The taxability of pension is under the head “Salary” or “Income from Other Sources” depending upon the fact who is receiving the pension.

What is pension?

Pension is an amount for consideration of past services payable after the retirement of the person. Further, the payment of pension amount can be either monthly or lump-sum.

Also Read: All About The National Pension Scheme

Taxability of pension: Which head of income to choose?

As stated above, the taxability of a pension depends upon the fact who is receiving the pension. Having said that, the pension can be either received by the pensioner himself or his family as a family pension.

Case 1: Pensioner receives pension himself

If the person receives a pension himself, then the taxability of pension is just like taxation on salary. Therefore, the head of income will be “Income from Salary”. Accordingly, there will be a deduction of TDS under Section 192. In addition to this, he will have to file Income Tax Return through form ITR-1/2, subject to other conditions of the forms.

Further, in the case of income from pension, the income is generally credit through the banks and not from the employer. Therefore, for claiming TDS, the pensioner must quote the TAN of the bank and not of the employer.

Also Read: Know About The TDS Rates For FY 2022-23 Easily Explained

Case 2: Family members receives the pension

There may be cases where family members receives the pension, after the demise of the pension holder. In such a case, the treatment of income from pension is to be under the head “Income from Other Sources”. Now you may ask why this pension income is not shown under the head “salary” in this case also? Well, the answer is that here, in this case the family did not receive this income for rendering any services to the deceased (pensioner)’s employer. Accordingly, the income cannot be shown under the head “income from salary” but “income from other sources”.

Types of pension

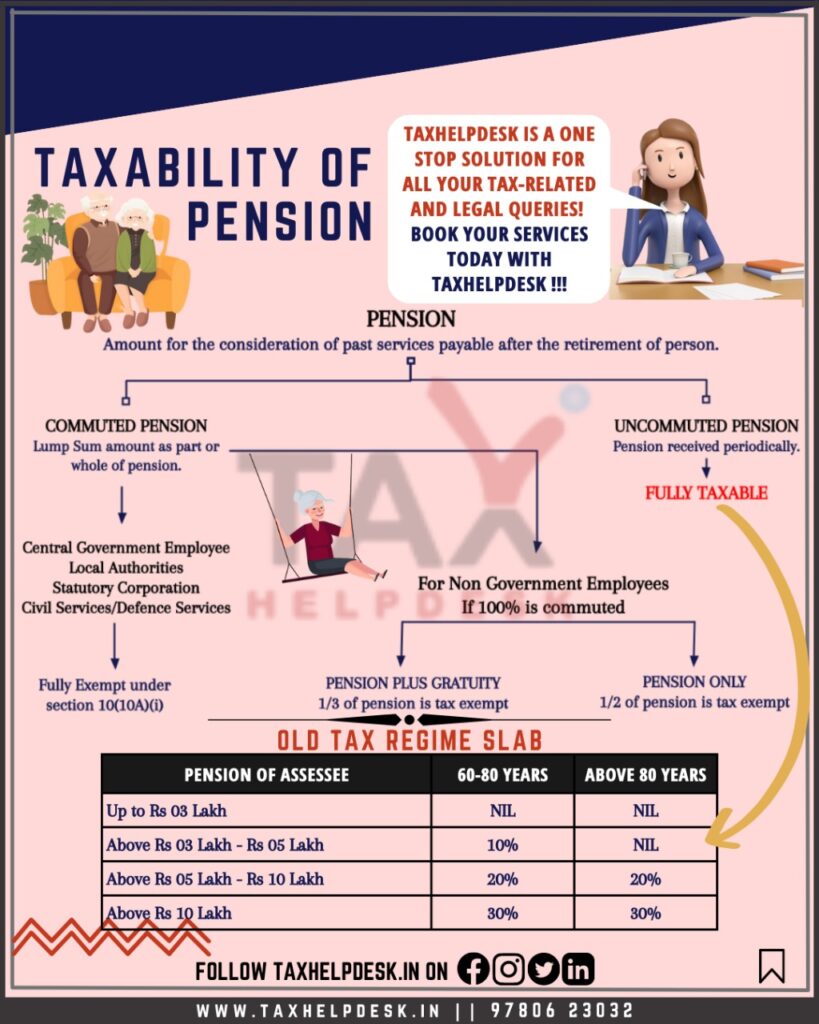

For the purposes of the tax on pension, there are two types of pension:

– Commuted Pension

– Uncommuted Pension

Commuted Pension:

The term “commuted pension” refers to a lump-sum payment of a pension. It can be the entire pension or just a portion of the overall pension.

Also Read: Do I need to file Income Tax Returns?

Uncommuted Pension:

On the other hand, an uncommuted pension is a pension that is received periodically.

For instance, Ram is eligible for a pension amount of Rs. 15 lacs. He can choose to claim the complete amount of Rs. 15 lacs in lump-sum. Alternatively, he can choose to claim Rs. 5 lacs or Rs. 10 lacs in one go and rest in periodic instalments. The amount that he chooses to claim in one go i.e., in a lump-sum or in advance i.e., Rs. 5 lacs or Rs. 10 lacs is a commuted pension. Whereas, the remaining amount received periodically is an uncommuted pension.

Taxability of commuted & uncommuted pension

The taxability of pension in case of commuted pension is classified into parts

– Government employees

– Non government employees

Government employees: In case of government employees or employees retiring from defence services is fully exempt from paying of taxes.

Also Read: Ways to Save Taxes in 2022

Non-Government employees: In the case of non-government employees, the taxability depends upon whether the person getting a pension also receives gratuity or not.

– Person earns both PENSION + GRATUITY: 1/3rd of the amount of the pension is exempt from levy of taxes

– Person earns only PENSION -> 1/2 of the amount of pension is exempt from levy of taxes

Uncommuted pension: It is a periodical pension and it is fully taxable in the hands of all employees, whether government or non-government. Further, the rate of tax applicable is as per the Income Tax Slab of the assessee.

FAQs

In case the pensioner (senior citizen more than 75 years age) have only pension income and interest income, then they do not require to file ITR. In any other case, the pensioners have to file ITR.

Yes, a legal heir can claim a deduction @33.333% of family pension or Rs. 15,000, whichever is less.