As per Section 80D of the Income Tax Act, Individuals and HUFs can claim deductions on premiums paid on health insurance.

In these unprecedented times, we all have realised that ‘Our Health is Our Wealth’ and in order to keep us protected from these uncertain times, we have taken every possible measure to meet the medical expenditures, if needed. Furthermore, to promote health planning and well being of the people, Section 80D of the Income Tax Act was introduced by the legislature. This section allows deductions on the health insurance and medical expenditures incurred by the persons.

Through this, double benefits are provided to persons – one to the policyholder or his family members and the other is a tax benefit to the person.

In this blog, we will talk in detail about the health insurance tax benefits under Section 80D.

What Is Section 80D?

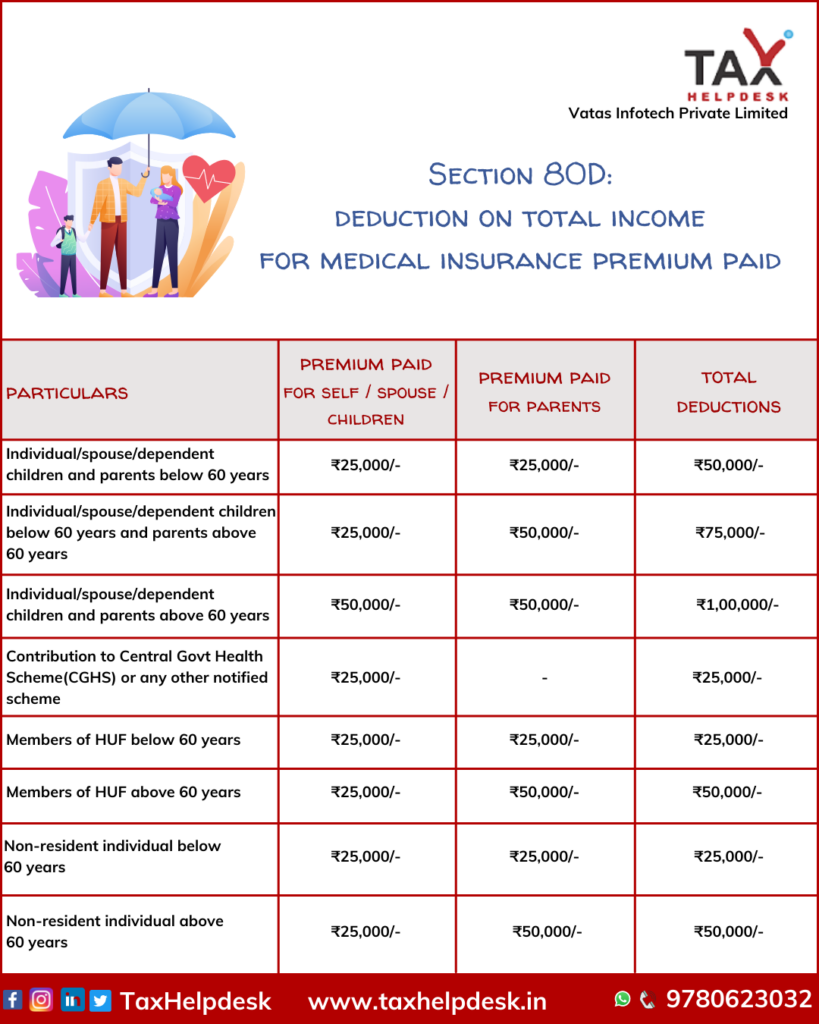

Section 80D: Deduction on total income for medical insurance premium paid

As per Section 80D of the Income Tax Act, a person can claim a deduction on the premium paid on health insurance.

Who Can Claim Deductions Under Section 80D?

Following persons can claim deduction under Section 80D

– Individual (Indian/foreign citizen) for self, spouse, dependent children and parents(whether dependent or not).

– HUF for any of the members.

– NRI’s.

Note:

One can claim a deduction under Section 80D only if he chooses to opt for the old tax regime.

Section 80D deductions payments

A person can claim a deduction under Section 80D on the following payments:

– Payment of health insurance premium paid for self / spouse / dependent children / parents.

– Expenditure on a preventive health checkup.

– Medical expenditure on the health of senior citizen (aged 60 years or above) who is not covered under any health insurance scheme.

– The contribution made to the Central government health scheme or any scheme as notified by the government.

Also Read: Rules Related To EPF Withdrawal

Amount of Deductions under Section 80D

Note:

Section 80D also includes a deduction of Rs 5,000 for any payments made towards preventive health check-ups. This deduction will be within the overall limit of Rs 25,000 / Rs 50,000, as the case may be.

Also Read: All About Advance Tax Under Income Tax Act

Mode of Payment

Following should be the mode of payment to claim deduction under Section 80D

| Particulars | Mode of Payment |

|---|---|

| Medical Insurance Premium | Other than cash |

| Preventive Health Checkup | Cash/Non-Cash |

| Medical Expenditure | Other than cash |

Illustration

Amitabh (55 years old) is a taxpayer. Other members of his family are – Jaya (53 years old, Amitabh’s wife), Abhishek and Aishwarya (dependent children) and parents. The following expenditure for incurred by Amitabh for FY 2022-23:

| Particulars | Amitabh, Jaya, Abhishek, Aishwarya | Parents |

|---|---|---|

| Medical insurance premium paid by cheque | Rs. 23000 | – |

| Medical Expenditure paid by cheque | – | Rs. 49,000 |

| Medical Expenditure paid by cash | Rs. 5000 | Rs. 7000 |

| Preventive health-check-up | Rs. 10000 | Rs. 14000 |

The deduction that Amitabh can claim is as follows:

| Particulars | Amitabh, Jaya, Abhishek, Aishwarya | Parents |

|---|---|---|

| Medical insurance premium paid by cheque | 23000 | – |

| Medical Expenditure paid by cheque | – | 49,000 |

| Medical Expenditure paid by cash | Not allowed cash expenses | Not allowed cash expenses |

| Preventive health-check-up | Maximum limit is Rs. 25000. Since Rs. 23,000 has been utilised, only Rs. 2000 can be claimed | Maximum limit is Rs. 50000. Since, Rs. 49,000 utilised, remaining Rs. 1,000 can only be claimed. However, preventive health check-up has an overall limit of 5000, which has been already used for self and family, so no amount can be claimed now |

| Total 80D deduction that can be claimed by Amitabh is Rs. 65,000 | 25000 | 49000 |

Medical insurance premium paid for brother, sister, grandparents, aunts, uncles or any other relative cannot be claimed as a deduction for taking tax benefit.

Premium paid for working children cannot be taken for tax deduction.

In the case of part payment by you and a parent, both of you can claim a deduction to the extent paid by each.

Group Health Insurance premium provided by the company is not eligible for deduction.

Payment of health insurance premium can be paid through any mode other than cash.

If you have any suggestions/feedback, then please drop us a message in the chat box. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp, channel on Telegram or follow us on Facebook, Instagram, Twitter and Linkedin!

The views are personal of the author and TaxHelpdesk does not owe any liability on the information provided!

Pingback: 10 Ways to Save Your Taxes! | TaxHelpdesk

Pingback: Types of Special Allowances | TaxHelpdesk

Pingback: Decoding Section 87A: Rebate Provision under Income Tax Act | TaxHelpdesk