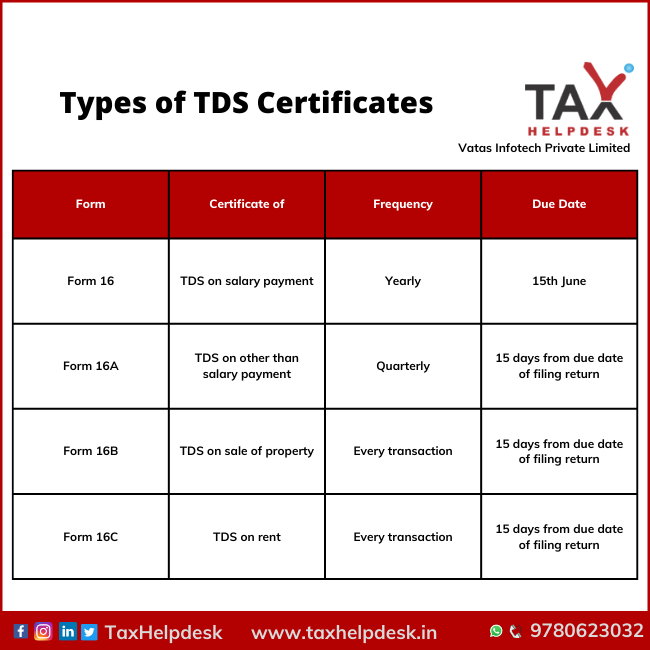

Types of TDS Certificates are Form 16, 16A, 16B and 16C. These certificates are issued by the person deducting TDS to the assessee from whose income TDS was deducted while making payment.

What are TDS certificates?

TDS certificates are issued when any tax is to be deducted at source. Further, these TDS certificates help the assessee to claim the applicable tax credit, along with the applicable refunds.

What is Tax Deducted at Source?

Tax Deducted at Source or TDS, as the name suggests is the deduction of the tax at the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source. Consequently, the amount so collected is to be remitted to the Central Government’s account. After this, the deductee from whose income tax has been deducted at source would be entitled to get the credit of the amount so deducted based on Form 26AS or TDS certificate issued by the deductor.

Let us discuss types of TDS Certificates in detail.

Also Read: Do I need to file Income Tax Return?

