There can be various instances wherein, the taxpayers can be aggrieved by an order passed by an Assessing Officer. Consequently, in such a scenario the taxpayers have an option of filing Income Tax Cases as well as Appeals against the order of the Assessing Officer.

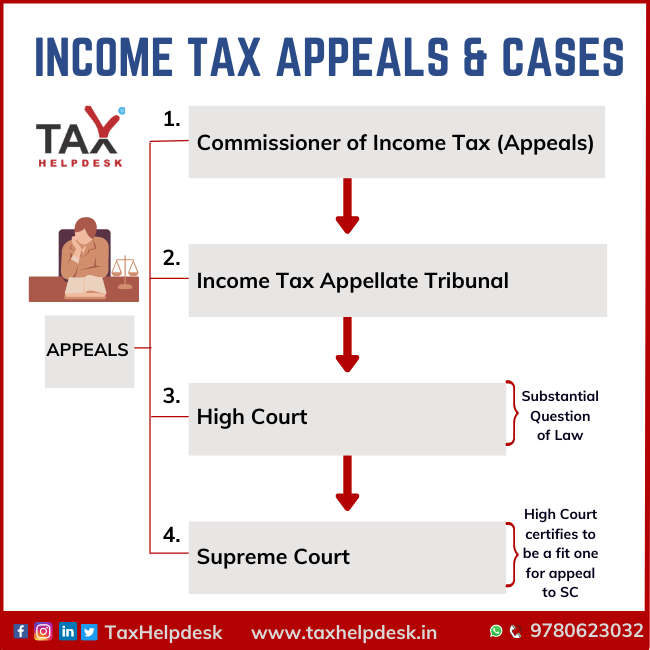

Hierarchy of filing income tax cases & Appeals against the order of Assessing Officer

Pecuniary Jurisdiction for filing Income tax cases & appeals

The pecuniary jurisdiction for filing appeals in different forums is set by the Central Board of Direct Taxes. Accordingly, the CBDT vide instruction no. 17/2019 on the date 8 August, 2019 has set limits for filing appeals in front of the ITAT, High Courts as well as Supreme Courts as follows:

| Forum | Limit |

|---|---|

| Income Tax Appellate Tribunal | Rs. 50 lacs |

| High Court | Rs. 1 crores |

| Supreme Court | Rs. 2 crores |

Specifically, in order to determine the value for the purposes of pecuniary jurisdiction the amount of tax effect is considerable. Further, the tax effect is the difference between the tax that can assess on income and tax on income without assessment adjustments.

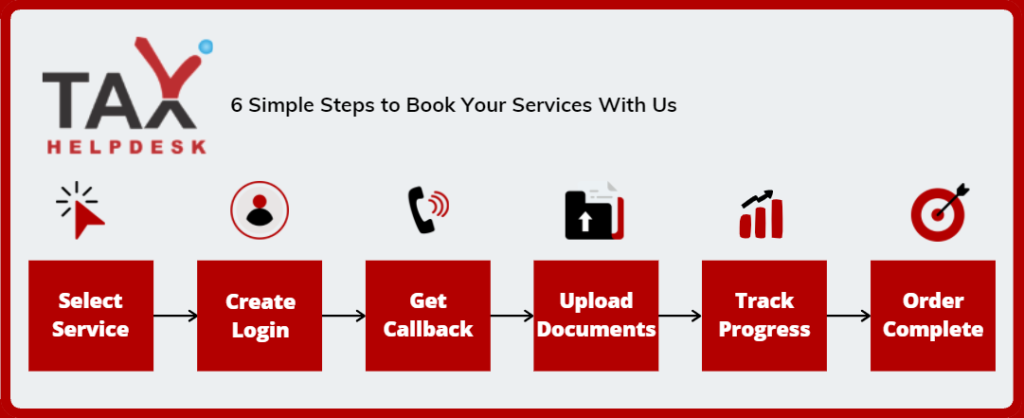

How to file for Income Tax Appeals through TaxHelpdesk?

After placing of service request, the tax experts from TaxHelpdesk will get in touch with the user within 24 working hours. Thereafter, if there is a need for any document then, there shall be the communication of the same to the user by the TaxHelpdesk expert. Additionally, the user can upload the documents in his account.

Cases where appeals can be filed

Section 246A specifies the orders against which an appeal can file is given below:

- In case, where the taxpayer denies the liability to be assessed accordingly under the Income Tax Act.

- The adjustments have been made as per income to tax in the return of income.

- Even, when the adjustments are made in the filed statement.

- Assessment order. However, it is except in case of pursuance of directions of the Dispute Resolution Panel.

- Also, an assessment order under section 144.

- Order of Assessment, Re-assessment, or also Re-computation pass after reopening the assessment. However, it is except for an order in pursuance of directions of the Dispute Resolution Panel.

- An order referred to in section 150.

- Similarly, an order of assessment or reassessment in case of search/seizure.

