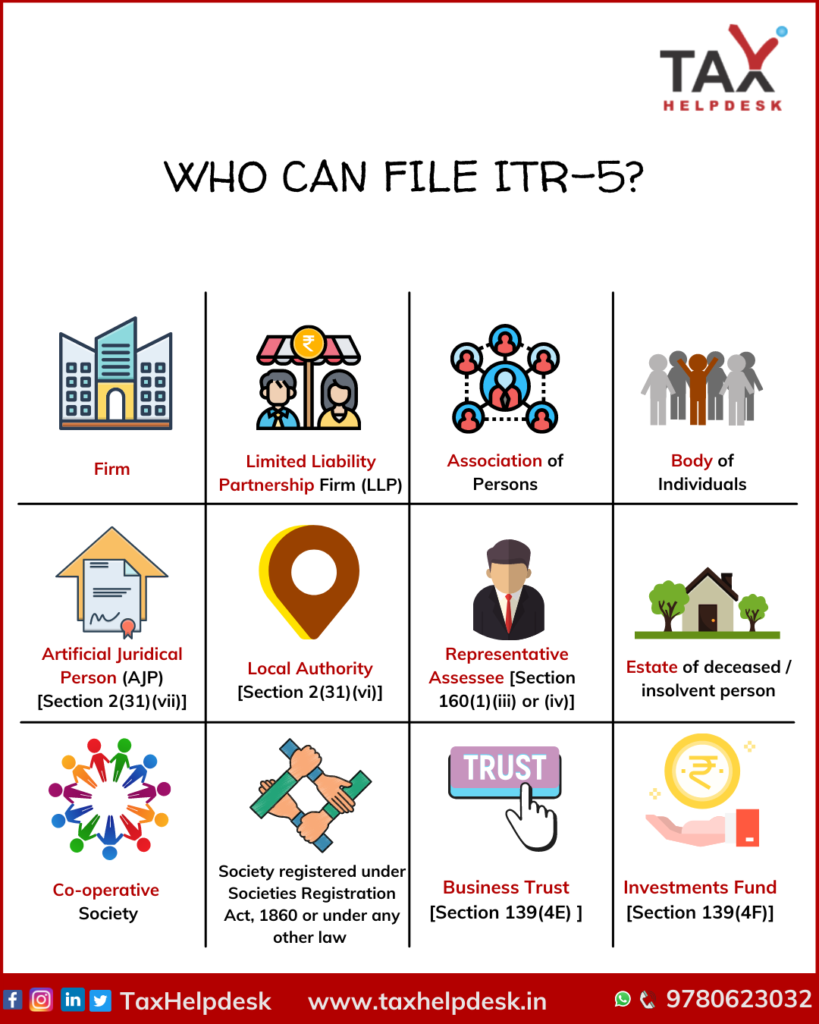

Filing of Income Tax Return for LLP, Firms & Others can be through the form ITR-5.

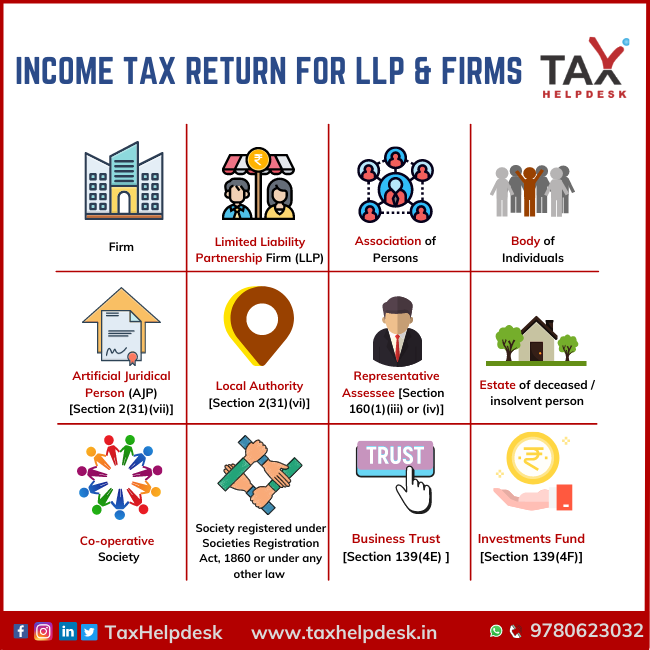

Form Applicable for Income Tax Return for LLP & Firms

Note:

A person who need to file the Return of Income either under Section 139(4A) or 139(4B) or 139(4D) shall not use this ITR-5 form.

