No one likes to pay extra money rather everyone wants to save their money as much as possible. While the person has to pay income tax return on his earnings, he can save a whole lot of money by making use of the provisions under the Income Tax Act. Read this blog ahead to know what can you do as an individual, to save your hard earned money from taxes!

List of incomes that can save your Income Tax

1.Income through interest on savings account

| Particulars | Income Exempted (Below 60 years) | Income Exempted (Above 60 years) |

| Income through interest on savings account | Rs.10,000 | Rs. 50,000 |

Income from interest on deposits in saving accounts can be claimed as deduction under the Income Tax Act. If you are an individual below the age of 60 years, then as per Section 80TTA of the Income Tax Act, 1961 the amount of interest on saving accounts of upto Rs. 10,000 can be claimed as a deduction. On the other hand, if you are an individual above the age of 60 years, then as per Section 80TTB of the Act, the amount of interest upto Rs. 50,000/- is eligible for deduction.

2. Life Insurance

Life insurance is one of the necessity to secure your and your loved ones life. The Income Tax Act provides you tax exemption for investment in life insurance under Section 10(10D) and tax deduction under Section 80C.

Section 10(10D) of the Income Tax Act grants exemption on the income tax under two categories, which is as follows:

| Particulars | Life Insurance Premium | Premium Criteria |

|---|---|---|

| Section 10(10D) | The insurance policy issued on or after 1st April 2003 but on or before 31st March 2012 | The premium payable, exceeds 20% of the actual capital sum assured, for any of the years (during the term of the policy). |

| Section 10(10D) | The insurance policy issued on or after 1st April 2012 | The premium payable, exceeds 10% of the actual capital sum assured, for any of the years (during the term of the policy). |

Under Section 80C, premiums paid by you for life insurance policy is given a tax deduction of up to Rs. 1.5 lacs.

Also Read: Best ways to save taxes other than Section 80C investments

3. House Rent Allowance

As per Section 10(13) of the Income Tax Act, the House Rent Allowance is exempted from income tax, if the employee resides in rented accommodation and pays rents to his owner. The exemption of HRA can be availed by submitting proofs of the rent paid to the employer or at the file of filing Income Tax Returns. The amount of HRA exempted from the income tax is lower of the following:

| S.No. | Particulars |

|---|---|

| a) | HRA received from an employer |

| b) | Actual rent paid less 10% of basic monthly salary |

| c) | 50% of basic salary, if taxpayer is living in a metropolitan city |

| d) | 40% of basic salary, if taxpayer is living in a metropolitan city |

In other cases, where the HRA is not provided by the employer, in that case deduction towards rent paid can be claimed upto Rs. 60,000 under Section 80GG. However, this deduction is not available to

| S.No. | Individuals Who Cannot Claim Deduction under Section 80GG |

|---|---|

| 1) | Individuals who receive House Rent Allowance (HRA) |

| 2) | Self-employed individuals and business owners |

| 3) | Individuals who own residential property at the place of work or business |

| 4) | Taxpayers who own a house in another city and claim tax deduction under Section 24 towards repayment of home loan interest on that house. |

The deduction under Section 80GG is allowed on the lowest of the following three conditions:

| S.No. | Deduction under Section 80GG is least of the following |

|---|---|

| a) | At least 25% of the total income, excluding capital gains |

| b) | Actual rent minus 10% of the income |

| c) | Rs. 60,000 |

4. Standard Deduction

The budget of 2018 re-introduced the concept of standard deduction. Standard deduction is provided to both salaried individuals as well as the pensioners. The amount of standard deduction has been increased from Rs. 40,000 to Rs. 50,000 for the financial year 2019-2020. In the case of pensioners, the amount of standard deduction is amount of the pension or Rs.50,000, whichever is lower.

Also Read: Restriction On Cash Transactions Under The Income Tax Act

5. Income from Gratuity

The income from gratuity is exempted from tax up to Rs. 20 lacs. This income from gratuity comes into role play when the employee resigns from the organization after having working for at least 5 years with the same employer or takes retirement. Such income is given to the employee as a financial reward from the employer of the organization for having rendered services for a quite long period. The income from gratuity is calculated on following two basis:

| S.No. | Particulars |

|---|---|

| i) | Last drawn salary by the employee |

| ii) | Number of years the employee has worked in the organization |

It is to be noted that the last drawn salary of the employee includes only basic salary and dearness allowance. Other components of the salary are excluded while calculating income from gratuity.

