It is a settled law that the tax is calculated on the income earned during a relevant financial year. If the assessee has received any portion of salary ‘in arrears or in advance’, or received a family pension in arrears, then his tax liability may get increased. Therefore, to provide relief from higher tax payment, relief under Section 89(1) comes into play.

Cases where relief can be obtained under Section 89(1)?

Relief under Section 89(1) is available in the following cases:

– Salary received in arrears or in advance

– Family pension being received in arrears

– Gratuity

– Compensation on termination of employment

– Commuted pension

Also Read: 10 Best Ways to Save Taxes

Steps to calculate tax relief under Section 89(1)

The steps to calculate tax relief under Section 89(1) are as follows:

Step 1: Calculate the total tax payable on total income, including additional salary – in the year, it is received.

Step 2: Calculate tax payable on the total income, excluding additional salary in the year it is received. The amount of additional salary (Arrears) can be obtained from the arrear document given by your employer. You have to subtract the arrear from the total salary received (including the arrears), which can be taken from your Form 16. This calculation will give you the exact amount of tax liability in the given year if there were no arrears.

Step 3: Calculate the difference between Step 1 and Step 2. This will give the additional tax liability created due to arrears of income.

Step 4: Calculate tax payable on the total income of the year to which the arrears relate, excluding arrears.

Step 5: Calculate tax payable on the total income of the year to which the arrears relate, including arrears

Step 6: Calculate the difference between Step 4 and Step 5. This will calculate the actual tax liability in any past year pertaining to which arrears have been received in the current year, had the full arrears received in the same past year.

Step 7: Excess of the amount at Step 3 over Step 6 is the tax relief that shall be allowed. If the amount in Step 6 is more than the amount in Step 3, no relief shall be allowed.

Illustration

Suppose Mr Kamal, an employee, gives the following details for the FY 2022-2023| AY 2023-2024.

| PARTICULARS | AMOUNT (in Rupees) |

|---|---|

| Income from salary | 10,00,000 |

| Salary for FY 2016-17 received during FY 2022-2023 | 1,00,000 |

| Assessed income for FY 2016-17 | 4,00,000 |

In the given example, the tax liability is to be calculated as per the Income Tax Slab Rates of FY 2022-23 | AY 2023-24 and FY 2016-17 | AY 2017-18 applicable to the financial year.

| PARTICULARS |

AMOUNT (in Rupees) |

AMOUNT (in Rupees) |

|---|---|---|

| Assessment Year 2023-2024 | ||

| Total Income ( including arrears) | 11,00,000 | |

| Total Income ( excluding arrears) | 10,00,000 | |

| Tax on total income of Rs. 11,00,000 | 1,42,500 | |

| Add: Health & Education Cess @ 4% | 5,700 | |

| Tax on total income ( including arrears) (Step 1) | 1,48,200 | |

| Tax on total income of Rs. 10,00,000 | 1,12,500 | |

| Add: Health & Education Cess @ 4% | 4,500 | |

| Tax on total income ( excluding arrears) (Step 2) | 1,17,000 | |

| Difference between (Step 1) & (Step 2) (Step 3) | 31,200 | |

| Assessment Year 2017-18 | ||

| Total Income ( including arrears) | 5,00,000 | |

| Total Income ( excluding arrears) | 4,00,000 | |

| Tax on total income of Rs. 5,00,000 | 20,000 | |

| Add: Health & Education Cess @ 3% | 600 | |

| Tax on total income ( including arrears) (Step 4) | 20,600 | |

| Tax on total income of Rs. 4,00,000 | 10,000 | |

| Add: Health & Education Cess @ 3% | 300 | |

| Tax on total income ( excluding arrears) (Step 5) | 10,300 | |

| Difference between (Step 4) & (Step 5) (Step 6) | 10,300 | |

| Relief u/s 89 (Step 3 – Step 6) (Step 7) | 20,900 |

Tax payable for FY 2022-23 = Rs. 1,48,200 – Rs. 20,900 = Rs. 1,27,300.

How to claim relief under Section 89(1)?

The relief under Section 89(1) can be claimed by filing Form 10E. This form can be filed online on the Income Tax Portal.

How to file Form 10E?

