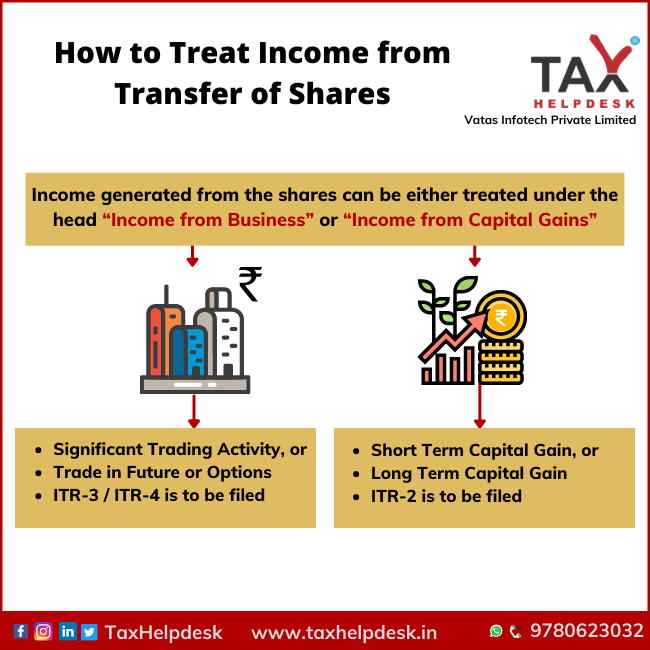

The treatment of Income from the transfer of shares can be under the head either “Income from Business” or “Income from Capital Gains”.

People make Investments for the purpose of generating more sources of income. And, one such source of investment could be investing in shares or mutual funds. Further, investing your earnings in shares or mutual funds could be sahi hai as shown in the advertisements. But it requires the due attention of the investor to the disclaimer that the “shares are subject to market risk, read all the documents carefully before investing.”

Let’s have a look at, how can you treat income from the transfer of shares.

Treatment on transfer of shares under head: Income from Business

If you are an individual who involves in significant trading activity or you trade in Future or Options on a regular basis, then your earnings from the transfer of shares will be under the head “Income from Business”. Consequently, in such a case, the individual has to file ITR-3.

While filing the Income Tax Return, the individual can reduce the expenses incurred in earning such earnings. Apart from this, he can add profits to his total earnings. The Income Tax chargeable on such earnings is as per the Income Tax Slab of the prevailing financial year.

NOTE:

If there is no intention of holding the shares, then the treatment of such earnings shall be as business income.

Income on transfer of shares as capital gains

On the contrary to the above, if you do not do significant trade activity or trade-in Future of Options, then you can treat income from the transfer of shares as capital gains. Further, the capital gain is when the sale price is more than the purchase price.

In addition to the above, earnings from capital gains are dependent on three factors:

– Firstly, the period of holding shares

– Secondly, the nature of the instrument – shares, equity mutual fund or debt mutual fund, and

– Thirdly, payment of STT (Securities Transaction Tax)

Also Read: Know Types & Taxability Of Mutual Funds SIP

Capital Gains have been classified into two types:

