We often hear the net worth statements like:

– Mark Zukerberg’s net worth is $11,950 crores

– Elon Musk’s net worth is $15,600 crores

– Twitter company’s net earning is $4.4 billion

– Mukesh Ambani’s net earning is $8,520 crores, and so on

But what is the meaning of this Net Worth?

Meaning of Net Worth

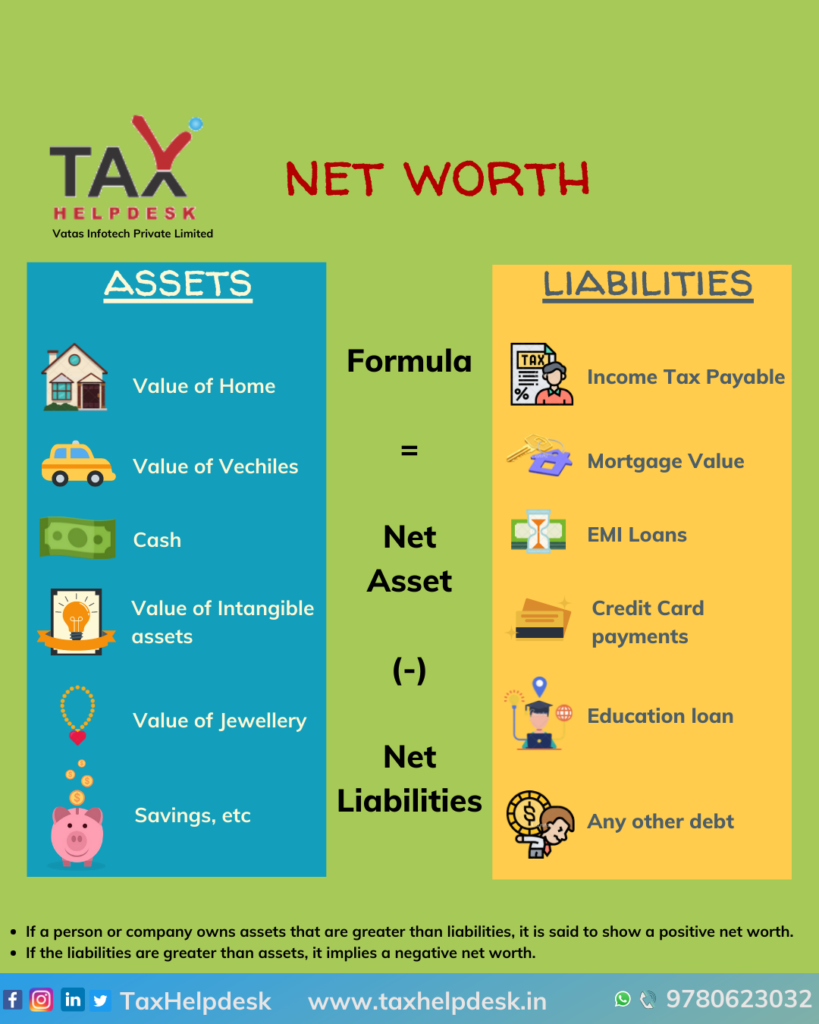

Net worth, in layman’s language means the sum of all the assets owned by an individual or a company, minus any debts or liabilities. This net earning help in measuring wealth and works as a financial indicator for all the persons.

How to calculate net earning of an individual?

Calculating net worth of an individual requires to gather all the information of the current assets as well as liabilities. The step wise details for calculating net earning are as follows:

Calculation of Assets

Step 1: List your largest assets

In order to start calculating the net worth, an individual must start with the calculation of his largest assets. These largest assets could be value of home, real estate properties, vehicles like cars and bikes. In the case of business owner, the assets would also include the value of business. These assets can also include intangible assets like patents, trademarks, goodwill among other assets.

Also Read: Key Differences Between Cash Credit & Overdraft

Step 2: Gather latest statements for your liquid assets

The second step involved in calculating net earning of an individual is to gather the latest statements for the liquid assets. Some of the examples of liquid assets are savings accounts, cash, fixed deposits, certificates of deposits, etc.

Step 3: List down the value of personal items

After gathering and calculating the value of largest assets and liquid assets, the individual must now list down the value of personal items like jewellery, precious metals, stones, and many more.

Step 4: Add all the assets

The final step in calculating the value of assets is to add the value of largest assets, liquid assets and personal items. On adding, the individual’s net value of assets will be ascertained.

Calculation of liabilities

Step 1: List your outstanding liabilities

The individual in order to calculate his liability must start with the listing of all of his outstanding liabilities such as mortgages, income tax payable, GST payable and other related liabilities.

Step 2: Reconcile your personal liabilities

The next step in calculating liabilities is to reconcile the personal liabilities. Personal liabilities examples are EMI loans, credit card payments, student loan, etc.

Step 3: Add the above liabilities

The last step in calculation of liabilities is to add the outstanding liabilities and personal liabilities.

Net Worth Calculation = Total Assets – Total Liabilities

Illustration

| Current Assets | Amount (in Rs.) | Current Liabilities | Amount (in Rs.) |

|---|---|---|---|

| Car | 5,00,000 | Accounts payable | 10,000 |

| Furniture | 50,000 | Taxes payable | 30,000 |

| Jewellery | 50,000 | Personal loan | 20,000 |

| Total Assets (A) | 6,00,000 | Total Liabilities (B) | 50,000 |

Net Worth = A – B

= Rs. 6,00,000 – Rs. 50,000

= Rs. 5,50,000

Net Income for company

The formula for calculating net worth for company is calculated in the same way as the net worth of an individual is calculated i.e., by subtracting net liabilities from net assets.

Net worth of company = Total Assets – Total liabilities

The net worth of a company is also known as ‘Book Value’ or ‘Shareholders Equity’ of the firm.

Illustration

| Particulars | 2019 (in Rs.) | 2020 (in Rs.) |

|---|---|---|

| Current Assets | 300,000 | 400,000 |

| Investments | 45,00,000 | 41,00,000 |

| Plant & Machinery | 13,00,000 | 16,00,000 |

| Intangible Assets | 15,000 | 10,000 |

| Total Assets (A) | 61,15,000 | 61,10,000 |

| Current Liabilities | 200,000 | 2,70,000 |

| Long term Liabilities | 1,15,000 | 1,40,000 |

| Total Liabilities (B) | 3,15,000 | 4,10,000 |

| Net Worth (A – B) | 58,00,000 | 57,00,000 |

Conclusion

Net earning works like a financial indicator. If a person or company owns assets that are greater than liabilities, it is said to show a positive net earning. If the liabilities are greater than assets, it implies a negative net worth. A positive net worth is associated with good financial health, whereas negative net earning can be perceived as a negative signal and shows the inability to settle liabilities.

If you have any suggestions/feedback, then please drop us a message in the chat box. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp, channel on Telegram or follow us on Facebook, Instagram, Twitter and Linkedin!

Pingback: How is Nifty and Sensex Calculated? | TaxHelpdesk