The steps involved in filing of Form 10E are as follows:

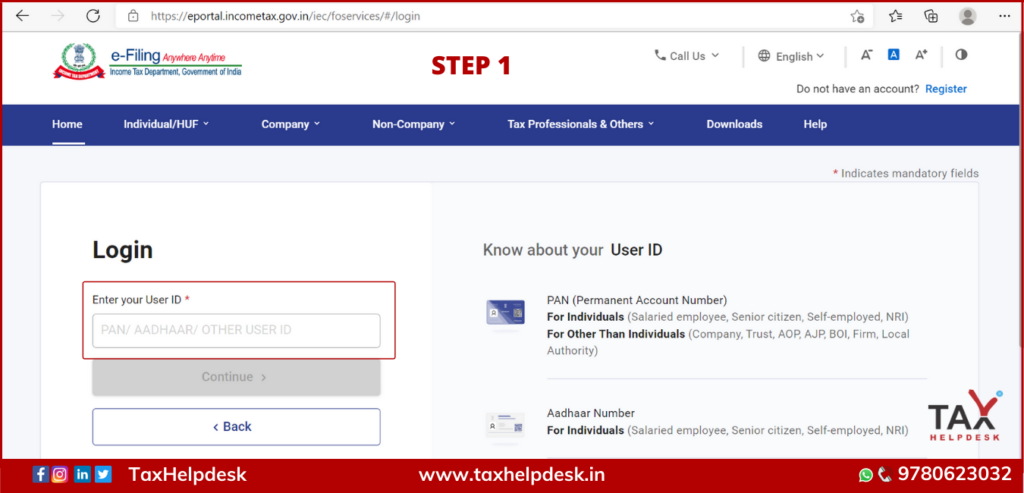

Step 1: Logon to the Income Tax Portal by putting your PAN/Aadhaar No./Username and password

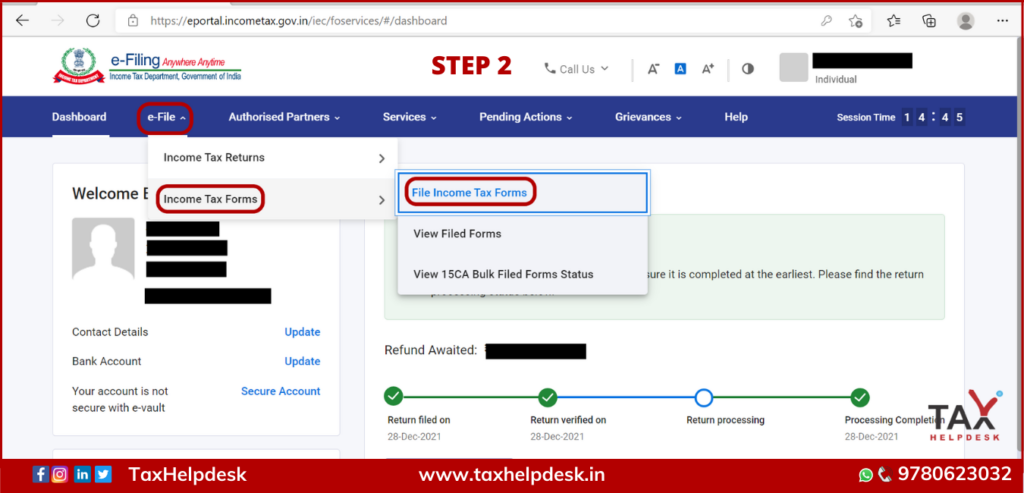

Step 2: Now head over to “e-file” –> “Income Tax Forms” –> File Income Tax Forms

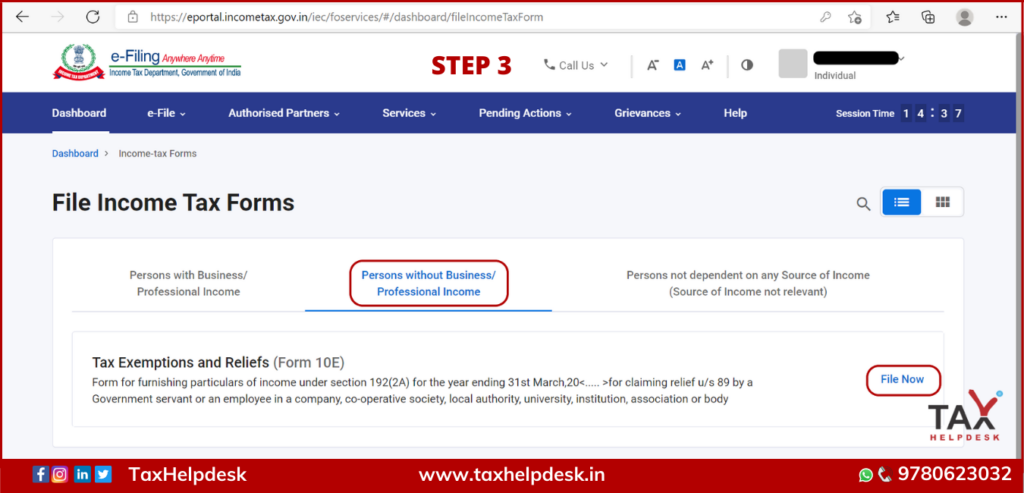

Step 3: Click on tab “Persons without Business/Professional Income”

