Annual Information Statement or AIS is rolled out by the Income Tax Department on the new Income Tax Portal. It is an enhanced version of Form 26AS. Further, it aims at capturing feedback from the taxpayers.

Also Read: Do I need to file Income Tax Returns?

Objectives of Annual Information Statement

The Annual Information Statement keeping is introduced by keeping in mind, the following 3 objectives:

- Firstly, for displaying complete information to the taxpayer with a facility to capture online feedback.

- Secondly, to promote voluntary compliance and enable seamless prefilling of return.

- Thirdly, to deter non-compliance

Features of Annual Information Statement

Following are the features of Annual Information Statement:

- The new AIS includes additional information relating to interest, dividend, securities transactions, mutual fund transactions, foreign remittance information etc

- Taxpayer Information Summary (TIS) for ease of filing return

- Taxpayers are now able to submit online and offline feedback on AIS’s information

- Taxpayers are also now able to download information in PDF, JSON, and CSV file formats

Details captured by AIS

Some of the details captured by the AIS are:

– Stocks

– Mutual Funds

– Dividends

– House Property

– Salary or business income

– Interest from savings back account

– Insurance

Also Read: Taxability on Mutual Funds SIP

Steps to view AIS

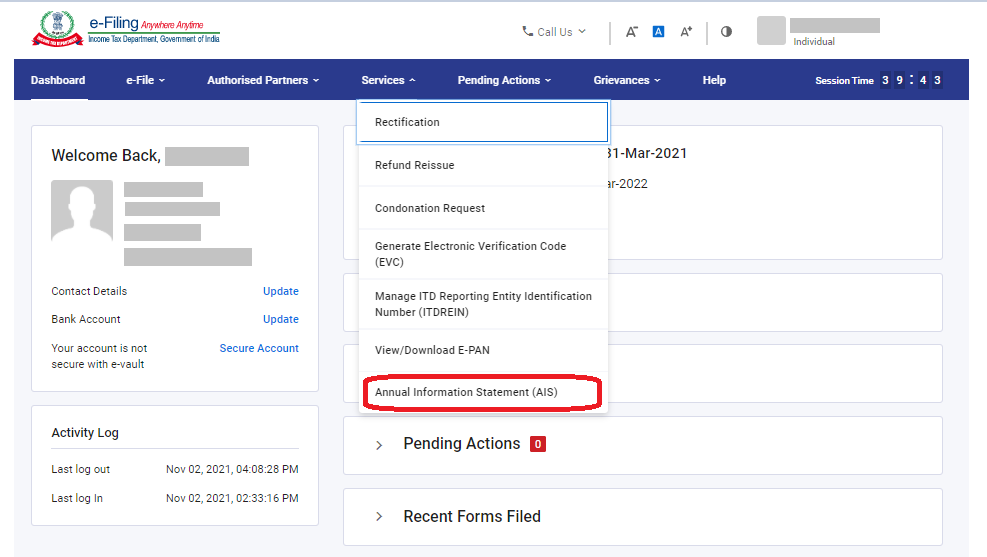

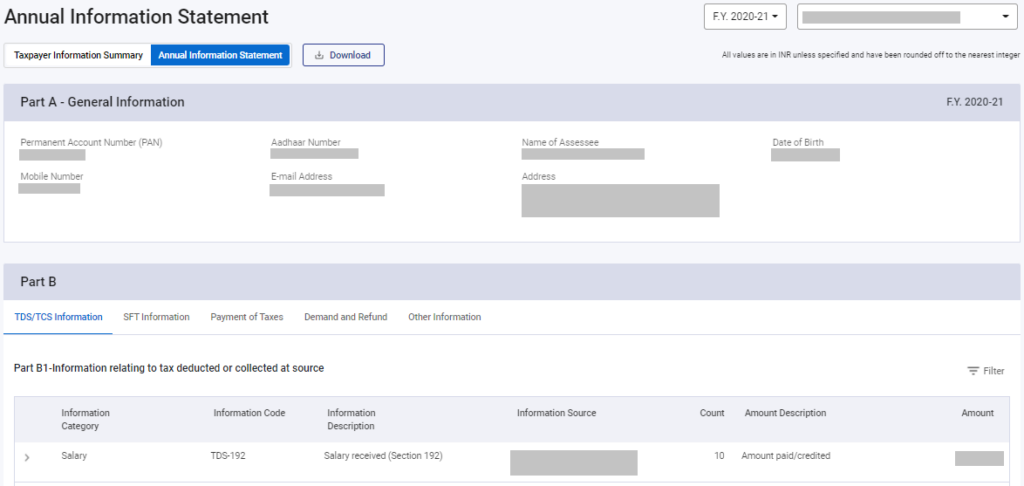

Step 1: The Annual Information Statement can be accessed by the taxpayer by logging on to the income tax e-filing portal at www.incometax.gov.in. Go to ‘Services’>’Annual Information Statement’.

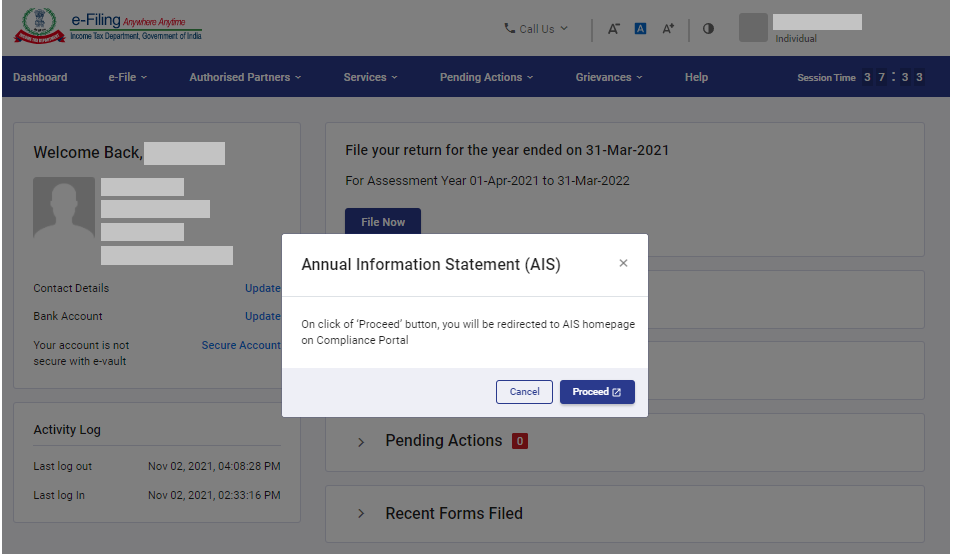

Step 2: Click on the ‘Proceed’ button.

