Section 194S was introduced in the Income Tax Act, 1961 just like Section 194R through the Finance Act, 2022. Thereby, as per Section 194S, there shall be a deduction of TDS @1% on the transfer of Virtual Digital Assets (VDA). Further, the provisions of this Section shall come into effect from July 1, 2022.

On whom Section 194S is applicable?

The provisions of Section 194S apply to all persons i.e.,

– Individuals

– HUFs

– Partnership Firms (including LLPs)

– Companies

– Others

However, for the threshold limit for the calculation of TDS, the individuals and HUFs are classified as “specified persons”. Whereas, the rest of the persons are “other than specified persons”.

Also Read: Know About The TDS Rates For FY 2022-23 Easily Explained

Threshold limit for TDS deduction under Section 194S

The threshold limit refers to the value of the Virtual Digital Asset. Further, the threshold limit for TDS deduction under Section 194S for Individuals and HUFs is different for other persons. Accordingly, the threshold limit for both the categories is as follows:

Person | Particulars | Threshold Limit (Aggregate Value on the transfer of VDA) |

Individual and HUFs | Total sales or gross receipts do not exceed Rs. 1 Crore, in case of business or Rs. 50 Lakhs in case of profession or There is no income from business or profession | Rs. 50,000 |

Others | Including firms, LLPs and companies | Rs. 10,000 |

Therefore, there shall be a deduction of TDS where the above conditions are applicable as well as the threshold limits exceed the above amount.

Also Read: Understand TDS Deduction: If Person Is Resident In India

Who can deduct TDS under Section 194S?

The deduction of TDS under Section 194S depends upon the question that who are the parties. In addition to this, the medium through which there is selling of Virtual Digital Assets is also seen. Accordingly, there are 4 such scenarios:

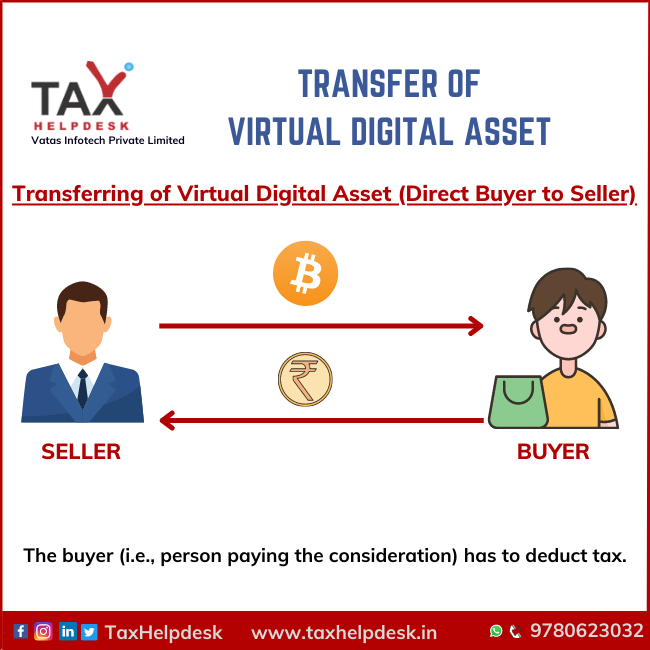

Firstly, transferring VDA through the exchange (i.e., direct buyer to seller)

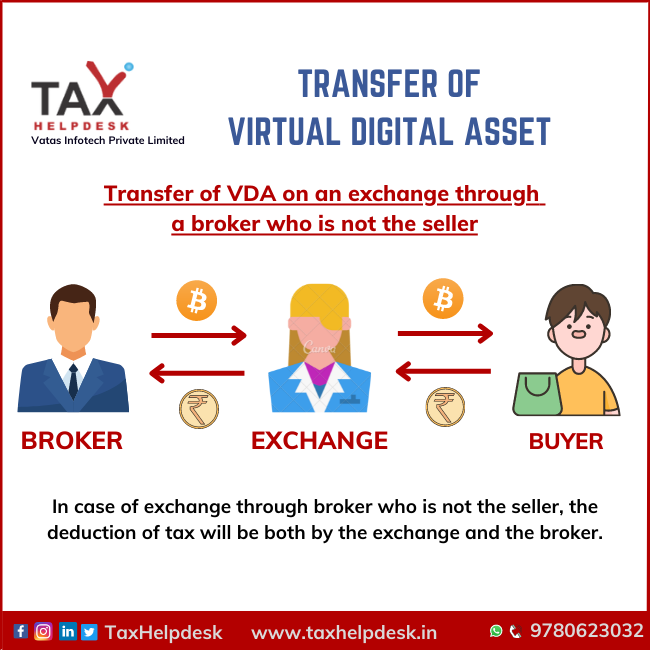

Secondly, the transfer of VDA on an exchange through a broker who is not the seller

