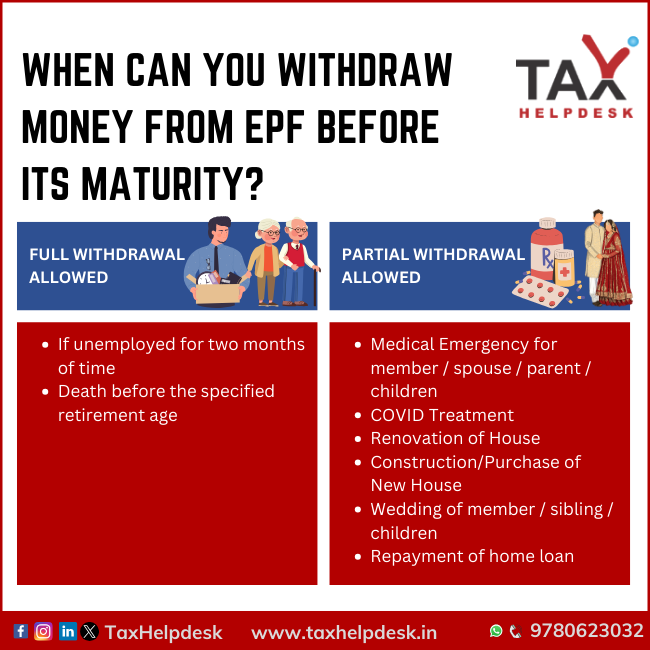

Know When Can You Withdraw Money From EPF?

Employees Provident Fund or EPF is savings cum retirement scheme for the salaried individuals. Under this scheme, contribution is made both by the employer and the employee. The amount contributed in EPF scheme is 12% of the salary (basic + dearness allowance). The amount invested over the years, along with specified interest, is paid out to an employee on his/her retirement.