During each Financial Year, we are required to file our Income Tax Returns, also commonly known as ITR. Many of us think that filing of ITR is not necessary in our case as tax has been already deducted by the employer or our income is below the exemption limit and many more. Still it is advised to file ITR, even if the income is below the exemption limit, for various benefits attached with it.

Also Read: Benefits of filing of Income Tax Return

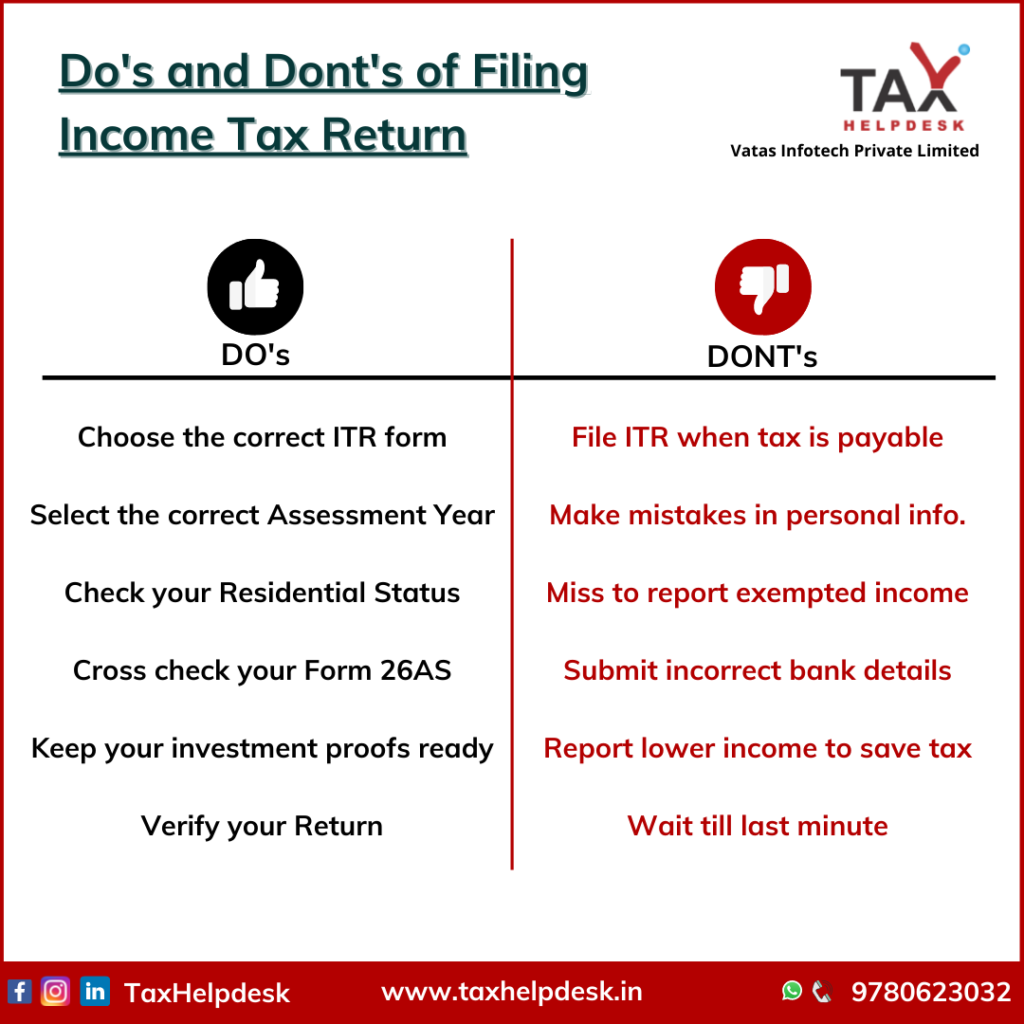

The last date for filing of ITR for Assessment Year 2022-23 for individuals who are not required to get their accounts audited has been extended to 31st September, 2021. In this article, we will tell you about the ‘Do’s and Don’ts of filing ITR’

Do’s for filing Income Tax Return

– Choose the Correct Form

There are 7 forms of Income Tax Return. Each individual has to choose wisely the form in which they have to file their ITR. Out of these seven forms, ITR-1, 2, 3, 4 & 5 are related to individual’s total income, sources of income and other categories. Whereas, ITR-6 is meant for companies and ITR-7 is used for filing of Income Tax Returns for Societies, Trusts, Political Parties, etc. If the individual files his ITR in incorrect form, then his return will be considered as invalid.

