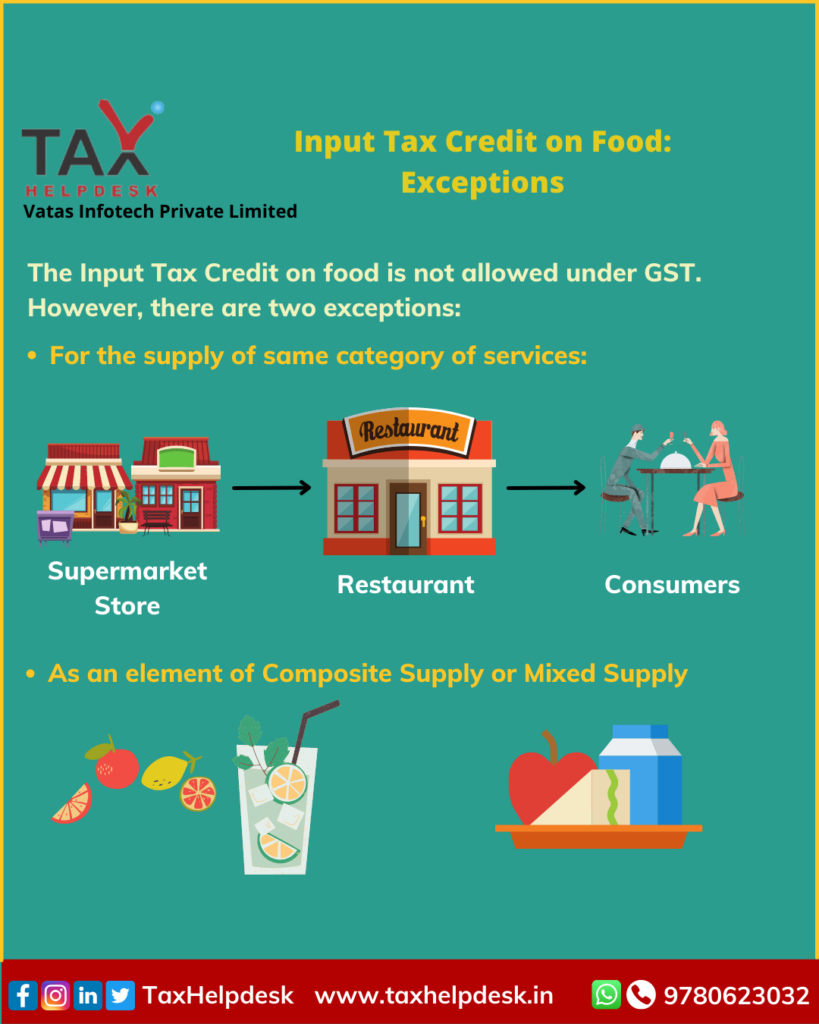

The input tax credit on food and beverage supplies are blocked credit for registered person. That is, one cannot claim Input Tax Credit on Food. However, there are certain exceptions wherein the register person can claim ITC on food.

Input Tax Credit Exceptions on Food

The registered person can claim ITC on food,

– Where an inward supply of goods or services or both of food of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both,

– Also, if such inward supply of food is used in making either a taxable composite or mixed supply, then the input tax is allowed.

Also Read: Relevance of Supply under GST

Cases where ITC on food is not available:

The input tax credit on food is not available in following cases:

– Firstly, if goods or services or both of food are used for personal consumption

– Secondly, if foods as goods are stolen, lost, destroyed, written off or disposed of by way of gift or free samples.

Can ITC be claimed on food used for business purposes?

The registered person can claim ITC where inward supply is obtain from a registered supplier like a registered person in the course or furtherance of business. However, the tax invoice must duly be issued and supply made. Therefore, ITC is available if the supply is for any purpose in the course or furtherance of business.

Also Read: Can you claim GST ITC on travel?

GST Rates on Food and Beverage Services:

| Description | GST Rate |

|---|---|

| Food services provided by restaurants including takeaway facility (both air-conditioned and non-a/c) | 5% with No ITC |

| Any food/drink served at cafeteria/canteen/mess operating on a contract basis in the office, industrial unit, or by any school, college, etc on basis of a contractual agreement that is not event-based or occasional | 5% with No ITC |

| Services provided by restaurants within a hotel with a room tariff of less than Rs. 7,500 | 5% with No ITC |

| Services provided by restaurants within a hotel with a room tariff of Rs. 7,500 or more | 18% |

| Meals/food services provided by Indian Railways/IRCTC or their licensees both in trains or at platforms | 5% with No ITC |

| Food services provided on a premise arranged for organizing function along with renting of such premises | 18% |

| Food services provided at exhibitions, events, conferences, and outdoor & indoor functions that are event-based or occasional in nature | 18% |

| Other Accommodation, food, and beverage services | 18% |

Rates of GST on Food Items

| Description | GST Rate |

|---|---|

| GST on fresh/chilled vegetables such as potatoes, onions, garlic, leek, etc. | Nil |

| GST on non-container dried leguminous packed vegetables(shelled) whether skinned/split or not | NIL |

| GST on fruits such as fresh grapes, fresh/dried coconut, fresh/dried bananas/plantain, fresh apples, fresh pears, etc. | Nil |

| GST on non-veg items such as meat (not in a container, whether fresh or chilled) | Nil |

| GST on eggs in the shell (fresh/cooked/preserved) | Nil |

| GST on unsweetened milk (pasteurized/unpasteurized), cream, etc. | Nil |

| GST on container packed vegetables (uncooked/steamed/boiled) | Nil |

| GST on vegetables preserved using brine/other means unsuitable for immediate human consumption | Nil |

| GST on meat packed in a container having a registered trademark or brand name | 5% |

| GST on eggs not in shell/egg yolks boiled or cooked by steaming | 5% |

| GST on dried leguminous vegetables packed in a container having a registered trademark/brand name (skinned/split or not) | 5% |

| GST on vegetables such as ginger (excluding fresh ginger), turmeric (excluding fresh turmeric), thyme, curry leaves, bay leaves, etc. | 5% |

| GST on food such as meal/powder of dried leguminous vegetables | 5% |

| GST on fruits, vegetables, nuts, and edible plant parts preserved using sugar | 12% |

| GST on vegetables, fruits, nuts, and edible parts of the plant that are preserved/prepared using vinegar/acetic acid. | 12% |

| GST on food items prepared using flour, malt extract, etc. including cocoa less than 40% of total weight. | 18% |

| GST on chocolate and other cocoa products | 18% |

FAQs

If coffee and tea are packed in a packet register trademark or brand name, then GST will be applicable. In addition, the company can claim ITC, if the taxable invoice has been issued.

Yes, restaurant registered as normal tax payer are eligible to claim ITC. Furthermore, as an inward supply of goods or services are used for making an outward taxable supply.

No, ITC will not be available. Reason being that “goods or services or both used for personal consumption” will not be entitled for ITC. In addition, water comes under personal consumption. Therefore, No ITC will be available.

Conclusion

The input tax credit on food is not allowed under GST. However , if the outward supply is made under a registered brand name and put up in unit container, then it would be liable to tax.

If you want to know more about GST ITC or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!