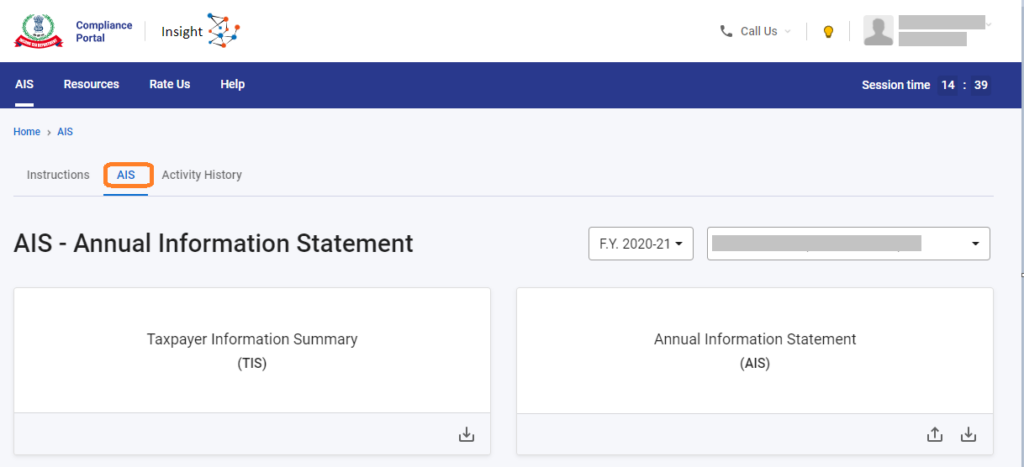

Step 3: The taxpayer will be redirected to his compliance portal. From here, he can view his Taxpayer Information Summary (TIS) and Annual Information Statement (AIS) on the AIS home page.

Step 4: Now select the relevant financial year. After this, the taxpayer can view the Taxpayer Information Summary (TIS) or the Annual Information Statement (AIS) by clicking the relevant tiles.

Note:

Taxpayer can also download the AIS and TIS by clicking on the download icon in the respective tiles. The TIS can be downloaded in PDF format. On the other hand, AIS can be downloaded in PDF or JSON formats

Also Read: Cash Restrictions under the Income Tax Act

Taxpayer can download the PDF file, it is password protected. To unlock, enter the password as a combination of the PAN (in upper case) and the date of birth in case of individual taxpayer or date of incorporation/formation for a non-individual taxpayer in the format DDMMYYYY without any space.

For example, if the PAN is AAAAA9876A and the date of birth is 21st January 1991, your password will be AAAAA9876A21011991.

Performa of AIS

FAQs

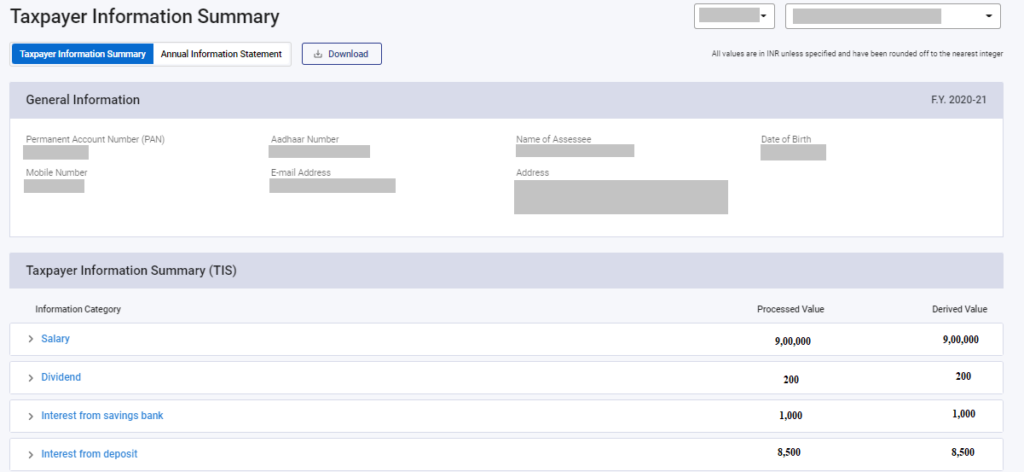

Taxpayer Information Summary or TIS shows aggregated value for the taxpayer for ease of filing return. Further, it also shows the processed value and derived value.

Processed value is the value generated after deduplication of information based on pre-defined rules. Whereas, derived value is the value derived after considering the taxpayer feedback and processed value.

Both the documents – Form 26AS and AIS are to be seen for filing of ITR.

Also Read: Which ITR should I file?

In case there is a variation between the TDS/TCS information or the details of tax paid as displayed in Form26AS on TRACES portal and the TDS/TCS information or the information relating to tax payment as displayed in AIS on Compliance Portal, the taxpayer may rely on the information displayed on TRACES portal for the purpose of filing of ITR and for other tax compliance purposes.

In case the ITR has already been filed and some information has not been included in the ITR, the return may be revised to reflect the correct information.

If you want to know more about AIS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: TDS on Cash Withdrawal From Bank (Section 194N) | TaxHelpdesk