Know about your Digital Signature Registration

DSC or Digital Signature Certificate is a safe digital key that is issued by the certifying authority to approve and affirm the identity of the individual holding this certificate. These Digital Signatures utilize the open key encryption to make the signatures and is basically like an electronic PAN Card or Passport that establishes the credentials of individual when doing business or other transactions on the Web.

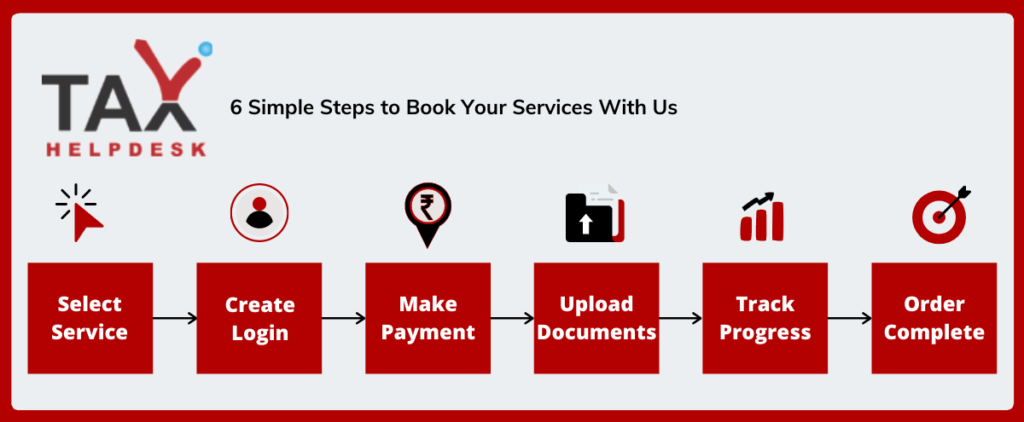

Key steps involved in obtaining Digital Signature Registration from TaxHelpdesk

Once your DSC registration online order is placed, TaxHelpdesk’s dedicated team for reviewing of documents will check the documents uploaded by you within 24 working hours. After reviewing documents, a Tax Expert will be assigned and your order will be processed. Apart from this, you also will be able to check the status of the order in your assigned account.

What does DSC contain?

DSC contains data about the following:

– Client’s name,

– Pincode,

– Country,

– Email address,

– Date of issuance of certificate, and

– Name of the concerned certifying authority

Classes Of Digital Signature Registration

Earlier, there were three classes of DSC namely – DSC Class 1, DSC Class 2 and DSC Class 2. However, w.ef., 1st January, 2021 DSC Class 1 and Class 2 have been discontinued by Controller of Certifying Authorities of India. Now, there is only one class of DSC i.e, DSC Class 3. The classes of DSC which stood earlier is as follows:

Class 1 Certificate | Class 2 Certificate | Class 3 Certificate |

These were issued to individual/private endorsers and are utilized to affirm that the client’s name and email contact details exist in the database of the concerned certifying authority | These were issued to the directors/signatory specialists of the organizations with the end goal of e-filing with the Registrar of Companies (RoC). Class 2 certificate was compulsory for people who need to sign manual records while filing of returns with the RoC. | These certificates were utilized in online investment/offering in e-auctions and online tenders at any place in India. The sellers who wished to take an interest in the online tenders were required to possess Class 3 certificates. |

Types of Certificates which are operational now:

Validity of Digital Signature Registration

The Digital Signature Certificates can be bought with a validity upto three years. The validity is controlled by law, and one cannot buy certificates more than three years and less than One year validity.

Utility Of DSC

Digital Signature Certificates are useful in verifying the individual data subtleties of the individual holder when the business is being conducted online. It has the following uses:

(a) Diminished expense and time: Instead of marking the printed version archives physically and filtering them to send them by means of email, one can digitally sign the PDF documents and send them substantially more rapidly and easily. The Digital Signature certificate holder does not need to be physically present to lead or approve a business.

(b) Information reliability: Documents that are marked digitally can’t be modified or altered in the wake of marking, which makes the information protected and secure. The administration offices regularly request these certificates to cross-check and confirm the business exchange.

(c) Validity of records: Digitally marked archives offer certainty to the beneficiary to be guaranteed of the endorser’s credibility. They can make a move based on such archives without getting stressed over the records being tampered or forged.

Who Has To Obtain DSC?

DSC is to be mandatorily obtained by the individuals/entities that have to get their account audited and has to compulsorily file their Income Tax Return. Also, as per the guidelines issued by Ministry of Corporate Affairs, Government of India – all the reports, applications, and forms can be filed using digital signature only.

Under the regime of GST, any company can get registered on verifying the GST application through digital signature. Even for filing of applications, amendments and various other related forms, digital signature is necessary.