Sources of Income Tax Return for LLP & Other Firms

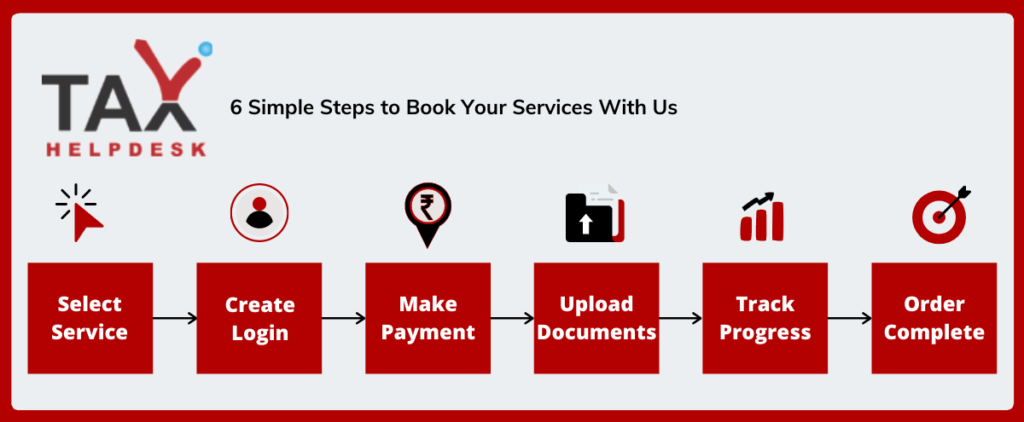

Step by step procedure to get your Income Tax Return filed by TaxHelpdesk experts

Once your order is placed, TaxHelpdesk’s professional team review the documents and check the documents uploaded by you within 24 working hours. Thereafter, a Tax Expert will be assigned and accordingly, your order will be processed. Furthermore, you also will be able to check the status of the order in your assigned account.

E-filing Audit Reports

After the AY 2013-14, it has become mandatory for an assessee to furnish a report of audit under sections. Further, they are including 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)(via), 10A, 10AA, 12A(1)(b), 44AB, 44DA, 50B, 80-IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E, 115JB or 115VW. In addition to this, it can file electronically either on or before the date of filing the return of income.