Also Read: 10 Ways To Save Your Taxes!

– Select the correct Assessment Year

Assessment year is the year in which the income earned during the Financial Year is assessed as well as taxed. While both the Assessment Year and Financial Year starts on 1st April and ends on 31st March, Assessment Year is a year next to Financial Year. For the current financial year (2021-22), the assessment year for filing return is 2022-23. Entering the incorrect year in your ITR can lead to delay in getting your tax refund.

– Check your Residential Status

The taxability on income earned by an individual is dependent on his residential status. It is different from the citizenship of the individual. Under the provisions of the Income Tax Act, 1961 tax is charged on the basis of the residency of the individual. Choosing wrong residential status can also lead to defective return.

– Cross check your Form 26AS

While filing of ITR, mentioning amount of tax deducted from Form 16/Form 16A is not enough. The individual must cross check the amount of TDS from his Form 26AS. If the amount mentioned in Form 16 and Form 26AS does not match, then the individual can get a notice from the Income Tax department.

– Keep your investments proofs ready

During every financial year, the individuals make investment as a part of their future planning. Some of these investments are exempted from tax. Therefore, it is always advisable to keep record of all the investment proofs and show them in the form of amount while filing of ITR and claim tax refund, if applicable.

Also Read: Income Tax Slab Rates For Individuals Under The Old And New Tax Regime

– Verify your Return

Filing of ITR does not fulfil your job. The ITR is said to be have been duly filed when it has been verified by the individual. There are six ways of verifying the return – through Aadhaar OTP, net banking, bank account, demat account, bank ATM and e-verification procedure after filing ITR. If the return is not verified within 120 days of filing return, then it will be considered as invalid.

Don’ts of filing Income Tax Return

– File ITR when tax is payable

While filing of ITR, the individual must check that there are no tax liabilities on his part which are to be paid. In case, there is a tax liability, then it should be paid before filing of ITR. Filing of ITR with tax liability can lead to notice from Income Tax Department.

-Make mistakes in personal information

The details of the individual – name, address, PAN, aadhaar number, date of birth and other relevant details should be exactly as per the details in his PAN/Aadhaar. Filing of incorrect information can result in delay of processing of ITR.

– Miss to report exempted

While filing ITR, the individual must report all his income including the exempted income. If the individual fails to report his exempted income, then he will have to revise his return within one year to claim the refund. However, in order to save the time, the individual should be diligent while filing ITR.

Also Read: Can I Claim HRA Even If I’m Staying With My Parents?

– Submit incorrect bank details

Submitting of correct bank details is crucial. This is so because if there is any refund available after filing of ITR, then the amount will get credited to the bank account stated by the individual while filing of ITR. Stating the incorrect bank details may result into delay in refunds.

– Report low income to avoid tax

It is the duty of each individual to report the exact income earned by him during a financial year. The Income Tax Department can ask for proofs of income earned from any individual and if he fails to give account of the same, then he may have to bear huge penalties.

– Wait for the last minute

The individuals should not wait for the last minute to get their ITR filed. In case of any ambiguity, they must take the help of experts!

Please note that the above do’s and don’ts are only inclusive and not exhaustive.

If you have any suggestions/feedback, then please leave the comment below. You can also drop us a message on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!

Pingback: Pay Double TDS on Non-Filing of ITR | TaxHelpdesk

Pingback: What happens if ITR is not verified within 120 days? | TaxHelpdesk