When the purchase price of shares is more than the sale price, then it is a Capital Gain. On the other hand, if the purchase price is less than the sale price, then it is Capital Loss.

Capital Gain on sale of shares:

The capital gains on share are dependent on two factors namely:

– Payment of Securities Transaction Tax

– Duration of holding the shares

Also Read: How to treat income from transfer of shares?

Payment of Securities Transaction Tax

The payment of securities transaction tax (STT) determines whether the share is a listed or unlisted. If there is STT payment, then it means that the share is listed. On the contrary, if there is no payment of STT, then the share is unlisted.

Duration of holding the shares

In addition to the above point, the duration of holding the shares is also essential to determine the tax on capital gains on shares. This is so because, the taxation rate for long term and short term capital gains is different. Furthermore, for the basis of determining the tax on capital gains of shares, the duration is different for listed and unlisted shares.

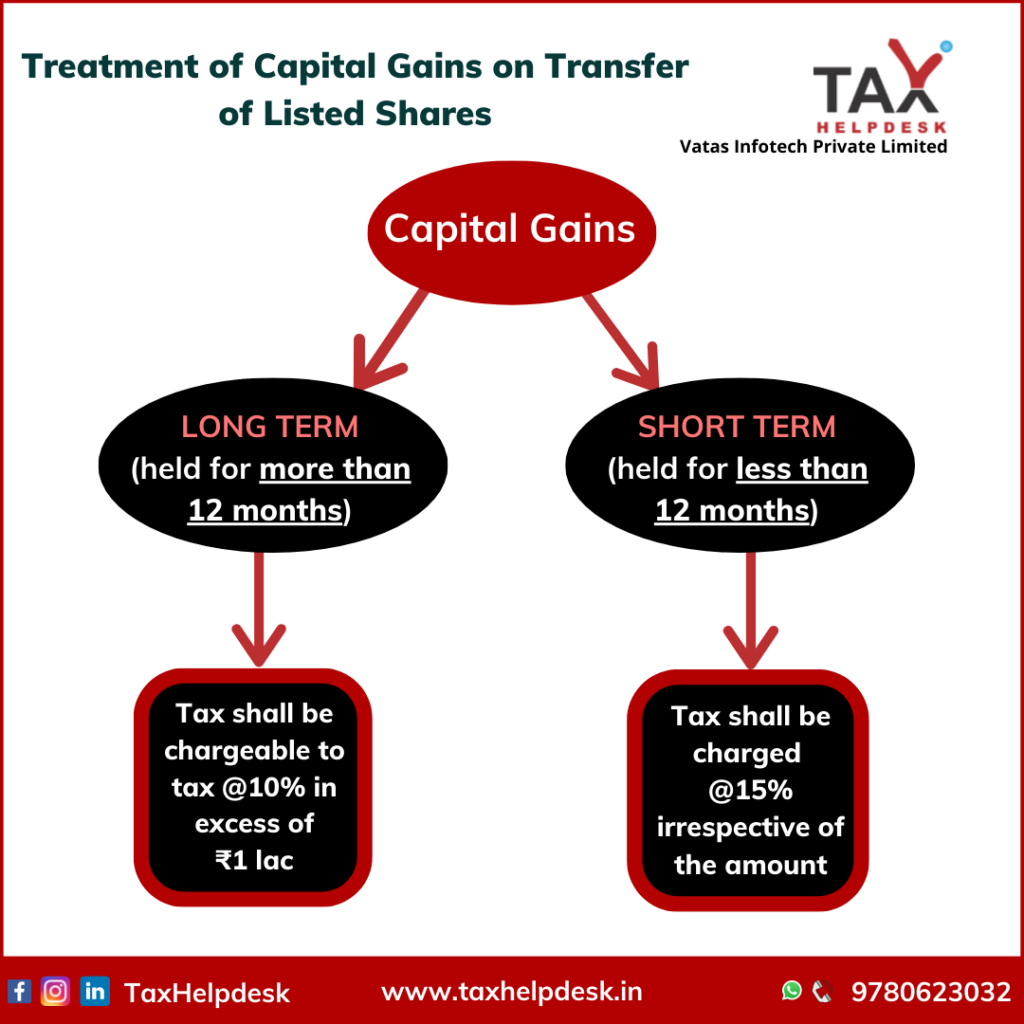

Duration for Listed Shares

If equity shares listed on a stock exchange are sold after 12 months of purchase, then it is a Long Term Capital Gain (or Capital Loss). Whereas, if such equity shares are sold before 12 months of purchase, then it is Short Term Capital Loss.

