It is a settled law that every person who has earned income above the basic exemption limit has to file Income Tax Return during each financial year. Further, these ITRs must be filed before or on the due dates notified by the Income Tax Department, Government of India. Filing of ITR on or before due dates is essential to prevent the interest and penalties which are levied on the late filing of ITR.

Due dates for filing of Income Tax Return

The due dates for filing Income Tax Returns are different for different categories of taxpayers. Usually, the individuals and HUFs have to file their ITR by 31st July of the assessment year. Such dates are notified by the Income Tax Department during each financial year. These dates can also be further extended by the Department. For instance, due to the pandemic COVID-19 and the new Income Tax Portal, the due date for filing of ITR for the Financial Year 2019-2020 was extended from 31st July, 2021 to 31st December, 2021. Usually, the following are the due dates for filing ITR for different categories of taxpayers:

| Category of Taxpayer | Due Date for Tax Filing- FY 2021-22 |

|---|---|

| Individual / HUF/ AOP/ BOI (books of accounts not required to be audited) | 31st July 2022 |

| Businesses (Requiring Audit) | 31st October 2022 |

| Businesses requiring transfer pricing reports (in case of international/specified domestic transactions) | 30th November 2022 |

| Revised return | 31 December 2022 |

| Belated/late return | 31 December 2022 |

Note:

Till the Financial Year 2019-2020, the was an option of filing belated ITR till 31st March of the assessment year. However, after the Union Budget, 2021, the belated return can be filed till 31st December of the assessment year. This amendment is effective from FY 2020-21.

Also Read: Do I need to file Income Tax Return?

Penalty charges for non filing of ITR on time

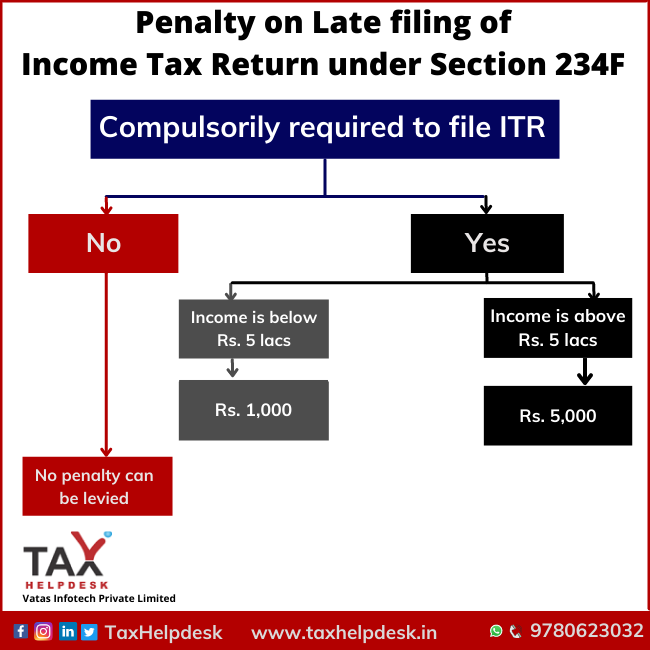

The penalty for non filing of ITR on time was introduced in the Union Budget of 2017 and accordingly, Income Tax Act was amended and Section 234F was inserted. Through this provision, penalty shall be imposed on late filing of ITR from Financial Year 2017-18 and onwards. The minimum amount of penalty that can be imposed under Section 234F is Rs. 1,000/- and maximum amount of penalty is Rs. 5,000/-. The bifurcation of penalties imposed for non filing of ITR by assessees who are required to file ITR by 31st July of the financial year are as follows:

| ITR Filing Date | Total income is less than Rs. 5 lacs | Total income is more than Rs. 5 lacs |

|---|---|---|

|

Before 31st July (Non-Audit), and 31st October (Audit Cases) |

Rs. 0 | Rs. 0 |

|

After 31st July (Non-Audit), and 31st October (Audit Cases) |

Rs. 1,000 | Rs. 5,000 |

Note:

Before the Union Budget, 2021, there was a late fees of Rs. 5000 for ITR filed till 31st December. On the hand, for ITRs filed between January-March had a late filing of Rs. 10,000.

Apart from this, if the tax evaded exceeds Rs 25 lacs the punishment could be imprisonment of 6 months to 7 years, as per the website of the Income Tax Department.

Also Read: 10 ways to save your taxes!

Illustration

The above table is explained with the help of following illustrations:

Illustration 1:

Mr. Ram, having a total income of Rs. 4 lacs, filed his Income-tax return for Assessment Year 2022-23 (Financial Year 2021-22) on 30/06/2021. What will be the fee (penalty) under section 234F?

Since the Income-tax return is filed within the due date, no fee (penalty) will be levied.

Illustration 2:

Mr. Shyam, having a total income of Rs. 16 lacs, filed his Income-tax return for Assessment Year 2022-23 (Financial Year 2021-22) on 10/11/2022. What will be the fee (penalty) under section 234F?

Since the Income-tax Return is filed after the due date, but on or before 31/12/2021, penalty will be Rs. 5,000/-

Illustration 3:

Mr. Mohan, has total income of Rs. 5.5 lacs, if he filed his Income-tax return for Assessment Year 2019-20 (Financial Year 2018-19) on 07/02/2020. What will be the penalty under section 234F?

Since the Income-tax return is filed after the due date and after 31/12/2019, penalty will be Rs. 10,000/-

In the above situation, if total income of the Assessee does not exceed Rs. 5 lacs, the fee penalty will be Rs. 1,000/-.