Through the Union Budget of Assessment Year 2021-22, the Finance Minister Nirmala Sitharman introduced the new tax regime with lower income tax slab rates. The taxpayers which are either individuals or HUFs are now given an option to choose between the new tax regime and the older tax regime.

How to opt for New Income Tax Return Regime?

The individuals or HUFs can opt for new tax regime at any time before filing of their Income Tax Return. This can be through intimating the Income Tax Department by filing Form 10-IE.

Major Deductions available under the Old & New Tax Regime

While the slab rates under the new tax regime are lower than the old tax regime, the individual will have to forego the major deductions which are still available under the old tax regime. Here is the list of major deductions which are available/non-available to a salaried individual under the old and new tax regime:

| Particulars | Old Tax Regime (FY 2022-23 or 2023-24) | New Tax Regime (FY 2022-23) | New Tax Regime (FY 2023-24) |

| Taxable income eligible for tax rebate | Rs. 5,00,000 | Rs. 5,00,000 | Rs. 7,00,000 |

| Maximum amount of tax rebate available | Rs. 12,500 | Rs. 12,500 | Rs. 25,000 |

| Standard Deduction | Rs. 50,000 | Not Allowed | Rs. 50,000 |

| Interest available on home loan under Section 24b on self-occupied or vacant property | Rs. 2,00,000 | Not Allowed | Not Allowed |

| Interest available on home loan under Section 24b on let-out property | Allowed as per the interest amount | Allowed as per the interest amount | Allowed as per the interest amount |

| Deduction under Section 80C (Investment in LIC, EPF, PPF, Tax Saving FD’s etc.) | Rs. 1,50,000 | Not Allowed | Not Allowed |

| Employee’s self contribution to NPS (Section 80CCD(1B)) | Rs. 50,000 | Not Allowed | Not Allowed |

| Employer’s contribution to NPS (Section 80CCD(2)) | Allowed | Allowed | Allowed |

| Contributions to Agniveer Corpus Fund – Section 80CCH | Entire amount that has been contributed | Did not exist | Entire amount that has been contributed |

| Deduction on medical insurance premium under Section 80D | Rs. 25,000/Rs. 50,000 | Not Allowed | Not Allowed |

| Interest on education loan – deduction under Section 80E | Allowed as per the interest on loan amount | Not Allowed | Not Allowed |

| Interest on electrical vehicle – deduction under Section 80EEB | Allowed as per the interest on loan amount | Not Allowed | Not Allowed |

| Donation to political parties/trusts – deduction under Section 80G | If made in cash – Rs. 2000 (max) Others – any amount | Not Allowed | Not Allowed |

| Deduction on Savings Bank Account under Section 80TTA/TTB | Rs. 10,000 / Rs. 50,000 | Not Allowed | Not Allowed |

| Deductions to individuals with disability under Section 80U | Rs. 75,000 / Rs. 1,25,000 | Not Allowed | Not Allowed |

| Other deductions | Allowed | Not Allowed | Not Allowed |

Also Read: Which ITR should I file?

Analysis of Old & New Tax Regime

From the above list, the following can be inferred:

– Standard deduction of ₹50,000/- is not available under the new tax regime. However, this deduction is automatically populated under the old tax regime.

– Deduction under Section 80C of ₹1,50,000/- which can be claimed by investing in ELSS mutual fund, EPF, PPF, life insurance premiums, Senior Citizen Savings Scheme, National Savings Certificate, 5-yr tax saving FD, Sukanya Samriddhi Account, expenses on school tuition fee, principal repayment of home loan etc. Is not available to the individual, if he opts for the new tax regime. Under the old tax regime, the individual still can claim this deduction.

– Contribution to National Pension Scheme under Section 80CCD(1B): The maximum limit of deduction is ₹50,000/-. This deduction is not available under the new tax regime. This deduction can be claimed under the old tax regime.

– Deduction of Health Insurance under Section 80D is for paying health insurance premiums for yourself or members of your family for up to ₹25,000 in a financial year. In case of senior citizens, the limit is ₹50,000. This deduction can be availed only under the old tax regime.