The income from gratuity is calculated by the following formula:

– Total number of years served x 15 days salary

– 15 days salary is computed by – Last month’s salary/26 x 15

6. Interest on housing loan

Under the Income Tax Act, an individual can claim interest paid on housing loan as a deduction from gross total income. Through the budget of July, 2019 the amount of interest on housing loan was increased from Rs. 2 lacs to Rs. 3.5 lacs, for those buying houses under affordable housing schemes. Under Section 80C of the Act, you can get a deduction of the principal (of the loan) repaid up to Rs 1.5 lakh a year and the interest paid is deductible up to Rs 2 lakh per annum under section 24 of the Act.

7. Interest on Education Loan

As per Section 80E of the Income Tax Act, interest paid on education loan, which is a part of your EMI is exempted from tax. This tax deduction is available for a maximum period of 8 years or till the interest is repaid, whichever is earlier. This tax benefit can be availed by either the parent or the child I.e., student, depending on who chooses to pay the loan. The whole amount of education loan can be claimed as a deduction.

8. Leave Travel Allowance

Leave Travel Allowance also known as LTA is an exemption or allowance given by employer to its employees for traveling on leave. This allowance has its roots defined in Section 10(5) of the Income Tax Act and it can be availed only for two journeys, in a block of 4 years.

LTA can be claimed under the following circumstances:

| Travel by | Exemption is allowed for |

|---|---|

| Train | AC first-class tickets |

| Air | Ticket fares of a national airline’s economy class |

| Other modes of travel | An amount equivalent to first-class, deluxe, or AC first-class fare, whichever is lower |

Another Ways Which Can Save Your Taxes

9. Mobile and internet reimbursement

The Income Tax return allows employees to claim tax allowances on mobile and internet. This allowance is limited to the amount stated in the salary package or bill amount paid, whichever is lower.

Also Read: Do’s And Don’ts Of Filing Income Tax Return

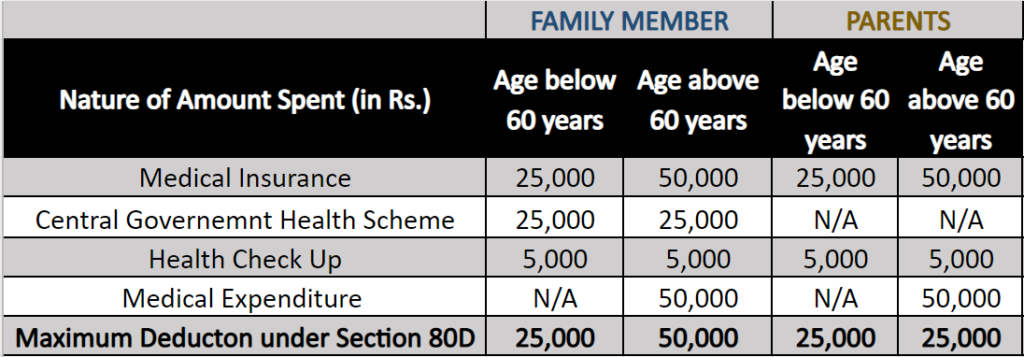

10. Medical Insurance

As per section 80D of the Income Tax Act, every individual can claim deduction for medical insurance. The assessee has to make the payment through Cheque. The following table shows the break up of deduction on medical insurance for family member or parents’ as follows:

If you have any opinions or feedback related to Saving of Taxes : Exemptions or Allowance or Deductions, then do share it in the comment section below.

Pingback: Section 80U: Deduction in case of disability | TaxHelpdesk

Pingback: Deductions on interest earned by Senior Citizens | Section 80TTB | TaxHelpdesk

Pingback: Deductions on Interest on Deposits in Savings Account: Section 80TTA | TaxHelpdesk

Pingback: Restriction on Cash Transactions under the Income Tax Act | TaxHelpdesk

Pingback: Section 80G: Deductions on Donations | TaxHelpdesk

Pingback: Section 80EEA | Deduction on interest paid on home loan | TaxHelpdesk

Pingback: Deduction under Section 80E – Interest paid on Higher Education | TaxHelpdesk

Pingback: Income Tax Slab rates For Individuals under the Old and New Tax Regime | TaxHelpdesk

Pingback: Deduction under Section 80C & its allied sections | TaxHelpdesk

Pingback: Deduction on Electrical Vehicle for Interest Paid on Loan | TaxHelpdesk

Pingback: Do’s and Don’ts of filing Income Tax Return | TaxHelpdesk