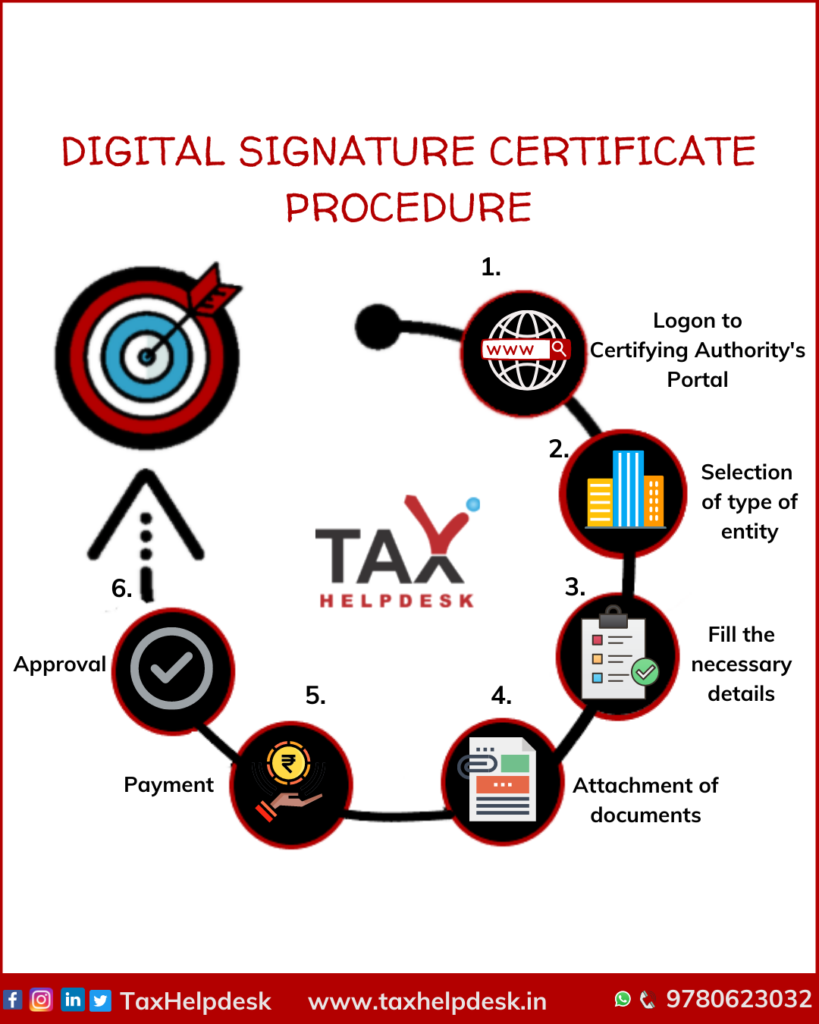

Key procedure of obtaining DSC Registration

Documents Required For DSC Registration

–Application Form

– Authorization letter from organisation

– Identity proof copy

– Address proof copy

– Passport copy, for foreign nationals

Time Involved In Obtaining DSC Registration

Time period taken from the date of application on submission of all the required documents:

Particulars | Time |

Application of DSC | 1 day |

Video/Mobile/Email Verification of DSC | Same day |

Physical copy of registration of DSC | 2-3 days |

FAQ’s

The DSC can be used for the following purposes:

(a) For sending and receiving digitally signed and encrypted emails/ documents.

(b) For carrying out secure web-based transactions.

(c) In eTendering, eProcurement, for Registrar of Companies e-filing,Income Tax for e-filing income tax returns and also in many other applications.

(d) For signing documents like MS Word, MS Excel and PDFs.

A Digital Signature Certificate (DSC) explicitly associates the identity of an individual/device with a two keys – public and private keys. The certificate contains information about a user’s identity (for example, their name, pincode, country, email address, the date the certificate was issued and the name of the CA. These keys will not work in the absence of the other. They are used by browsers and servers to encrypt and decrypt information regarding the identity of the certificate user. The private key is stored on the user’s computer hard disk or on an external device such as a USB token. The user retains control of the private key; it can only be used with the issued password. The public key is disseminated with the encrypted information. The authentication process fails if either one of these keys in not available or do not match. This means that the encrypted data cannot be decrypted and therefore, is inaccessible to unauthorized parties.

Yes, as per Information Technology Act 2000 in India, Digital Signature Certificates (DSCs) are legally valid in India. Digital Signature Certificates (DSCs) are issued by licensed Certifying Authorities under the Ministry of Information Technology, Government of India as per the Information Technology Act.

Yes, a person can have two digital signatures, one for official use and the other one for personal use.

Reviews

There are no reviews yet.