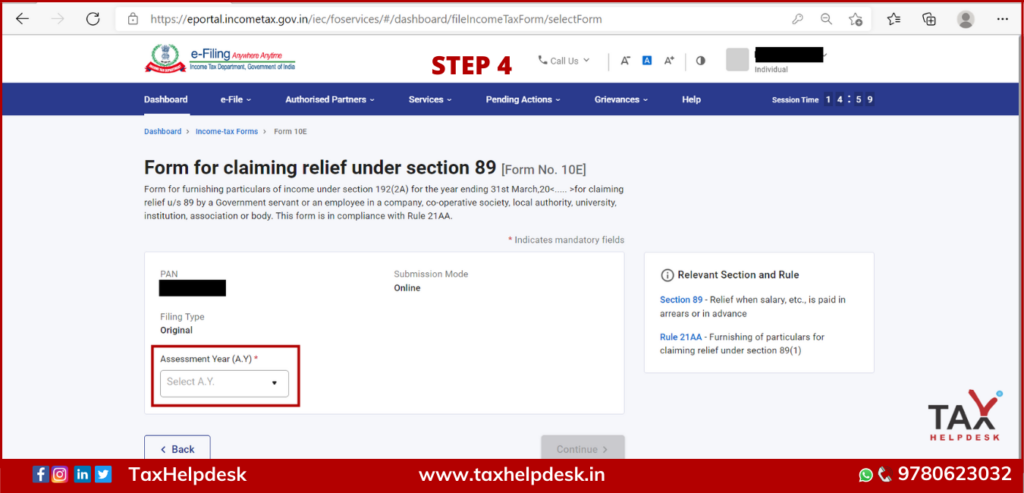

Step 4: Select the relevant “Assessment Year” and click on continue.

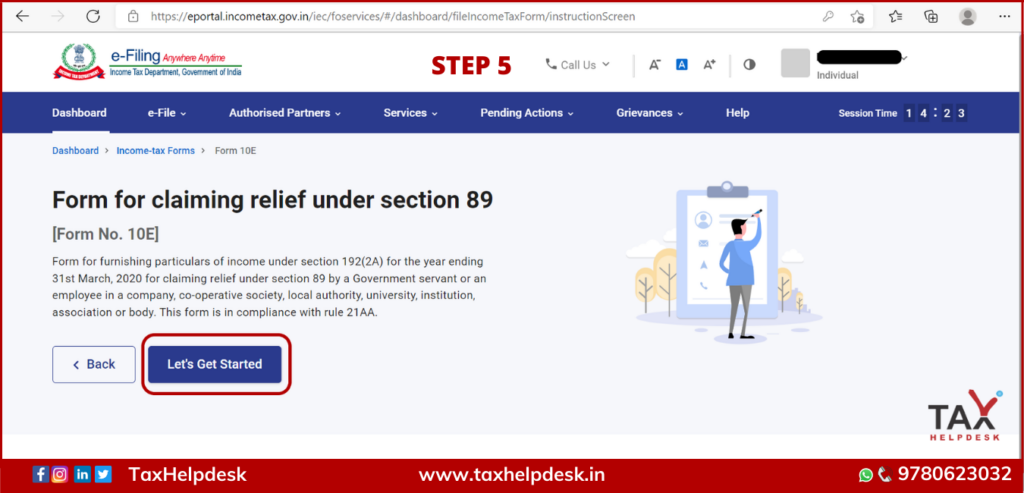

Step 5: After clicking on continue, click on “Let’s Get Started”

