In cases, where the individuals do not get House Rent Allowance from their employers, they still can get deduction on house rent paid through Section 80GG of the Income Tax Act

What is Section 80GG?

Section 80GG of the Income Tax Act is the provision, under which an individual can claim a deduction on the rent that is paid towards a furnished or unfurnished house. However, the house must be in use as the residential accommodation.

Who Can Avail The Deductions Of Section 80GG?

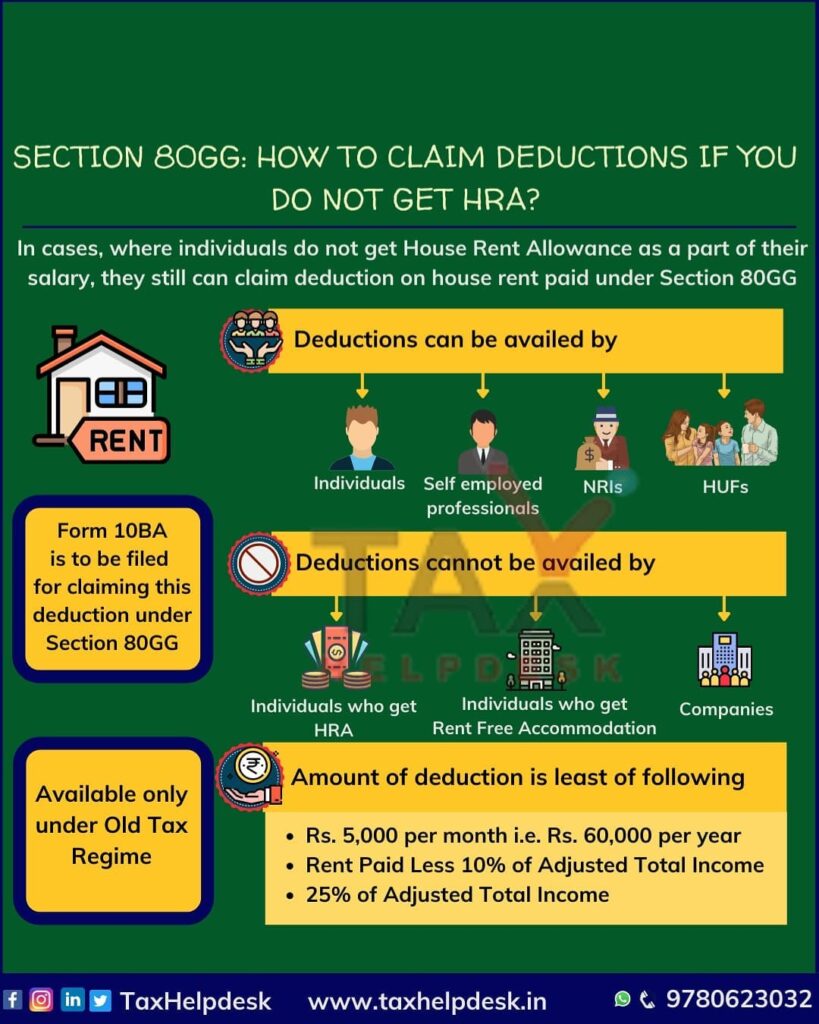

The Deductions under Section 80GG can be claimed by:

– Individuals who does not get House Rent Allowance as a part of their salary

– Self employed professionals who do not get salaries as such.

– Individuals residing on rent at parents house

– NRIs

– HUFs

Also Read: Section 80G: Deductions On Donations

Who Cannot Claim The Deductions Under Section 80GG?

The deductions under Section 80GG cannot be claimed by:

– Individual who get HRA as a part of their salary

– Individuals getting benefit of Rent Free Accommodation (RFA)

– Companies

What are the conditions to claim deduction under Section 80GG?

Following are the conditions which are to be fulfilled to claim deductions under Section 80GG:

- The individual’s spouse, minor child or HUF he is a part of should not own a residential house in any place of his employment, operate business or profession or in any other city where he is claiming benefit of a self-occupied house.

- The individual should not be claiming the benefit of tax deduction ofrepayment of interest and principle of home loan.

- While claiming tax deduction under this section, the individual needs to fill and submit form 10BA which is declaration stating you satisfy the first 2 conditions.

Note

If the individual owns a house in some another city, then it is treated as rented out.

Also Read: Deduction Under Section 80C & Its Allied Sections

How Much Amount Can Be Claimed As Deduction Under Section 80GG?

Deduction under Section 80GG shall be the least of the following-

– 5,000 per month i.e. Rs. 60,000 per year

– Rent Paid Less 10% of Adjusted Total Income

– 25% of Adjusted Total Income

Illustration

Akshay does not receive HRA and his salary is Rs. 10,00,000 p.a. and rent amount is Rs. 10,000/month.

Also Read: 10 Ways To Save Your Taxes!

In the above case, the amount of deduction that will be available to Akshay will be least of the following

– Rs. 5,000 per month i.e., Rs. 60,000 per year

– Rent paid less 10% of adjusted total income = 1,20,000-10% of 10,00,000 = Rs. 20,000

– 25% of adjusted total income = 25% of 10,00,000 = Rs. 2,50,000

The least of the above is Rs. 20,000/-. Therefore, deduction amount available under Section 80GG to Akshay is Rs. 20,000/-.

FAQs

Adjusted Total Income is calculated by deduction following incomes/deduction from Gross Total Income :

- Short Term Capital Gain from Equity Shares and MF

- Long Term Capital Gain (Equity as well as debt)

- Exempt Income Like Dividend on shares, Interest on PPF etc.

- Deductions from section 80C to 80U.

Following are the details required to be submitted for claiming deduction under section 80GG :

– Name of the assessee

– PAN

– Full address of the premises along with Postal Code

– Tenure (in months)

– Payment Mode

– Amount Paid

– Name of landlord

– Address of the landlord

– PAN of the landlord is mandatory if rental is more than INR 1 lakh for the assessment year

– A Declaration confirming that no other house property is owned by the taxpayer himself or in the name of Spouse / minor child or by the HUF of which he is a member.

Section 80GG deduction is available only under the Old Tax Regime

If you still have doubts regarding Section 80GG, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!