About Income Tax Forms

Apart from the Income Tax forms, the persons are need to filed other forms like Tax Audit Reports, Computation Report, Transfer Pricing Audit Reports, MAT Computation Report, Special Audit Report and various other forms can be filed either offline or online.

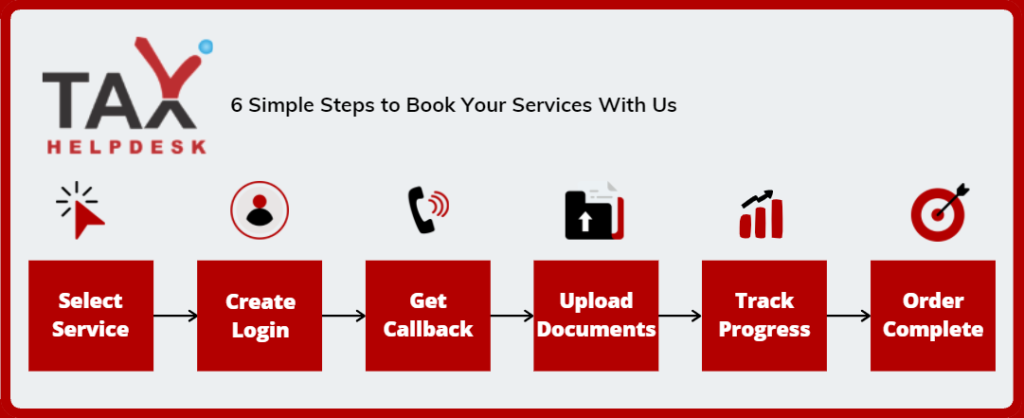

How to get your forms filed by experts at TaxHelpdesk?

After placing of service request, the tax experts from TaxHelpdesk will get in touch with the user within 24 working hours. In case, any document will require by the user, then he shall acknowledge about the same by the concern TaxHelpdesk expert and the user can upload the document in his account.

Various Forms (other than Income Tax Returns) for various persons and due dates

Individuals

HUFs

Firms

Companies

AOP/BOI/Trust/AJP/LA

Forms for Individuals

|

Form |

Description |

Due Date for Submission |

|

1 (Equalisation levy) |

Statement of Specific Services – Equalisation levy Rules, 2016 |

30th June of immediately following Financial Year |

|

3 (Equalisation levy) |

Appeal to the Commissioner of Income-tax (Appeals)- Equalisation |

30 days from the date of receipt of the order of the A.O. |

|

3AC |

Audit report under section 33AB(2) |

Form file along with return of income [Due date specified u/s 139(1)] |

|

3AD |

Audit Report under section 33ABA(2) |

Form file along with return of income due date specified u/s 139(1). |

|

Form 3AE |

Report of audit under section 35D(4)/35E(6) of the Income-tax Act, 1961 |

Form file along with return of income due date specified u/s 139(1). |

|

3CA – 3CD |

Audit report under section 44AB of the Income-tax Act,1961. |

30th September of the Assessment Year |

|

3CB-3CD |

Report under section 44AB of the Income-tax Act,1961. |

30th September of the Assessment Year |

|

Form 3CE |

Audit Report under sub-section (2) of section 44DA of the Income-tax Act, 1961 |

Form file along with return of income due date specified u/s 139(1). |

|

10BA |

Declaration by the assessee claiming deduction under section 80GG |

Form file along with return of income due date specified u/s 139(1). |

|

15CA |

Information to be provide for payments to a nonresident being a company, or to a foreign company |

No time limit |

|

Form 15CB |

Certificate of an accountant |

No time limit |

Forms applicable for HUF

Form | Description | Due Date for Submission |

Form 1 (Equalisation levy) | Statement of Specific Services – Equalisation levy Rules, 2016 | 30th June of immediately following Financial Year |

3 (Equalisation levy) | Appeal to the Commissioner of Income-tax (Appeals)- Equalisation | 30 days from the date of receipt of the order of the A.O. |

Form 3AC | Audit report under section 33AB(2) | Need to file along with return of income due date specified u/s 139(1). |

3AD | Report under section 33ABA(2) | Form file along with return of income due date specified u/s 139(1). |

Form 3AE | Audit report under section 35D(4)/35E(6) of the Income-tax Act, 1961 | Form file along with return of income due date specified u/s 139(1). |

3CA – 3CD | Audit report under section 44AB of the Income-tax Act,1961 where the accounts of the business or profession of a person have been audited under any other law | 30th September of the Assessment Year |

