Income Tax Returns offline can be filed by downloading the offline utiliy for ITRs.

Filing of Income Tax Return or ITR becomes compulsory in cases where the assessee’s income exceeds the exemption limit.

Further, the ITR can be filed either offline or online. In this blog, we have explained in detail how to file your Income Tax Returns offline?

Also Read: Do I Need To File ITR?

Steps to follow to file Income Tax Return offline

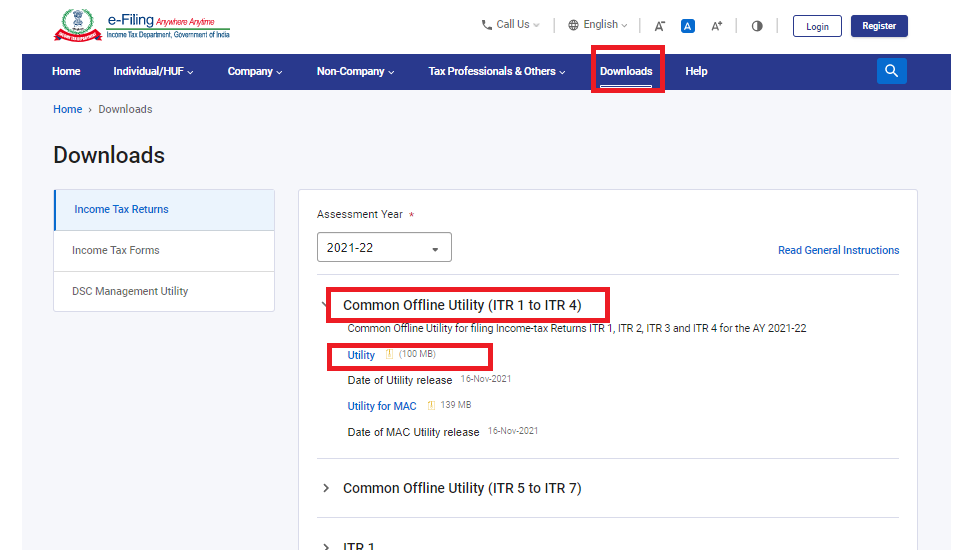

Firstly, go to the Income Tax e-filing Portal

Download Income Tax Return offline utility

Secondly, download the Appropriate Income Tax Return offline utility under ‘Downloads > ITR Preparation Software’.

Extract ITR downloaded zip file

Thirdly, extract the downloaded Income Tax Return Offline utility ZIP file and Open the Utility from the extracted folder.

Fill in ITR details

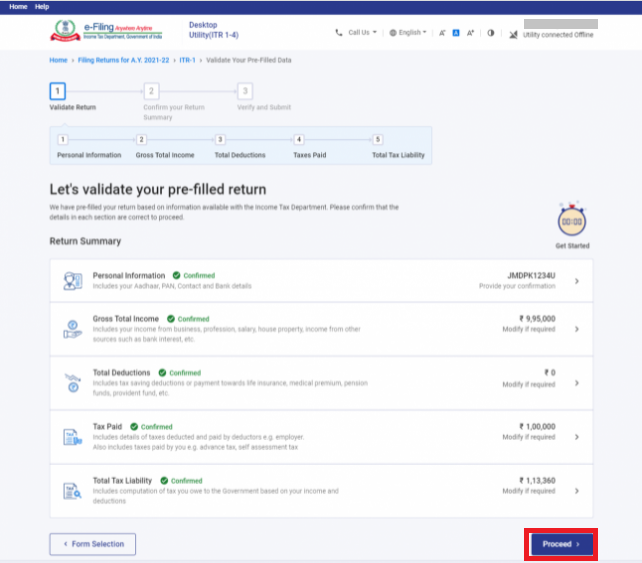

Fourthly, fill the applicable and mandatory fields of the ITR form

Validation & Calculation of tax

Fifthly, validate all the tabs of the ITR form and Calculate the Tax.

Generation & Saving of XML

Sixthly, generate and save XML

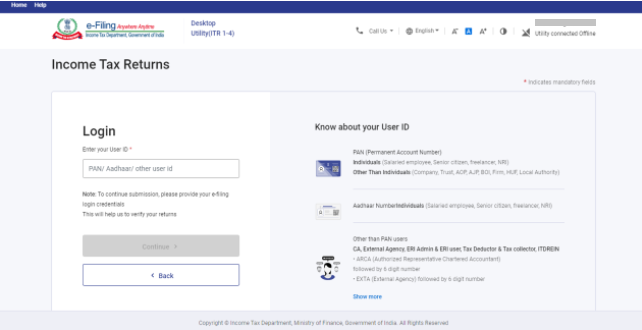

Login to e-filing portal

Seventhly, login to e-Filing portal by entering user ID (PAN), Password, Captcha code and click ‘Login’.

e-filing & ITR link

Eighthly, click on the ‘e-File’ menu and click the ‘Income Tax Return’ link.

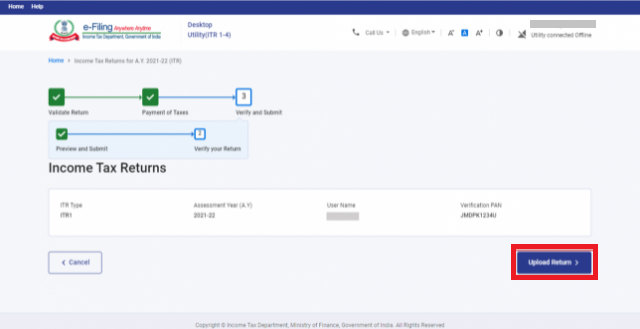

Uploading of XML file

Ninthly, on Income Tax Return Page:

- PAN will be auto-populated

- ‘Assessment Year‘ is to be selected

- Selection of ‘ITR form Number’

- Select ‘Filing Type’ as ‘Original/Revised Return’

- Select ‘Submission Mode’ as ‘Upload XML

Verification

- Digital Signature Certificate (DSC).

- Aadhaar OTP.

- EVC using Prevalidated Bank Account Details.

- EVC using Prevalidated Demat Account Details.

- Already generated EVC through My Account Generate EVC Option or Bank ATM. Validity of such EVC is 72 hours from the time of generation.

- I would like to e-Verify later. Please remind me.

- I don’t want to e-verify this Income Tax Return and would like to send signed ITR-V through normal or speed post to “Centralized Processing Center, Income Tax Department, Bengaluru – 560500

Also Read: What happens if you do not verify your ITR within 120 days?