– Long Term Capital Gains

– Short Term Capital Gains

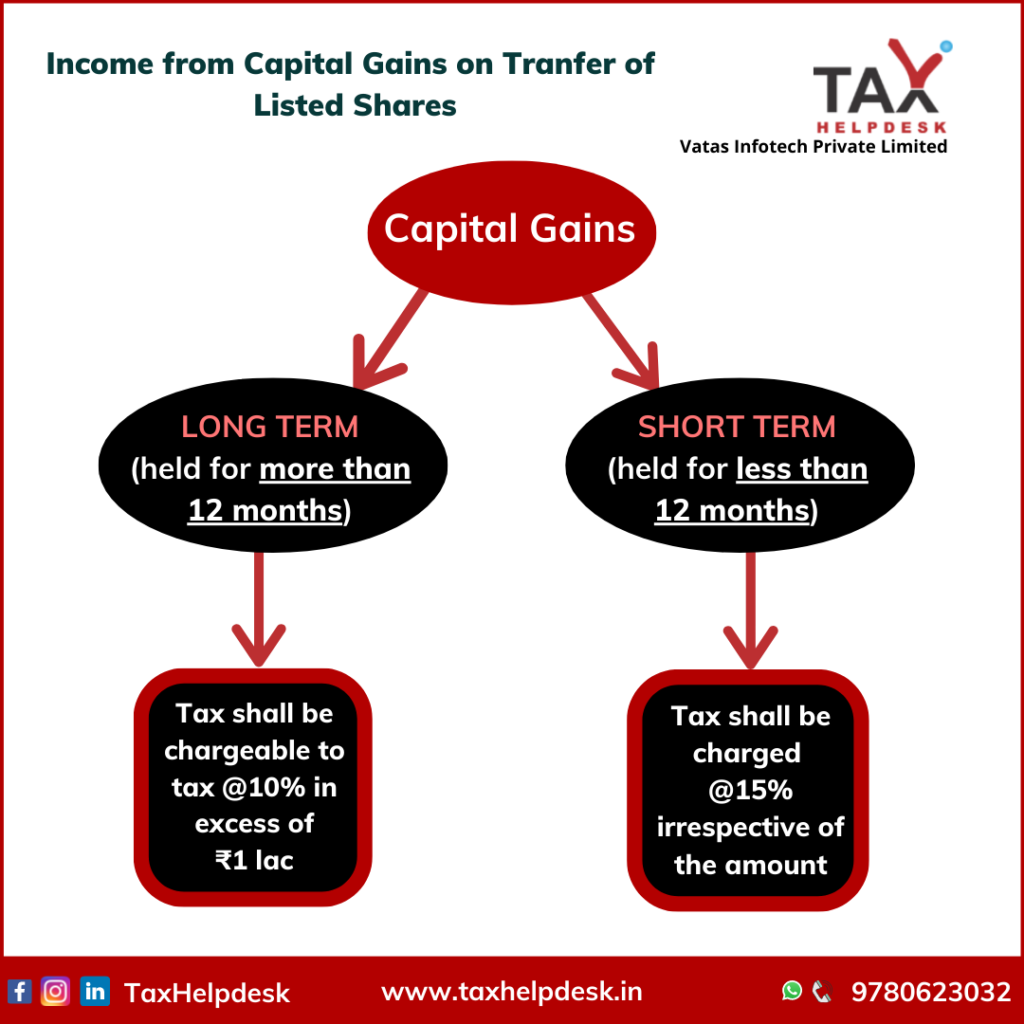

Treatment of Capital Gains for Listed Shares

– If the holding of listed shares is for more than 12 months, then the gains from the transfer of shares shall be classified as Long Term Capital Gains. Accordingly, tax shall be chargeable to tax @10% above Rs. 1 lac.

– On the other hand, if the holding of listed shares is for less than 12 months, then the gains from the transfer of such shares are Short Term Capital Gains. Accordingly, tax shall be chargeable @15% irrespective of the amount.