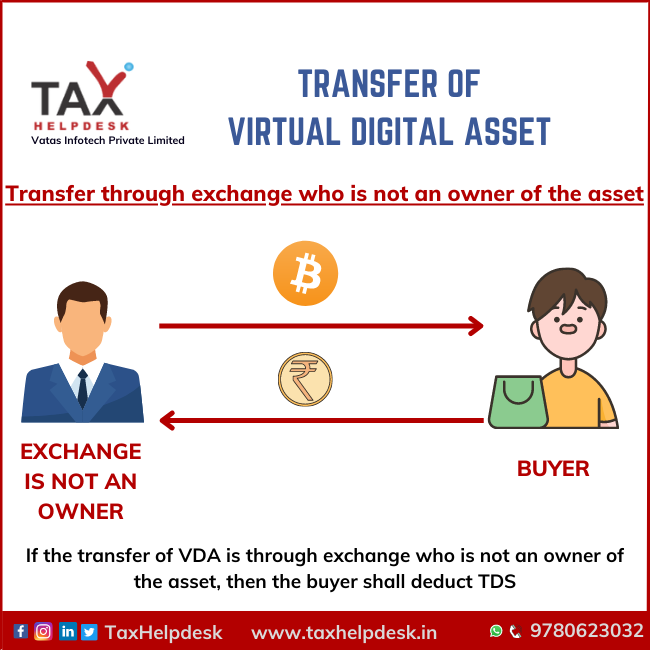

Thirdly, VDA transfer through exchange who is not an owner of the asset

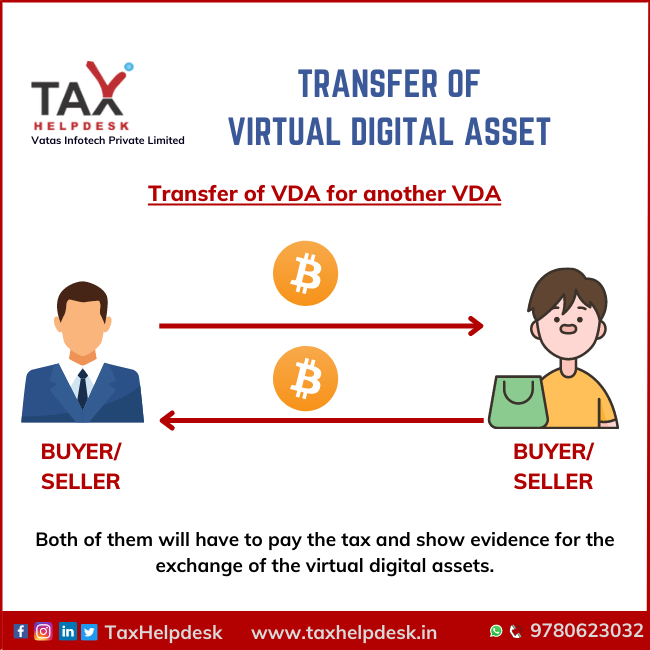

Lastly, the transfer of VDA for another VDA

Also Read: Section 192: TDS On Salary

Transferring VDA through exchange

As per Section 194S of the Act, any person who is responsible for paying to any resident any sum by way of consideration for transfer of VDA has to deduct tax. Therefore, in a peer to peer (i.e. direct buyer to seller) transaction, the buyer (i.e., person paying the consideration) has to deduct tax.

If there is transfer of Virtual Digital Asset through exchange, then only the exchange can deduct the TDS under Section 194S. This is so because through the exchange

Transfer of VDA on an exchange through a broker who is not the seller

As per the circular on Section 194S by the Income Tax Department, in the case of exchange through a broker who is not the seller, the deduction of tax will be both by the exchange and the broker. However, if there is a written agreement between the exchange and the broker that only the broker will be deducting tax, then the broker may alone deduct the tax.

VDA transfer through exchange who is not an owner of the asset

If the transfer of VDA is through exchange who is not an owner of the asset, then the buyer shall deduct TDS under Section 194S. However, there may be cases wherein the buyer may not be aware whether the exchange is the owner of the asset or not. Therefore, to remove this confusion, the circular states the exchange may enter into a written agreement with the buyer or his broker. The agreement may state that in regard to all such transactions the exchange would be paying the tax on or before the due date for that quarter.

Transfer of VDA for another VDA

If the person transfers VDA for another VDA, then both of them will be buyers as well as sellers. Accordingly, in this case, both of them will have to pay the tax and show evidence for the exchange of the virtual digital assets. Further, in this case also the buyer and seller can enter into an agreement for deduction of TDS.

Which date is to be considered for deduction of TDS?

The provisions of Section 194S are applicable from 1st July, 2022, which is applicable from FY 2022-2023. However, the calculation of the aggregate value of the consideration for transfer of VDA shall be on the basis of the whole year. Further, there shall be no TDS deduction on transfer of VDA before 1st July, 2022.

To sum it up, Section 194S will be applicable only when there is a deduction on the transfer of VDA after 1st July, 2022. In addition to this, the aggregate value of the transfer of VDA should be more than the threshold limit.

Also Read: Comprehensive Guide On Consequences Of Non TDS Deduction Compliances

When should the TDS be deducted under Section 194S?

The tax deduction is to be made at the time of credit of such sum to the account of the resident or at the time of payment, whichever is earlier.

Support us by joining our group on Telegram today!

The views here are personal of the author.