Gratuity under Income Tax Act is tax-exempt under Section 10. This is because, gratuity is a financial reward which is given by the employer to employee for the services that he has rendered in the past.

Please note that the gratuity is only tax-exempt under the Income Tax Act but the rules governing gratuity are under the Payment of Gratuity Act, 1972.

Who can claim Gratuity under Income Tax Act?

In order to be eligible to claim gratuity, the employee must satisfy the following conditions:

– The employee should be getting wages as full-time employee. Having said said that, apprentice or intern receiving stipend is not eligible to receive gratuity.

– And, most importantly, the employee should be in continuous service for a minimum of 5 years.

Note:

The condition of 5 years is not applicable in case of death or disablement.

When can one claim Gratuity under Income Tax Act?

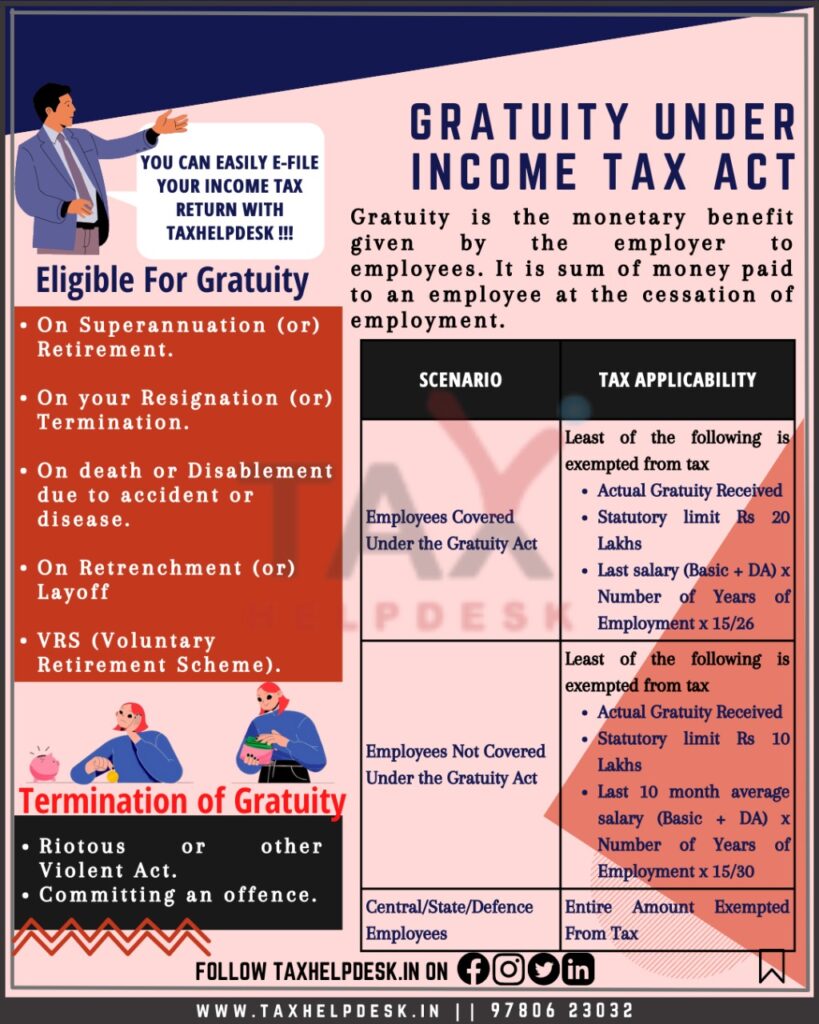

The person can claim gratuity under Income Tax Act if he falls in either of the following cases:

– Firstly, on superannuation or retirement

– Secondly, on resignation or termination

– Thirdly, on death or disablement due to accident or disease

– Fourthly, on retrenchment or layoff

– Lastly, in case he opts for Voluntary Retirement Scheme (VRS)

Also Read: Taxability of Pension: All You Need To Know

Who is an employee for claiming tax exemption on Gratuity?

For the purposes of claiming tax exemption on gratuity under Income Tax Act, an employee is:

Every individual – working in a factory, mine, oil field, port, railways, plantation, shops & establishments, or educational institution having 10 or more employees on any day in the preceding 12 months.

If the above definition is made applicable to employer and consequently, if the number of employee gets less than 10, then also gratuity will be still applicable.

Also Read: Know About The Income Tax Slabs FY 2023-24

Condition for availing Gratuity under Income Tax Act

The condition for availing gratuity is that the employee must have completed 5 years of continuous services before leaving the organization. However, in case of an employee’s death, the organization may put a relaxation wrt the duration of service years.

Also Read: Can you claim HRA even if own a house?

How much amount of gratuity is tax-exempt?

The amount of gratuity that is tax-exempt under the Income Tax Act depends upon various factors such as:

– Firstly, the type of employee (government or non-government)

– Secondly, the last salary (including Dearness Allowance) of the employee

– Thirdly, whether Gratuity Act is applicable to employees or not

– Lastly, the number of years the employee was in service

Also Read: Deduction Under Section 80C & Its Allied Sections

Calculation of amount of gratuity that is tax-exempt

Government employees

Gratuity for government employees is fully tax-exempt under the Act.

Employees covered under Payment of Gratuity Act

For the employees on whom the Payment of Gratuity Act is applicable, the least of the following amounts is tax-exempt:

– Last salary (basic + Dearness Allowance)* number of years of employment* 15/26;

– Rs. 20 lakhs (which has been hiked from Rs. 10 Lakh as per the amendment);

– Gratuity Actually received

Take an example of Krishna, whose last salary (basic + DA) was Rs. 1,00,000 per month. He was in employment for a continuous period of 20 years. Further, the gratuity actually received by him was Rs. 11,00,000

| Particulars | Amount/Years |

|---|---|

| Last Drawn Salary (Basic + DA) | Rs. 1,00,000 |

| Number of Completed Years of Service | 20 Years |

| Last Salary Drawn | Rs. 1,00,000 |

| Gratuity [(15/26) * Rs. 1,00,000 * 20)] | Rs. 11,53,846 |

| Maximum exemption allowed | Rs. 20,00,000 |

| Gratuity actually received | Rs. 11,00,000 |

| Taxable Gratuity | Rs. 0 |

Also Read: Deductions On Interest Earned By Senior Citizens | Section 80TTB

Employees not covered under Payment of Gratuity Act

On the other hand, even if the Payment of Gratuity Act is not applicable to the employees, then also they will be able to claim tax exemption on gratuity as per the Income Tax Act. Accordingly, the maximum amount that is claimed as the tax exemption is the least of the following:

– Last 10 month’s average salary (basic + DA)* number of years of employment* 1/2;

– Rs. 10 lakhs (statutory amount)

– Gratuity actually received

For instance, Sudama was in employment for a continuous period of 25 years. His average salary for the last 10 months is Rs. 1,00,000. The actual gratuity received by him is Rs. 11,00,000

| Particulars | Amount (in Rs.) |

|---|---|

| Average of last 10 months salary | 1,00,000 |

| Number of years of employment | 25 |

| Gratuity (1,00,000*25*1/2 ) | 12,50,000 |

| Maximum exemption allowed | 10,00,000 |

| Gratuity actually received | 11,00,000 |

| Allowable tax exemption (least of the three) | 10,00,000 |

| Taxable Gratuity | 1,00,000 |

Tune into our Telegram Channel to stay updated with Income Tax, GST, and Financial and legal updates.

**Views of the author are personal.