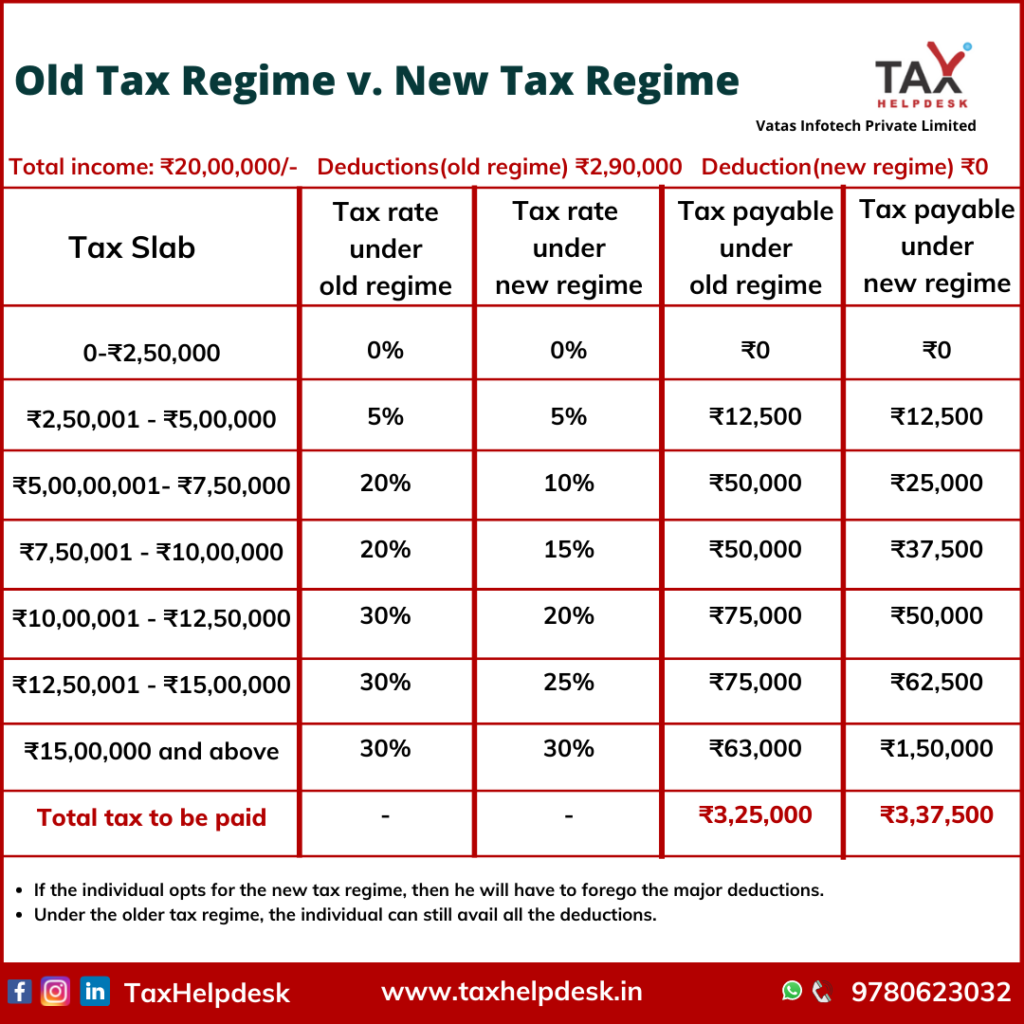

Illustration

Now, in order to clear your confusion as to which tax regime suits you the best, here are the tax slab rates and the calculation of taxes on the net taxable income arrived in the above mentioned illustration under both the regimes:

From the above illustration, it can be inferred that the taxpayers having income below Rs. 15 lacs must opt for Old Tax Regime. But if you have already made investments for the current financial year, then you must opt for old tax regime and claim all the deductions, allowances and exemptions possible.

Pease note that the standard deductions are available only to salaried individuals!

Choose your tax regime wisely and if you still have doubts, then it is feel free to contact our experts at TaxHelpdesk.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin!

Disclaimer: The views expressed in the article are personal to the author. TaxHelpdesk does not owe any liability towards any person in any manner whatsoever.

Pingback: Extended Due Dates of Income Tax: AY 2021-22 | TaxHelpdesk

Pingback: Deduction on Electrical Vehicle for Interest Paid on Loan | TaxHelpdesk

Pingback: Deduction under Section 80E – Interest paid on Higher Education | TaxHelpdesk

Pingback: Do I need to File Income Tax Returns? | TaxHelpdesk

Pingback: 10 Ways to Save Your Taxes! | TaxHelpdesk

Pingback: Decoding Section 87A: Rebate Provision under Income Tax Act | TaxHelpdesk

Pingback: Income Tax Slab rates For Individuals under the Old and New Tax Regime | TaxHelpdesk

Pingback: Do I need to File Income Tax Returns? | TaxHelpdesk