What is meant by Startup?

Startup, as the name suggests is a newly established business which usually has small investment and is started by one or group of individuals. In order to qualify as a startup, the product or service must be a new one i.e., there should be innovation.

In legal terms, Startup means an entity, incorporated and registered in India

– As a Private Limited Company or Limited Liability Partnership or Registered as a Partnership Firm.

– With an annual turnover not exceeding Rs. 100 crore for any of the financial years since incorporation/registration

– Working towards innovation, development or improvement or of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation.

– An entity formed by splitting up or reconstruction of an existing business shall not be considered a ‘Startup’.

– Shall not be more than 10 years old for Startup recognition OR not incorporated before April 2016 to claim Tax Exemption certificate.

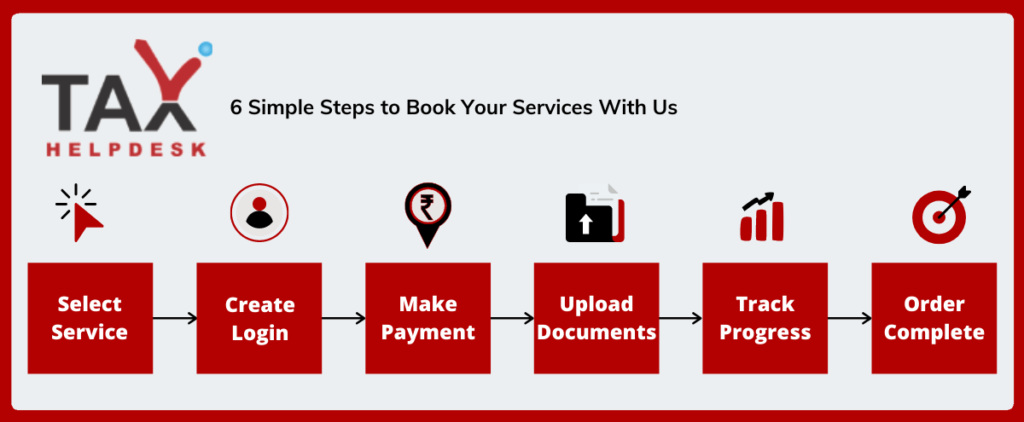

How can you get your Startup registered with TaxHelpdesk?

Once your order is placed, TaxHelpdesk’s dedicated team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, a Tax Expert will be assigned and your order will be processed. Apart from this, you also will be able to check the status of the order in your assigned account.

Startup Registration Process in India

Documents to be attached for Startup Registration

– Incorporation Certificate of Startup

– Company / Firm Details

– Details of the Directors/Partners

– A brief about business and products/services and notes on innovations

– Patent and trademark details (optional)

– PAN Number

– Revenue model and Uniqueness of the Product

– Website / Pitch Deck / Video

– Memorandum of Association for Private Limited / LLP Deed Board Resolution (if any)

Time involved in Startup Registration

The startup registration is complete on the verification of all the documents uploaded by the concerned person. This verification of documents takes 2 business days to complete the process.

Benefits attached with Startup Registration

– Tax saving benefits under Section 80IAC and Section 56

– Enables Government Tender participation

– Provides opportunity of government funding

– Helps in participating in various government schemes

– Can participate in Startup Grand challenges

– IPR Government Fee Concession

– Easy winding up process

– Enables networking

FAQs

– The entity should be a DPIIT recognised startup

– It should be a Private Limited Company or Limited Liability Partnership Firm

– The startup should have been incorporated after 1st April, 2016

An entity shall cease to be a Startup,

– On completion of 10 years from the date of incorporation/registration.

– If its turnover for any previous year exceeds Rs. 100 crore.

Once the application is complete, and the startup gets recognised, you will receive a system-generated certificate of recognition. You will be able to download this certificate from the Startup India portal.

Reviews

There are no reviews yet.