Financial assumptions or Statements are prepared, based on certain assumptions which are neither disclosed nor required to be disclosed and this is why, they are called as Fundamental Assumptions Accounting.

As per Accounting Standards 1 of the ICAI, certain fundamental accounting assumptions underlie the preparation and presentation of financial statements. They are usually not specifically stated because their acceptance and use are assumed. Disclosure is necessary only if they are not followed.

Also Read: Golden Rules of Accounting

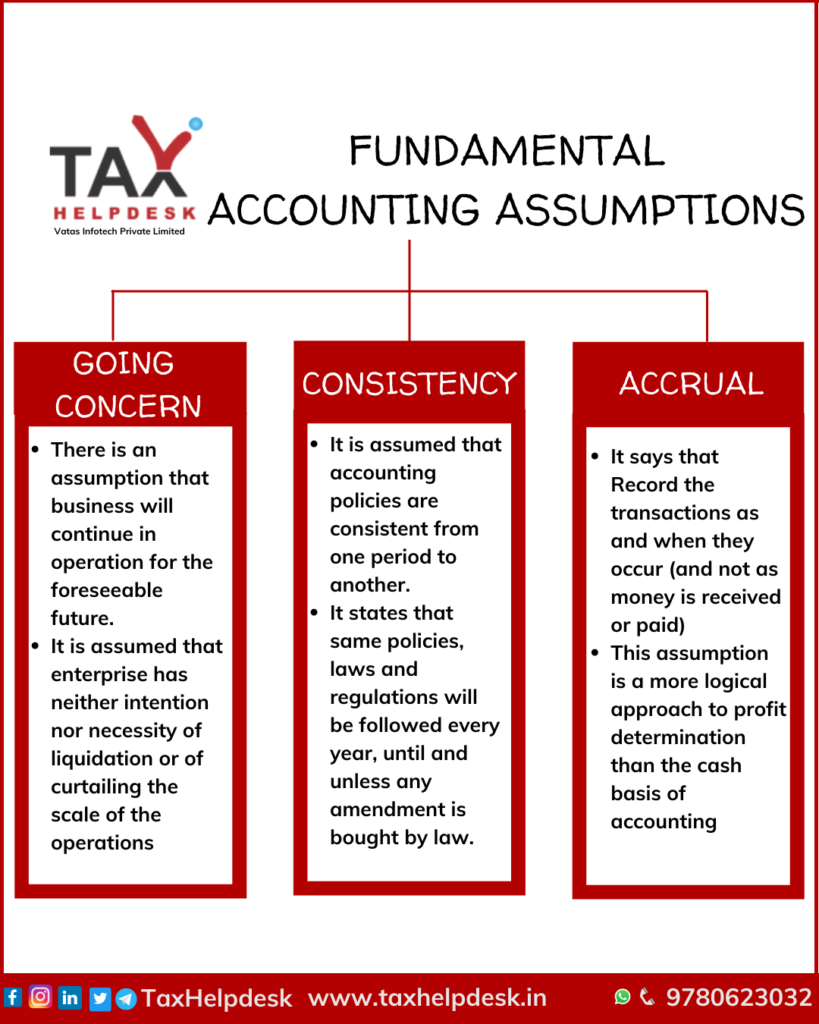

Types Of Accounting Fundamental Assumptions

A. Going Concern

The enterprise is normally viewed as a going concern, that is, as continuing in operation for the foreseeable future. It is assumed that the enterprise has neither the intention nor the necessity of liquidation or of curtailing materially the scale of the operations.

B. Consistency

It is assumed that accounting policies are consistent from one period to another.

C. Accrual

Revenues and costs are accrued, that is, recognised as they are earned or incurred (and not as money is received or paid) and recorded in the financial statements of the periods to which they relate. (The considerations affecting the process of matching costs with revenues under the accrual assumption are not dealt with in this standard.

What Is Going Concern?

The financial statements are normally prepared on the assumption that an enterprise will continue in operation in the foreseeable future and neither there is intention, nor there is need to materially curtail the scale of operations. Going concern fundamental Assumptions is not likely to be compatible with the intention or necessity to enter into a scheme of arrangement with the enterprise’s creditors or to liquidate in near future.

Also Read: Which ITR should I file?

Financial statements prepared on going concern basis recognise among other things the need for sufficient retention of profit to replace assets consumed in operation and for making adequate provision for settlement of its liabilities. If any financial statement is prepared on a different basis, e.g. when assets of an enterprise are stated at net realisable values in its financial statements, the basis used should be disclosed.

What Is Consistency?

The principle of consistency refers to the practice of using same accounting policies for similar transactions in all accounting periods. The consistency improves comparability of financial statements through times. However, an accounting policy can be changed if the change is required,-

(i) by a statute;

(ii) by an accounting standard; or

(iii) for more appropriate presentation of financial statements.

This assumption in preparation of financial statements reflects that such entity has intention to continue business activities/ operation in foreseeable future. In other words there is no plan to discontinue/ liquidate the business in near future.

What Is Accrual?

Under this basis of accounting, transactions are recognised as soon as they occur, whether or not cash or cash equivalent is actually received or paid. Accrual basis ensures better matching between revenue and cost and profit/loss obtained on this basis reflects activities of the enterprise during an accounting period, rather than cash flows generated by it.

While accrual basis is a more logical approach to profit determination than the cash basis of accounting, it exposes an enterprise to the risk of recognising an income before actual receipt. The accrual basis can therefore overstate the divisible profits and dividend decisions based on such overstated profit lead to erosion of capital. For this reason, accounting standards require that no revenue should be recognised unless the amount of consideration and actual realisation of the consideration is reasonably certain.

Despite the possibility of distribution of profit not actually earned, accrual basis of accounting is generally followed because of its logical superiority over cash basis of accounting as illustrated below. Section 128 of the Companies Act makes it mandatory for companies to maintain accounts on accrual basis only. It is not necessary to expressly state that accrual basis of accounting has been followed in preparation of a financial statement. In case, any income/expense is recognised on cash basis, the fact should be stated.

Assumption relating to Accrual indicates that Financial Statement have been prepared based on mercantile system, wherein the effect of transactions is recognised/ recorded when they are entered into (and not when the cash is received or paid) and accordingly they get reported in the financial statements of the relevant financial year to which they relate.

If you want to know more about Accounting or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!