GST ledgers, commonly known as e-ledgers are electronic passbooks for GST transactions. These ledgers comprise all the details wrt GST. Further, these ledgers are available to all the GST registered persons on the GST Portal.

Types of GST Ledgers

There are three types of GST Ledgers, namely:

– Firstly, Electronic Cash Ledger

– Secondly, Electronic Credit Ledger

– Thirdly, Electronic Tax Liability Ledger

Electronic Cash Ledger

An Electronic Cash Ledger, as the name suggests is a GST ledger that comprises of transactions in relation to the money. Accordingly, when a GST taxpayer makes a GST payment through modes like online banking, debit card or credit card transfer, wire transfer, or over-the-counter payment, the amount reflects in this electronic cash ledger.

Also Read: GST Invoices Bill Easily Explained Guide By Expert

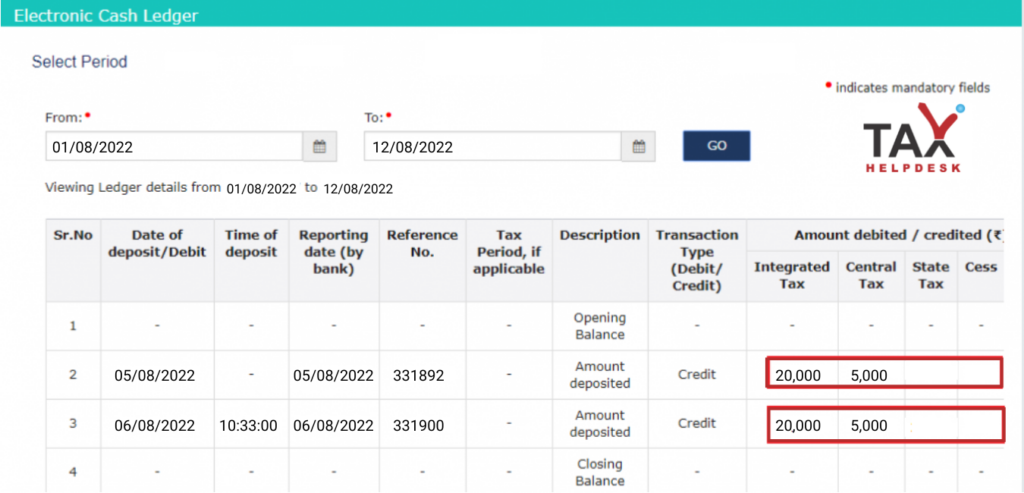

For instance, Ram has a GST liability of Rs. 25,000 as on 1st August, 2022. He can make the payment of the same through cash or bank payment. When he deposits this money, there will be reflection of this payment in his Electronic Cash Ledger as follows:

GST Ledger – Electronic Credit Ledger

The second type of GST Ledger is Electronic Credit Ledger. This electronic credit ledger comprises of all the Input Tax Credit claimed by the GST registered person through the filing of GST Returns. In other words, the details of the Input Tax Credit of GSTR-2 and GSTR-3B are visible in the Electronic Credit Ledger. Further, the GST taxpayer can make use of the amount in this credit ledger to make payment of GST. However, the taxpayer cannot make use of this ledger for the payment of interest, penalty, or late fees.

Also Read: Input Tax Credit: Know How Does It Work?

In addition to the above, the manner of utilization of Input Tax Credit in the Electronic Cash Ledger is as per the new rules wrt setting off of the Input Tax Credit, which is as follows:

– SGST Input Tax Credit is to be set off firstly against IGST and then, SGST. And, there cannot be the utilization of SGST ITC against CGST liability.

– CGST Input Tax Credit is to be set off firstly against IGST and then, CGST. And, there cannot be the utilization of CGST ITC against SGST liability.

– IGST Input Tax Credit is to be set off firstly against IGST. It then can be utilized against SGST or CGST liability in any manner.

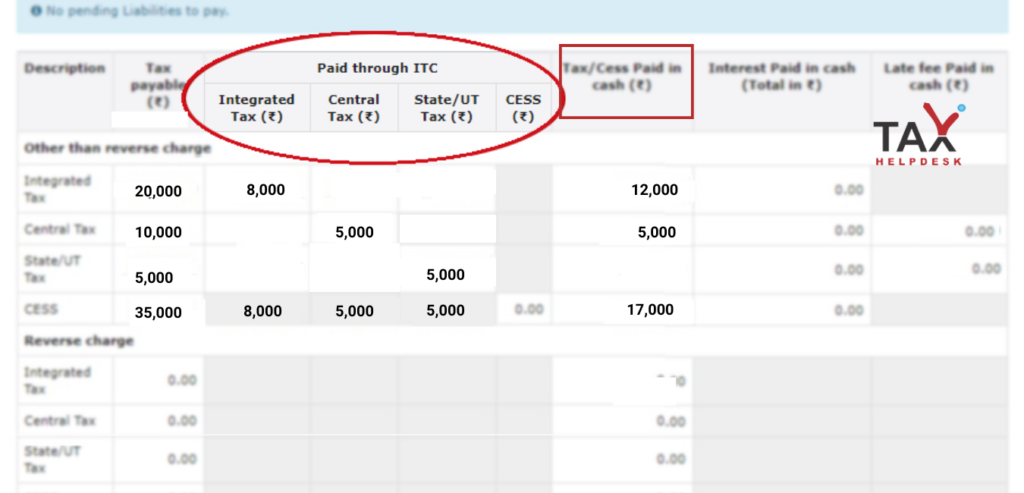

Now, take, for example, Ram has IGST liability of Rs. 20,000, CGST liability of Rs. 10,000, and SGST liability of Rs. 5,000. And, he has the IGST Credit of Rs. 8,000, CGST Credit of Rs. 5,000, and SGST Credit of Rs. 5,000. Further, he has made a payment of GST through cash of Rs. 12,000.