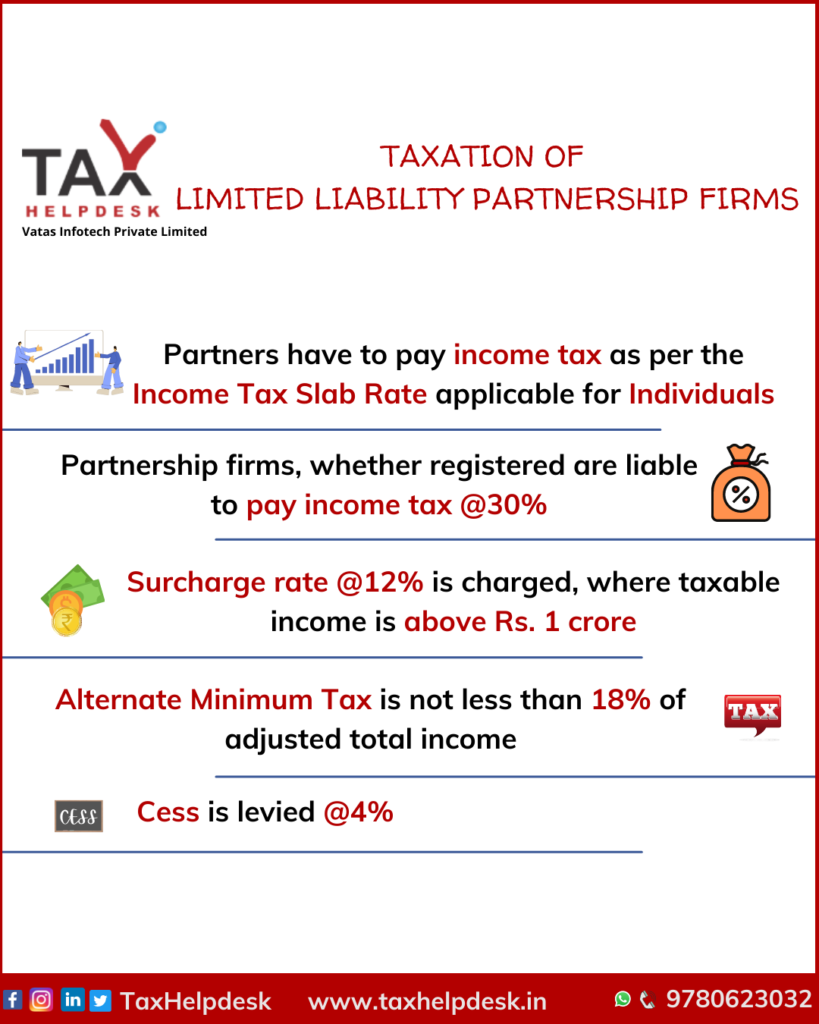

Income Tax Liability of Firms & Limited Liability Partnership Firms

Tax Rates (For AY 2022-23) for Firms including LLP’s

| Particulars | Tax Rate |

|---|---|

| Long – term capital gain | 20% |

| Short – term capital gain u/s 111A | 15% |

| Other Income | 30% |

| Alternate Minimum Tax (minimum) | 18.5% |

Note:

Firstly, Health & Education Cess at rate of 4% on amount of Income-tax plus surcharge is applicable on above rates.

Thereafter, a surcharge of @12% of such tax is applicable, where the total income exceeds Rs.1 crore.

Additionally, marginal relief shall also available, wherever applicable.

Income Tax Slabs applicable for Association of Persons/Body of Individuals/Artificial Juridical Persons

| Net income range | Income-tax Rates |

|---|---|

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001- Rs. 5,00,000 | 5% |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Note:

In addition to the above, the rates of Surcharge, Marginal Relief and cess shall be levied/provided in all applicable cases.

Deductions available to Partnership Firms

Following deductions are available to Partnership Firms:

– Firstly, remunerations or interest paid to the partners of the firm. Meanwhile, this interest is not in accordance with the terms of the partnership.

-Secondly, salaries, bonuses, remunerations, and commissions paid to the non-working partners of the firm.

– Lastly, if remuneration paid to partners is in accordance with the terms of the partnership deed. But, such transactions were made, in relation to anything that pre-dates the partnership deed.

Exemptions & Deductions available to Association of Persons / Body of Individuals / Artificial Juridical Persons

| Deductions for AOP/BOI/AJP | Eligibility Criteria |

|---|---|

| Section 10(1A) – Agricultural Income | AOP/BOI/AJP generating agricultural income |

| Section 10(2) – Share of Income from Partnership | AOP/BOI as partner in a partnership firm |

| Section 10(21) – Scientific Research Association | AOP/BOI engaged in scientific research |

| Section 10(22B) – News Agency | AOP/BOI operating as a news agency |

| Section 10(23A) – Educational Institution | AOP/BOI running an educational institution |

| Section 10(23B) – Hospital/Nursing Home | AOP/BOI operating a hospital or nursing home |

| Section 10(26BB) – Income of Scheduled Tribes | AOP/BOI comprising members from Scheduled Tribes |

| Section 11 – Income from Property Held for Charity | AOP/BOI involved in charitable activities |

| Section 12AA – Registration for Charitable Trust | AOP/BOI registered as a charitable trust |

| Section 35 – Expenditure on Scientific Research | AOP/BOI engaged in scientific research & development |

| Section 80G – Donations to Charitable Institutions | AOP/BOI making donations to approved charitable entities |

| Section 80IA – Industrial Undertakings | AOP/BOI engaged in certain industrial activities |

| Section 80IB – Profits from Certain Businesses | AOP/BOI engaged in eligible businesses |