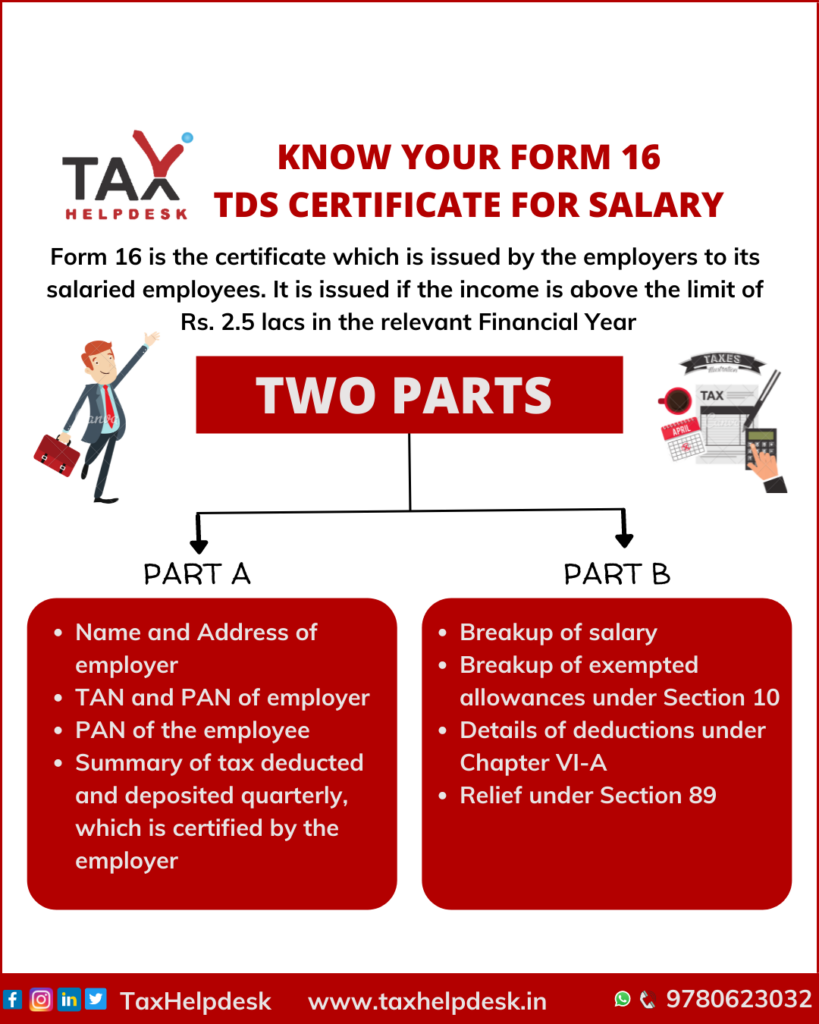

TDS certificate for salaried employees: Form 16

Form 16 is issued to the salaried employees by their respective employers. In other words, Form 16 is a salary TDS Certificate.

Cases where Form 16 is issued:

• Firstly, if person’s/employee’s income from salary for the financial year is more than the basic exemption limit of Rs 2,50,000, then his employer is required, by the Income Tax Act, to deduct TDS on his salary and deposit it with the government.

• Secondly, if the person/employee has disclosed his income from other heads to his employer, then also the employer will consider total income for TDS deduction.

Note:

If the employee has worked with more than one employer during the year, then employee will have more than one Form 16.

Also Read: Which ITR should I file?

Parts of Form 16

Form 16 has two parts: Part A and Part B.

• Part A has information of the employer & employee, like name & address, PAN and TAN details, the period of employment, details of TDS deducted & deposited with the government.

• Part B includes details of salary paid, other incomes, deductions allowed, tax payable etc

Also Read: Major Exemptions & Deductions availed by taxpayers in India

issue of Form 16: due dates

It must be issued by 15th June of the year for which it is being issued.

Other than salary TDS certificate: Form 16A

Form 16A TDS Certificate is applicable for TDS on Income Other than Salary.

Cases where Form 16A is issued

Form 16A is issued in case

– TDS is deducted for fixed deposits,

– It is deducted on insurance commissions,

– TDS is deducted on rent receipts, or

– Any other income you may receive on which TDS is deductable.

Also Read: Know Tax Benefits Of Purchasing Property Through Home Loan

When is Form 16A issued?

The TDS Certificate, Form 16A is issued quarterly. The due date is 15th of the month following the due date for quarterly TDS return.

TDS on Property: Form 16B

TDS Certificate Form 16B is issued in case of TDS that has been deducted on property. The buyer, in this case, is required to reduce the TDS on the property at the time of the property sale.

The TDS is deducted at 1% from the amount that the buyer has to pay the seller. That amount is then to be deposited with the Income Tax Department.

The buyer will issue Form 16B – after the amount is deposited with the Income Tax Department. This is proof of TDS is deducted from the property and is deposited with the government.

Also Read: Penalties On Late Filing Fees Easily Explained By TaxHelpdesk

Dates for Form 16B

A Form 16B is issued quarterly. The due date is 15th of the month following the due date for quarterly TDS return.

Rent TDS Certificate: Form 16C

Form 16C is a new TDS certificate introduced by the government of India. It reflects the amount of TDS deduction on rent @ 5 % by the individual/HUF (under Section 194IB).

Due date of issue of Form 16C

The person deducting TDS on the rent is required to furnish Form 16C to the payee within 15 days from the due date of furnishing challan cum statement in form 26QC.

If you want to know more about TDS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!