The setting of Input Tax Credit against the GST liability of Lakshman will be as follows:

– Firstly, the IGST credit of Rs. 8000 will be full set-off against IGST liability of Rs. 20,000. The remaining Rs. 12,000 is paid through cash which will be reflected in his electronic cash ledger.

– Secondly, the CGST credit of Rs. 5,000 will be full against the CGST liability of Rs. 10,000. Accordingly, he will have to make payment of the remaining GST liability of Rs. 5,000.

– Thirdly, the SGST credit of Rs. 3,000 will be fully set off against the SGST liability of Rs. 3,000.

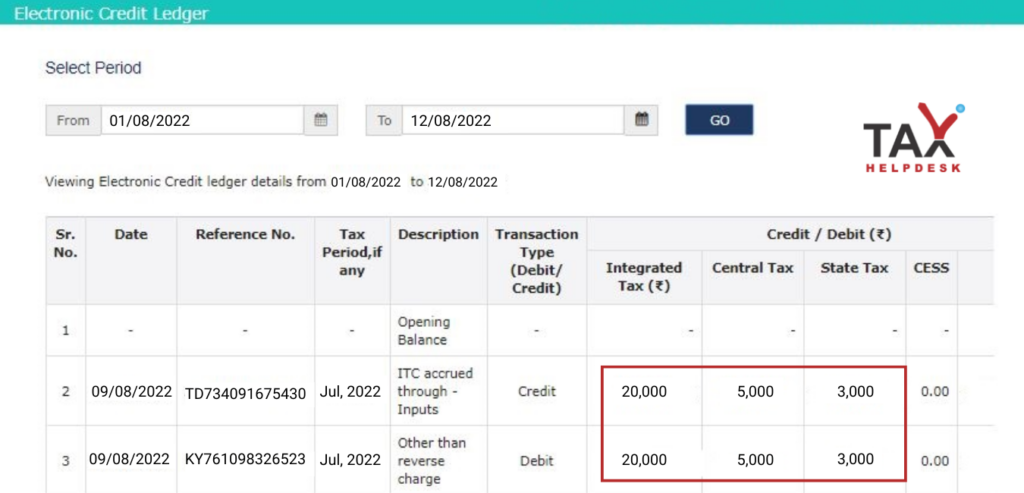

After setting off the Input Tax Credit, this is who Lakshman’s electronic credit ledger will look like on the GST Portal:

Electronic Tax Liability Ledger:

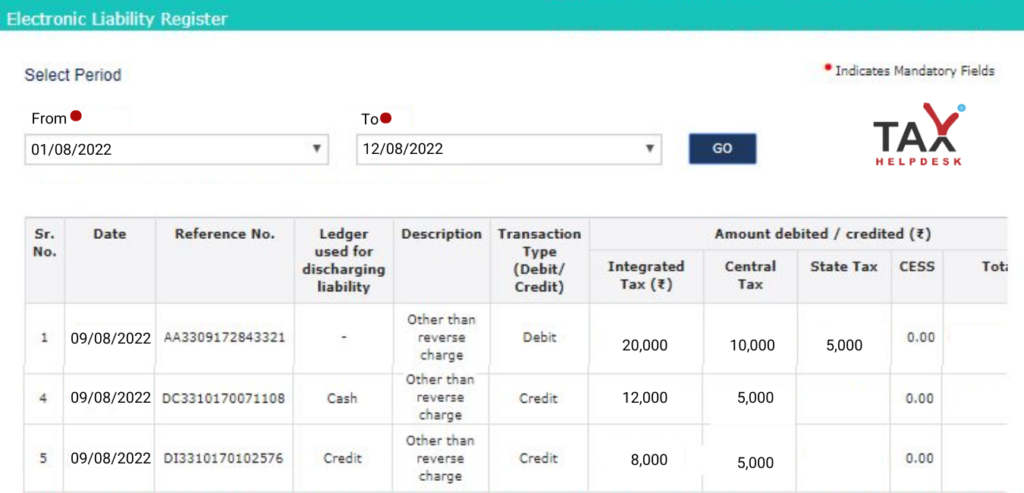

The last type of GST ledger is Electronic Tax Liability ledger. The electronic tax liability ledger comprises of details of all the GST liabilities. In addition to this, it contains the details of the manner of payment of GST liability i.e., through cash or credit. Accordingly, keeping in view the above two examples, this is how the Electronic Tax Liability Ledger of Ram will be on GST Portal:

Join TaxHelpdesk’s Telegram Channel today!