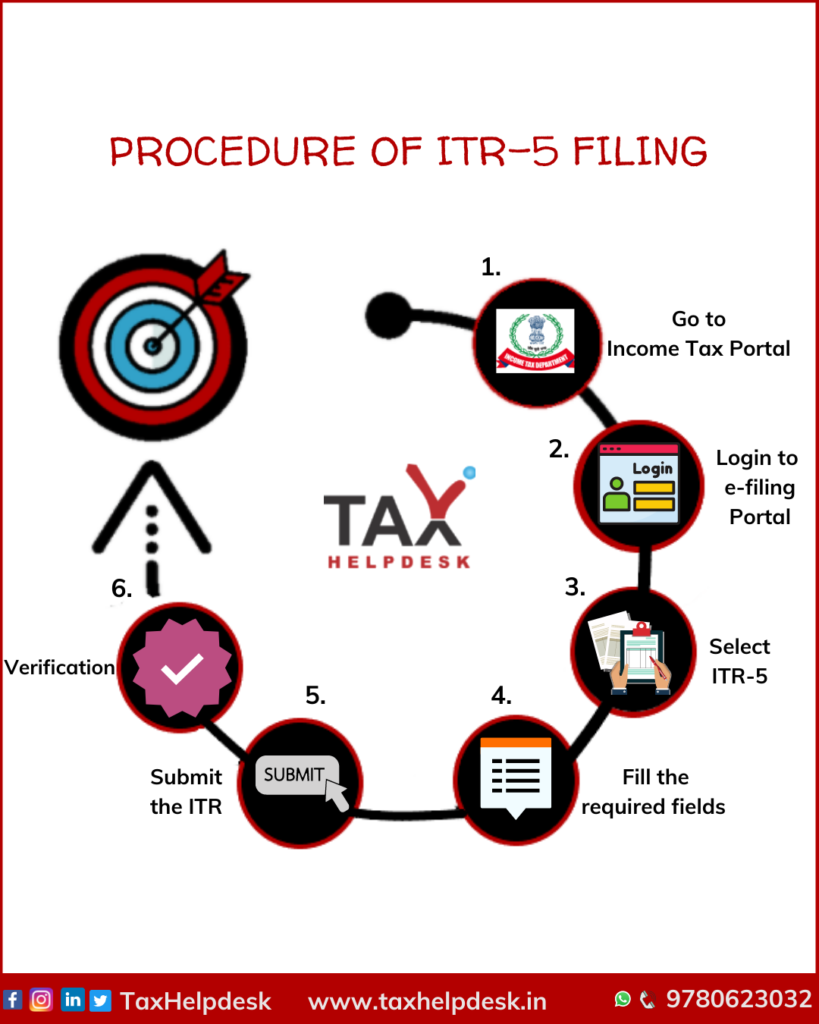

Key Procedure to file ITR-5

Documents involved in filing of ITR-5

– PAN Card copy

– Aadhaar Card copy

– Bank account details

– Email and mobile number

– Housing loan interest certificate

– House Rent details

– Interest certificate

– Bank statement

– Receipts for deductions

– DEMAT account statement

– Foreign assets/income details

– Details of assets

– Similarly, details of income from any other sources

– Balance sheet

– Even, Profit and Loss in A/c

Due dates for filing of return?

| Particulars | Due Dates |

|---|---|

| A firm who is required to get its accounts audited under the Income-tax Act or under any other law | October 31 of the assessment year |

| A firm who is required to furnish a report in Form No. 3CEB under Section 92E | November 30 of the assessment year |

| In any other case | July 31 of the assessment year |

*However, the due dates are subject to change.

FAQs

A limited liability partnership (LLP) is a body corporate under the Limited Liability Partnership Act, 2008. Furthermore, it is a legally separated entity from that of its partner.

Yes, it is mandatory for every Limited Liability Partnership (‘LLP’). Hence, they need to file the return of income irrespective of amount of income or loss.

It is mandatory for a firm to file return of income electronically with or without digital signature. In addition, a partnership firm may also file return of income under Electronic Verification Code. However, a firm liable to get its accounts audited under Section 44AB. Even more, it shall furnish the return electronically under digital signature.

Reviews

There are no reviews yet.