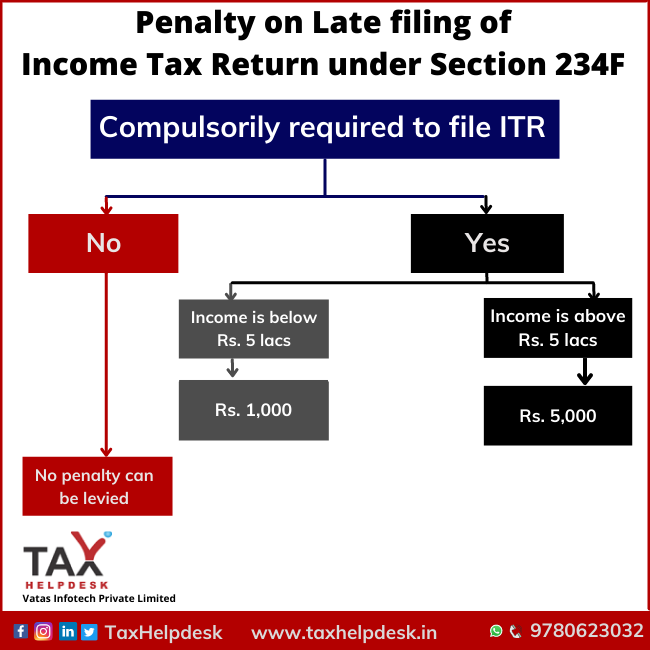

Know Penalty for Late filing of ITR (Section 234F)

It is a settled law that every person who has earned income above the basic exemption limit has to file Income Tax Return during each financial year. Further, these ITRs …

Know Penalty for Late filing of ITR (Section 234F) Read More »