TDS & TCS both are direct taxes that are taxed on the income which the person earns. Having stating that, both being the direct taxes often create confusions in the minds of people. In this blog, all your confusions related to difference between TDS and TCS will go away!

TDS and TCS

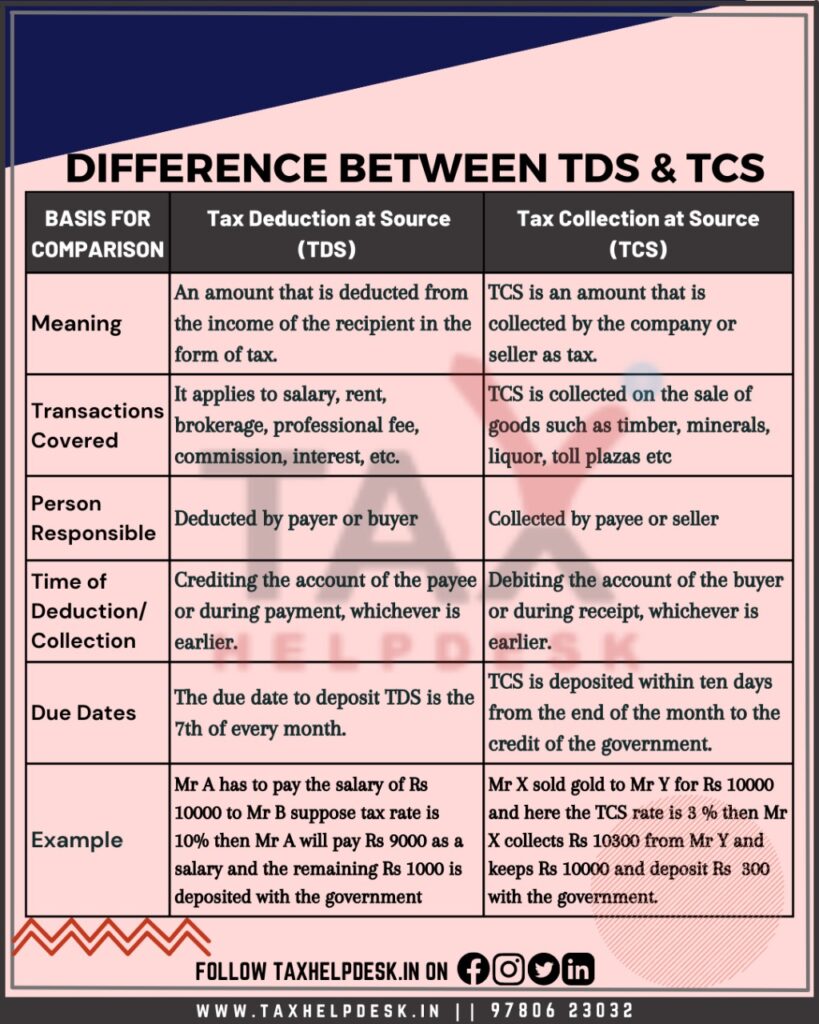

– Firstly, the TDS stands for Tax Deducted at Source and on the other hand, TCS stands for Tax Collected at Source.

– Secondly, TDS is deducted on a payment made by a company to an individual whereas, TCS is collected by sellers while selling something to buyers.

– Thirdly, This TDS is applicable only on payments exceeding a certain amount. However, TCS is applicable on sales of specific goods which do not include production or manufacturing material.

– Fourthly, TDS is applicable on payments such as salaries, rent, professional fee, brokerage, commission, etc. On the contrary, TCS is applicable on sales of goods like timber, scrap, mineral wood, and so on.

Also Read: Transactions on which TCS is applicable

Difference between TDS and TCS

Illustration: TDS and TCS Difference

The Paradox Group Pvt. Ltd. pays Rs. 40,000 rent per month for their office space to DXB Group. Their annual rent amounts to Rs. 480,000. This amount exceeds the TDS non-deduction limit of Rs. 2,40,000 (Section 194I).

Also Read: A Comprehensive Guide: TDS on Rent

Therefore, Paradox Group Pvt Ltd. will deduct TDS @10%, i.e., Rs. 4000 per month, and pay Rs. 36,000 per month as rental payment.

In their income tax return, the owner of the office space i.e., DXB Group will list Rs. 4,80,000 as gross income and claim TDS of Rs. 48,000 (already deducted) as a total tax liability credit, termed as the TDS credit.

Now, let’s consider another example where , Mr. Raja is a wood trader, and Ms. Rani buys wood from him for ₹50,000. But, Ms. Rani will pay ₹52,500 [50,000 + (5%*50,000)] to Mr. Raja.

The extra Rs. 2500 is a TCS collection by Mr. Raja

While filing her ITR, Ms. Rani can claim a credit of Rs. 2500 for total tax liability, which is a TCS credit.

Penalties for non-compliance

The deductor/collector can be subject to penalty if they fail to pay TDS on time and file their TDS/TCS return correctly under Section 271H. The deductor/collector can face a minimum fine of Rs. 10,000. Additionally, maximum penalty of Rs. 1,00,000 is to be paid for filing an incorrect TDS/TCS return. Furthermore, Section 201(1A) of the Income Tax Act mandates an interest of @1.5% per month applicable for non-deduction of TDS from the date on which tax was deductible to the date on which tax is deducted. In case of late TDS payments, the same interest of 1.5% will apply from the date of deduction to the payment date.

If you want to know more about TDS & TCS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!