Also Read: Know Taxability of Capital Assets in India

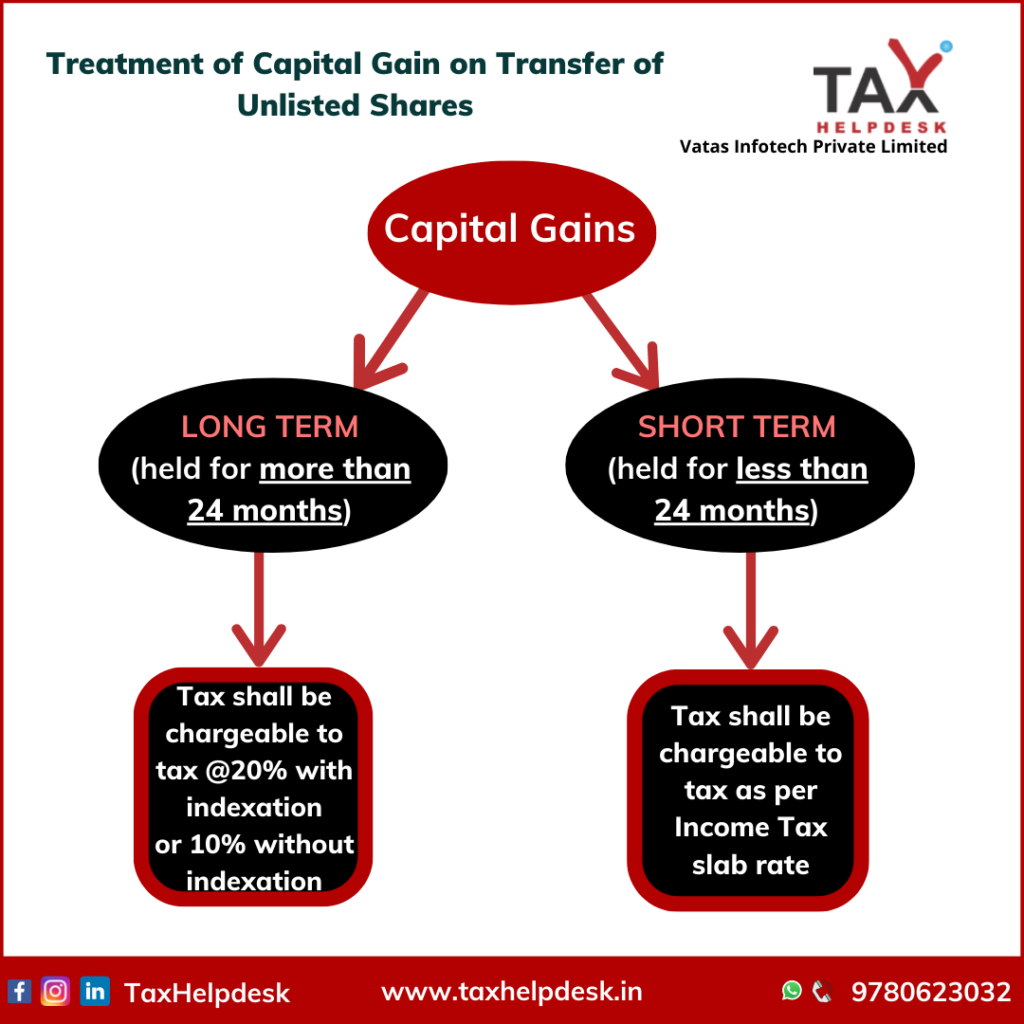

Duration for Unlisted Shares

On the other hand, if the shares not listed on stock exchange are sold after 24 months of purchase, then it is a Long Term Capital Gain (or Capital Loss). In contrast, if such shares are sold before 24 months of purchase, then it is Short Term Capital Loss.

Taxation of Capital Gain from Listed Shares

Long term capital gain listed shares on a stock exchange are not taxable up to the limit of Rs 1 lakh. Further, long term capital gain of more than Rs 1 lakh on the sale of these shares will attract a capital gains tax of 10% and the benefit of indexation will not be available. Whereas, short term capital gain is taxable at 15% irrespective of the tax slab.

Also Read: How To Adjust Profit/Losses From Transfer Of Shares

Unlisted Shares: Taxability of Capital Gain

In case of unlisted shares, the long term capital gain is taxable @20% with taxation or 10% without indexation. Conversely, the short term capital gain on unlisted shares is taxable as per the Income Tax Slab rate.

Conclusion

Particulars

Taxes on Long Term Capital Gains

Taxes on Short Term Capital Gains

Securities Transaction Tax (STT) paid on sale of shares

NIL for capital gains up to Rs. 1 lac, if the minimum holding period is 1 year

15%, if held for less than 1 year.

Non STT paid on sale of shares

20% with indexation or 10% without indexation. Minimum holding period is 2 years.

As per the Income Tax Slab plus 3% cess plus surcharge, if applicable.

If you want to know more about stock market or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!