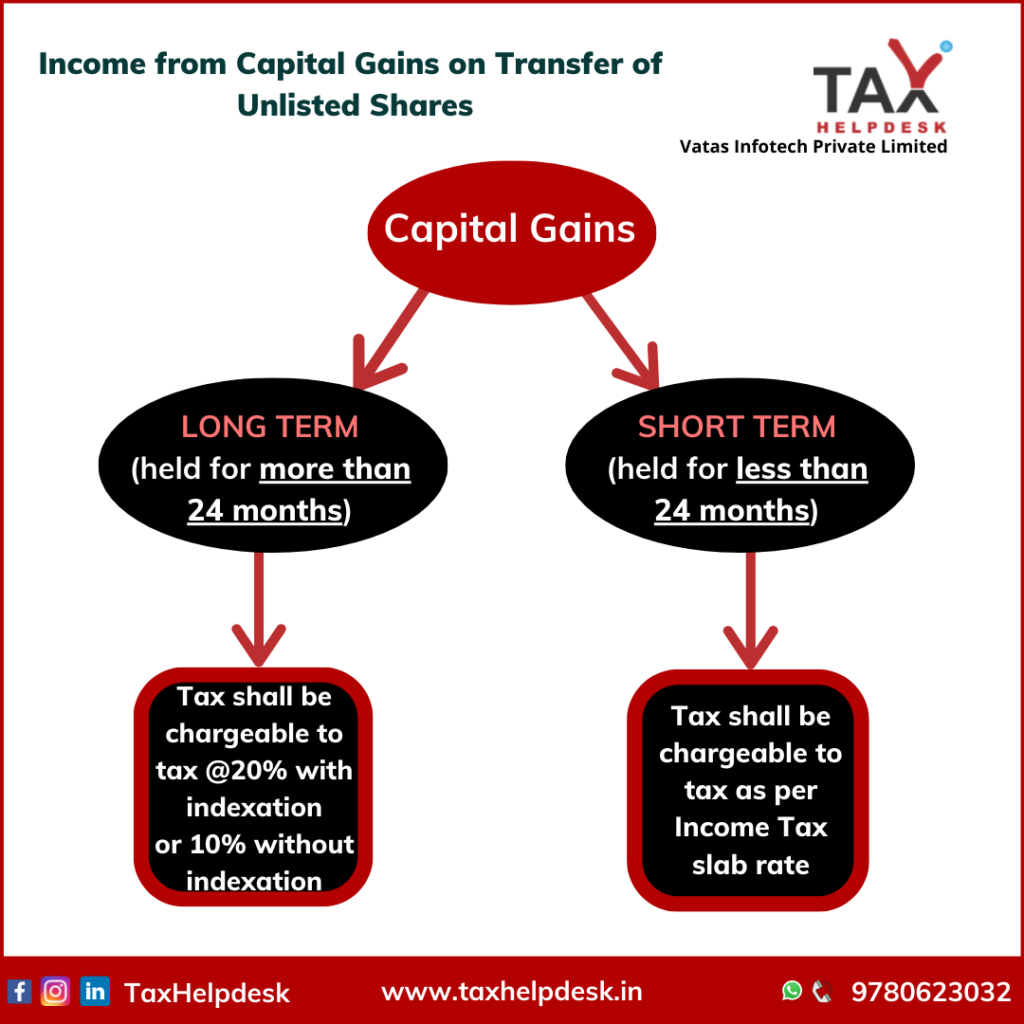

Capital Gains Treatment for Unlisted Shares

Unlisted Shares, the holding of which for more than 24 months are Long Term Capital Gains. Whereas, the shares whose holding period is less than 24 months are Short Term Capital Gains.

Also Read: How To Adjust Profit/Losses From Transfer Of Shares

Note:

This is with effect from Assessment Year 2017-2018.

Treatment of Income

To treat earning from shares as income from business or earning from capital gains has been a matter of litigation. Therefore, to avoid ambiguity, CBDT had issued circular no. 6/2016 dated 29th February, 2016 which clarifies the position.

- If the taxpayer opts to classify his equity holdings as stock-in-trade, then treatment of the earnings shall be under business income. In such cases, the AO shall accept the choice of the taxpayer and there shall be no grounds for dispute.

- In the case of long-term holdings (more than 12 months), the taxpayer has an option to opt to treat the same as capital gains and the AO shall not dispute the same. However, the taxpayer shall maintain consistency in this classification. And, on opting one option, he cannot change it in future years

- In all the other cases, the basic premise for classification of capital gains versus business income is dependent on the concept of “Significant trading activity”. If the churning of the stock portfolio is frequent, then the treatment of income shall be under business income. The dispute, therefore, boils down to the classification of STCG on equities.

Significant Trading Activity

While the definition of Significant Trading Activity (STA) is not present anywhere, there are some broad rules by CBDT for the classification of the same. The decision will conclude down to how to treat the short-term equity holdings as Investments or as Stock-in-Trade? Here are some such broad rules that are indicative of the same:

– Volume of equity

While there are no hard and fast cut-offs, some online brokers do advise traders to classify as business income if the trading volumes in a particular fiscal year exceed Rs.1 crore.

– Ratio of Purchases to Sale

If the purchases and sales of shares are of similar magnitude it is typical of a trader and must be classified as business earning. The activity of buying and holding the shares is more of a sign of an investor.

– Average period

Normally if your average holding period is shorter, then it is more likely to be business income.

– Activity in the Future & Options

A trader being more active in Future & Options is a sign of a shorter time frame and a greater intent to trade. Therefore, the treatment shall be under the head “Income from the business”.

Please note that despite this, the period of holding the stock and the intention of the trader are two relevant factors to determine whether the income is from business or capital gains. Once the individual opts between the two choices, he will have to continue with the same for a subsequent number of years unless there is a change in the circumstances of the case.

Which ITR is to be filed?

- In case, the assessee does “trading” in shares, then the treatment of income from the transfer of shares will be an earning from “profits and gains from business and profession”. Accordingly, ITR-3 is to be filed.

- Alternatively, if turnover from share trading is less than Rs. 2 crore, then the calculation of tax on earnings may be on a presumptive basis, @6% of turnover (or 8% of turnover, there is no use of an electronic clearing system). In this case, there may be a use of a simpler form i.e., ITR 4.

- In the case of non-trading activities, the filing of ITR for income on transfer is through form ITR-2.

Pingback: Taxability of Intraday Trading | TaxHelpdesk

Pingback: Know How is Nifty & Sensex Calculated? | TaxHelpdesk

Pingback: Know Types & Taxability of Mutual Funds SIP | TaxHelpdesk

Pingback: All you need to know about Annual Information Statement | TaxHelpdesk

Pingback: Taxability of Capital Assets in India | TaxHelpdesk

Pingback: How to Treat Income from Transfer of Shares? | ...

Pingback: Taxhelppdesk | Pearltrees