Form 10G | Application for grant of approval or continuance thereof to institution fund u/s 80G(5)(vi) of the Income-tax Act, 1961 | No time limit |

15CA | Information to be furnished for payments to a nonresident being a company, or to a foreign company | There is no time limit that specified |

Form 15CB | Certificate of an accountant | No time limit |

Form 41 | Form for maintaining accounts of subscribers to a recognise provident fund | 15th day of June in each year or as date define according to AO |

applicable Forms for Firms

|

Form |

Description |

Due Date for Submission |

|

1 (Equalisation levy) |

Statement of Specific Services – Equalisation levy Rules, 2016 |

30th June of immediately following Financial Year |

|

3 (Equalisation levy) |

Appeal to the Commissioner of Income-tax (Appeals)- Equalisation |

30 days from the date of receipt of the order of the A.O. |

|

3AC |

Audit report under section 33AB(2) |

Form file along with return of income due date specified u/s 139(1). |

|

35 |

Appeal to the Commissioner of Income-tax (Appeals) |

Within 30 days of date of service of order |

|

40C |

Application for recognition of a recognised provident funds |

No time limit has been prescribed |

|

41 |

Form for maintaining accounts of subscribers to a recognised provident fund |

15th day of June in each year or as date fixed by AO |

|

64 |

Income paid or credited Statement by Venture Capital Company or Venture Capital Fund to be furnished under section 115U of the Income-tax Act, 1961 |

30th day of November of the financial year following the previous year |

|

64A |

Statement of income distributed by a Business Trust is to be furnished under section 115UA of the Income-tax Act, 1961. |

30th day of November of the financial year following the previous year |

|

64D Form |

Statement of income paid or credited by investment fund to be furnished under section 115UB of the Income-tax Act, 1961. |

30th day of November of the financial year following the previous year |

|

64E |

Statement of income paid or credited by a securitisation trust to be furnished under section 115TCA of the Income tax Act, 1961 |

By 30th day of November of the financial year following the previous year during which such income is defined |

Forms for companies

Form | Description | Due Date for Submission |

1 (Equalisation levy) | Statement of particular Services – Equalisation levy Rules, 2016 | 30th June of immediately following Financial Year |

3 (Equalisation levy) | Appeal to the Commissioner of Income-tax (Appeals)- Equalisation | 30 days from the date of receipt of the order of the A.O. |

3AC | Audit report under section 33AB(2) | Form file along with return of income due date specified u/s 139(1). |

3CEB | Report from an accountant to provide under section 92E. | 30th November of the Assessment Year |

10CCBBA | Audit report under section 80-ID(3)(iv) | Form file along with return of income due date specified u/s 139(1). |

15CA | Information to be furnished for payments to a nonresident being a company, or to a foreign company | No time limit has been prescribed |

15CB | Certificate of an accountant | No time limit |

35 | Appeal to the Commissioner of Income-tax (Appeals) | Within 30 days of date of service of order |

40C | Application for recognition of a recognise provident funds | No time limit |

41 | form for maintaining accounts of subscribers to a recognise provident fund | 15th day of June in each year or as date define according to AO |

Forms for AOP/BOI/Trust/AJP/LA

|

Form |

Description |

Due Date for Submission |

|

Form 1 (Equalisation levy) |

Statement of Specific Services – Equalisation levy Rules, 2016 |

30th June of immediately following Financial Year |

|

Form 3 (Equalisation levy) |

Appeal to the Commissioner of Income-tax (Appeals)- Equalisation |

30 days from the date of receipt of the order of the A.O. |

|

3AC |

Audit report under section 33AB(2) |

Form is to be file along with return of income due date specified u/s 139(1). |

|

3CA – 3CD |

Audit report under section 44AB of the Income-tax Act,1961 where the accounts of the business or profession of a person have been audited under any other law |

30th September of the Assessment Year |

|

10G |

Application for grant of approval or continuance thereof to institution fund u/s 80G(5)(vi) of the Income-tax Act, 1961 |

No time limit |

|

15CA |

Information to be furnished for payments to a nonresident not being a company, or to a foreign company |

No time limit has been prescribed |

|

15CB |

Certificate of an accountant |

There is no time limit has been prescribed |

|

35 |

Appeal to the Commissioner of Income-tax (Appeals) |

Within 30 days of date of service of order |

|

40C |

Application for recognition of a recognised provident funds |

No time limit has been prescribed |

|

41 |

form for maintaining accounts of subscribers to a recognise provident fund |

15th day of June in each year or as date specify according to AO |

Process of Filing Forms (other than ITRs)

Reviews

There are no reviews yet.