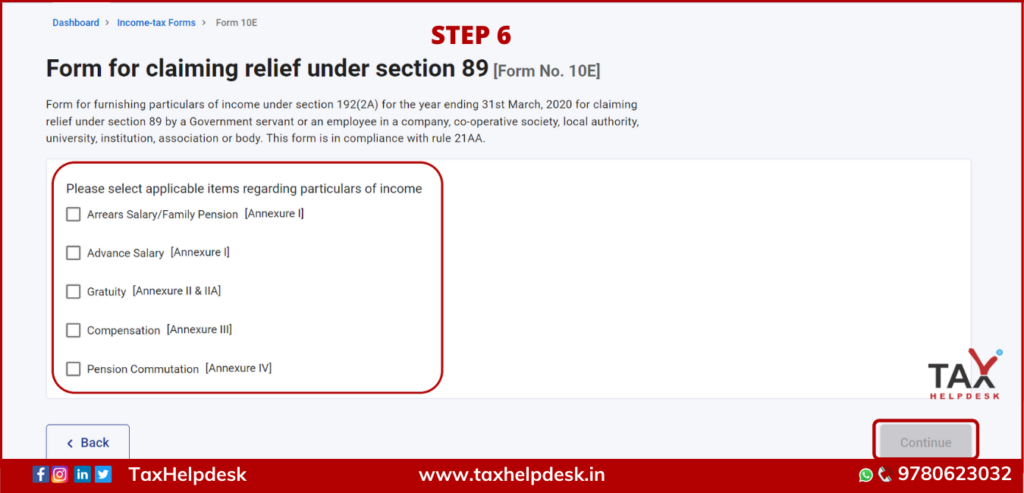

Step 6: Now select the relevant category of income and click on continue

Step 7: Enter the relevant details asked for and click on Preview button.

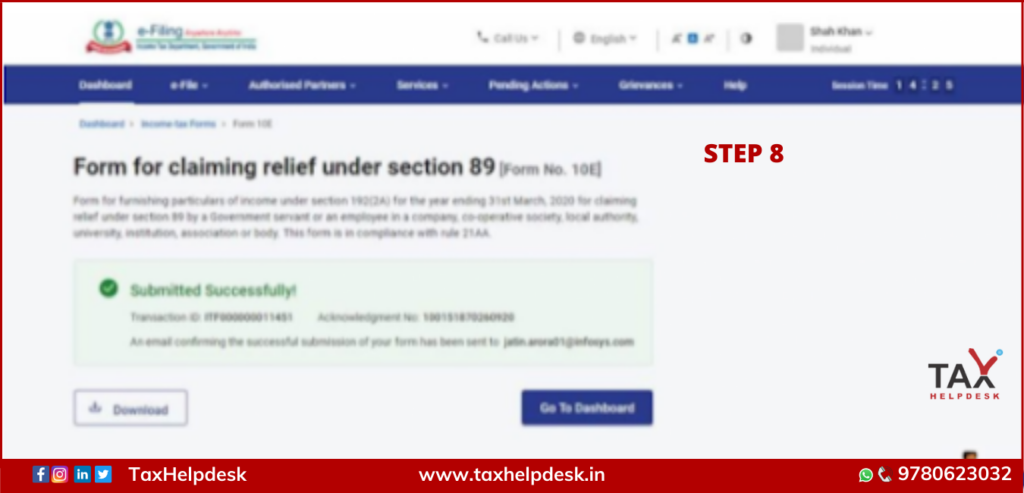

Step 8: Now proceed to e-verify. A message will be displayed on screen on successful submission of the form containing the transaction ID and acknowledgement receipt number.

Note:

From Financial Year 2014-15 (Assessment Year 2015-16), the Income Tax Department has made it compulsory to file Form 10E if you want to claim relief under section 89(1) of the Act. Taxpayers who have claimed relief under section 89(1) but have not filed Form 10E have received an income tax notice from the department containing the following lines –

“The relief u/s 89 has not been allowed in your case, as the online form 10E has not been filed by you. The furnishing of Online form 10E is required as per sec.89 of the Income Tax Act.”

FAQs

The assessment year is to be chosen in which arrears have been received. For example, if arrears are received in the financial year 2016-17, choose the assessment year 2017-18.

The form 10E is to be submitted before filing of the income tax return. In case the person has filed his income tax return and claimed relief under Section 89(1) and not filed Form 10E, then there are very likely chances that he will get a notice from Income Tax Department.

The form 10E is to be submitted before filing of the income tax return. In case the person has filed his income tax return and claimed relief under Section 89(1) and not filed Form 10E, then there are very likely chances that he will get a notice from Income Tax Department.

It is not mandatory to submit this form to the employer. However, your employer may ask for confirmation of submission of Form 10E before adjusting your taxes and allowing tax relief.

If you have any opinions or feedback related to tax reliefs, then do share it in the comment section below. You can also drop us a message on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!