The e-verification of ITR is mandatory after filing the Income Tax Return for the relevant financial year.

What is Income Tax Return?

Income Tax Return (ITR) is a form that contains information about a person’s income and the applicable taxes during the relevant financial year. Further, submitting an ITR form to the IT department gives a detailed picture of your total income and is the most trusted document during VISA as well as loan applications. One can complete the procedure of filing a return electronically within the allotted period.

Also Read: Know Reasons Why You Should File Your Income Tax Return

Is it Mandatory for doing e-Verification of ITR?

ITR is mandatory to be filed by persons with an annual income of over 2.5 lakhs. Consequently, if you do not do the e-verification of ITR, the ITR becomes invalid. However, there are some other cases also wherein filing of ITR is mandatory even if your total taxable income does not exceed Rs. 2.5 lakhs.

Also Read: Do I Need To File ITR? Comprehensive Guide Easily Explained

What is the Time Limit for Verification of Return of Income Field?

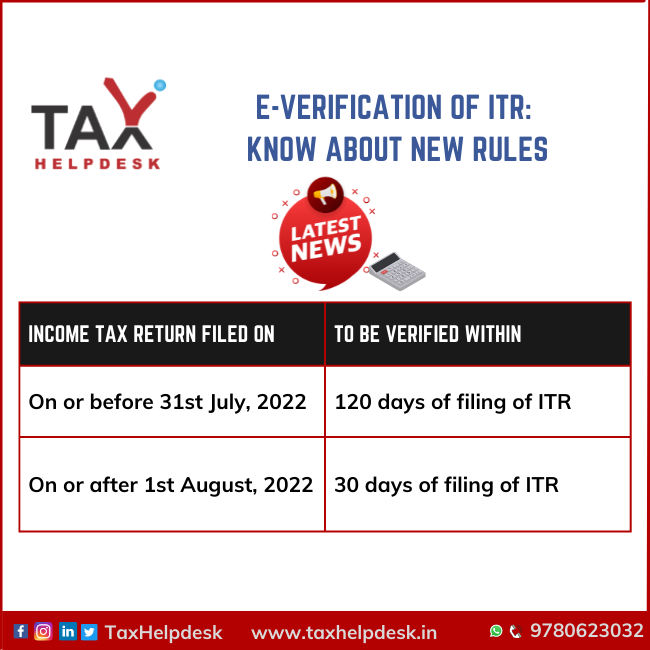

According to the new rules for E-verification of ITR from the Central Board of Direct Taxes, from August 1, 2022, the time limit is reduced to 30 days from 120 days. Therefore, now a valid e-verification of ITR should process within 30 days of filing an ITR.

In other words, the Income Tax Returns which have been filed on or before 31st July 2022 need to be verified within 120 days of ITR filing. Whereas, ITR filed on or after 1st August 2022 is to be verified within 30 days of ITR filing.

How to E-Verify ITR?

There are four popular ways in which you can e-verify your ITR if you have filed a return:

1. Digital Signature Certificate (DSC)

- On the e-Verify page, select I would like to e-Verify using Digital Signature Certificate (DSC). Then, select Click here to download the emsigner utility on the Verify Your Identity page.

- Download and install the emsigner utility and select I have downloaded and installed emsigner utility on the Verify Your Identity page and click Continue.

- Thereafter, on the Data Sign page, select your Provider, Certificate and enter the Provider Password. Click ‘Sign’.

2. Through generating Aadhaar OTP:

- On the e-Verify page, select I would like to verify using OTP on the mobile number registered with Aadhaar and click Continue. On the Aadhaar OTP page, please select the I agree to validate my Aadhaar Details checkbox and click Generate Aadhaar OTP. Enter 6-digit OTP from your registered mobile number and click Validate.

- If you already have the OTP, then please select I already have an OTP on Mobile number registered with Aadhaar.

Also Read: What Happens If ITR Is Not Verified Within 120 Days?

3. Using Electronic Verification Code (EVC)

- To generate EVC through a bank account or Demat account, on the e-Verify page, select Through Bank Account (Through Demat Account in case of Demat account) and click Continue. You’ll receive EVC on your pre-validated mobile number. Enter it with the email in your bank/Demat account in the Enter EVC textbox and click e-Verify.

- If you already have an EVC, then on the e-Verify page, select I already have an Electronic Verification Code (EVC). Enter your EVC in the Enter EVC textbox and click ‘Continue’.

4. Through Net banking

- On the e-Verify page, select Through Net Banking and click Continue. Select your bank and click Continue. Read the disclaimer and click ‘Continue’.

- Login to your Net Banking account, go to the respective ITR /Form/service from the dashboard and click e-Verify.

What Happens if ITR is not Verified?

If you don’t verify your ITR on time, your return remains unfiled. Accordingly, you may face the consequences of not filing the returns under the Income Tax Act, 1961. However, you may ask for pardon for the delay in verification by giving an appropriate reason.

Want to know more? Then, follow TaxHelpdesk on Facebook, Instagram, LinkedIn, and Twitter.