- Alternatively, an order under section 92CD(3).

- In the same way, in the case of Rectification order.

- Treating the taxpayer as an agent of non-resident.

- Assessing the successor of the business in respect of the income of the predecessor.

- Further, if recording the finding about the partition of a Hindu Undivided Family.

- Additionally, order on non-payment of TDS or non-deduction of TDS

- Order determining a refund under Section 237

- Lastly, an order imposing a penalty

Who can file appeal and authorised signatory?

| Type of Taxpayer | Authorised Signatory |

|---|---|

| Individual | Himself or a person duly auhorised by him who is holding power of attorney |

| Hindu Undivided Family | Karta, or if he is absent or is not capable of signing, then by any other adult member of such family. |

| Company | Managing Director, or he if not available or there is no managing director, then by any director of the company. |

| Foreign Company | Person who holds a valid power of attorney from such company. |

| Firm | Managing Partner, or he if not available or there is no managing partner, then by any partner (not being a minor). |

| LLP | Designated Partner, or he if not available or there is no designated partner, then by any partner |

| Local Authority | Principal Officer |

| Political Party | Chief Executive Officer |

| Association | Principal Officer or by any member of the Association |

| Any other person | By that person or by some other person competent to act on his behalf |

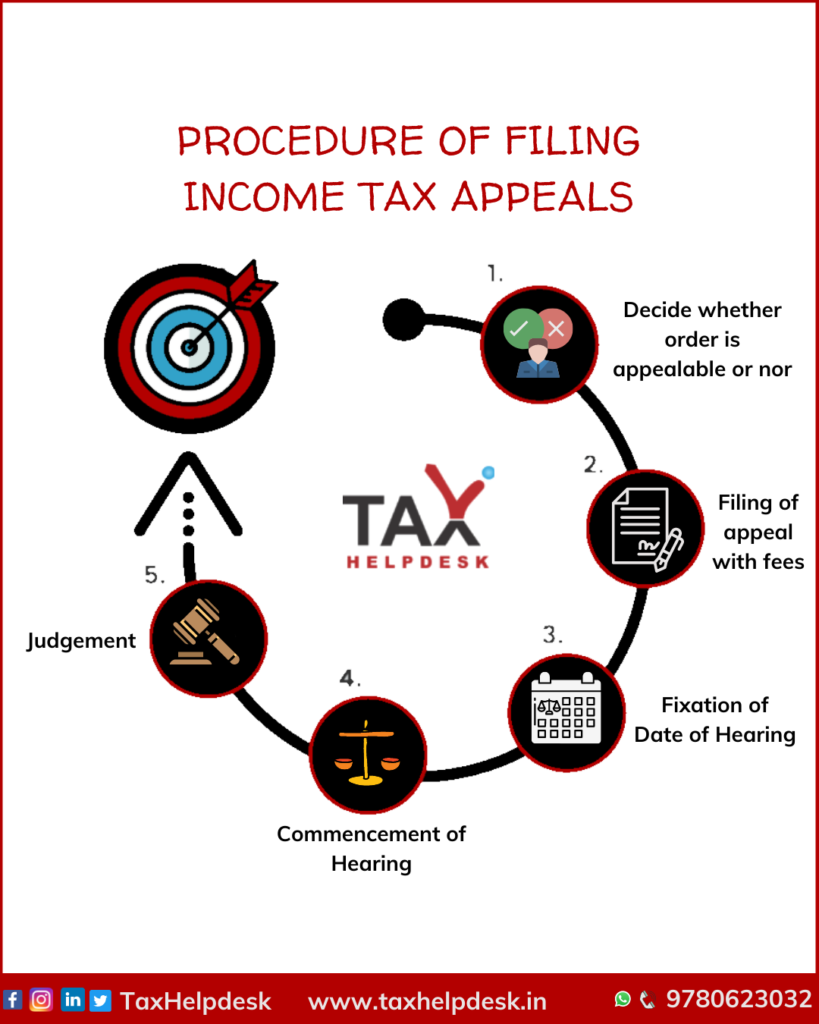

Procedure of filing Appeals

FAQs

The CBDT had substituted Rule 45 of Income-tax Rules, 1962 relating to filing of Form of appeal to CIT(A) vide Income-tax (3rd Amendment) Rules, 2016. Accordingly, by virtue of such amendment, CBDT issued a new Form No. 35 for filing an appeal before CIT(A). Furthermore, e-filing of Form is mandatory for persons for whom e-filing of return of income is mandatory.

Before filing the appeal, the taxpayer should pay the tax as per the return of income. Moreover, if the taxpayer does not file a return of income, then he should pay taxes equal to the amount of advance tax payable by him. However, on the application of the taxpayer, the Commissioner of Income-tax (Appeal) may exempt the taxpayer before filing the appeal such benefit is granted. For example, if good and sufficient reason is proved by the taxpayer for non-payment of tax before filing the appeal.

Reviews

There are no reviews yet.