The person has to pay TDS late filing fees under Section 234E, if he fails to file the TDS Return or does file the return within the due date. Apart from the late fee under Section 234E, he shall also be liable to pay penalty under Section 271H.

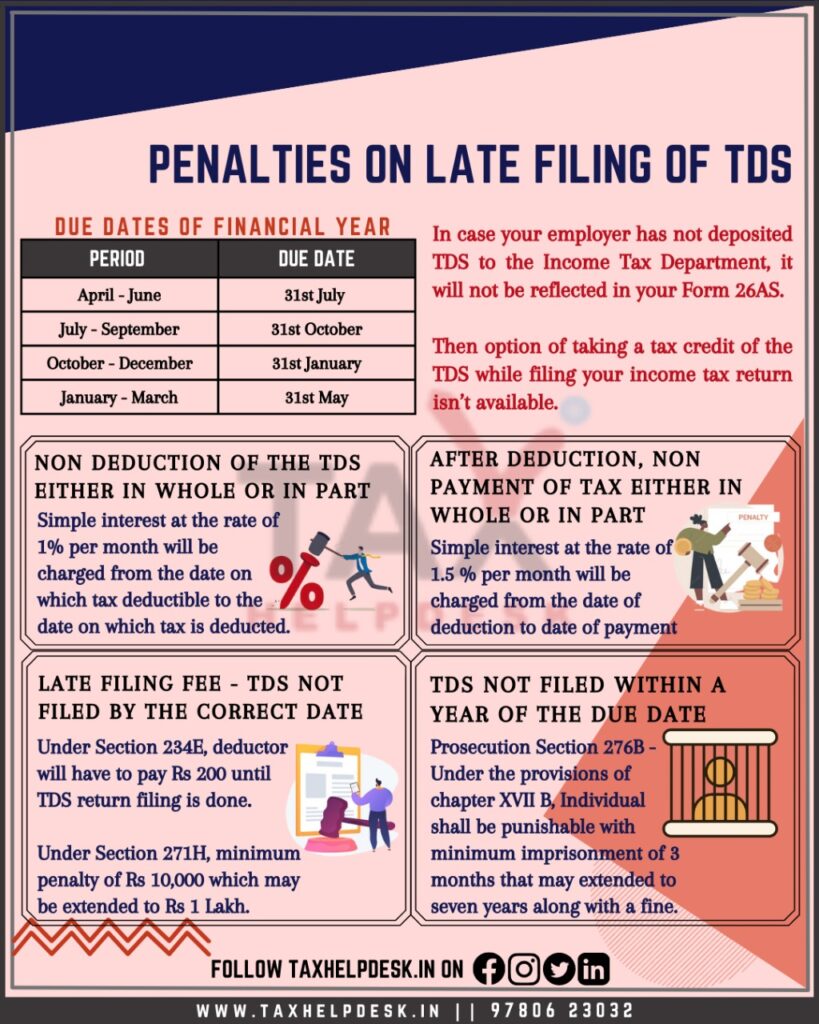

Due dates for filing of TDS Return

In order to avoid the TDS late filing, the person must file the TDS returns within the due dates prescribed. These due dates are as follows:

| Quarter | Quarter Period | Last date of filing |

|---|---|---|

| Q1 | 1st April – 30th June | 31st July |

| Q2 | 1st July – 30th September | 31st October |

| Q3 | 1st October – 31st December | 31st January |

| Q4 | 1st January – 31st March | 31st May |

Also Read: Expert Guidance For TDS Under GST

TDS Late filing fees under Section 234E

As per section 234E, where a person fails to file the TDS Return on or before the due date prescribed, then he shall be liable to pay, by way of fee, a sum of Rs. 200 for every day during which the failure continues. However, the amount of late fees shall not exceed the amount of TDS.

Further, the person cannot file a TDS return without payment of the above late filing fees. In other words, the person will have to deposit late filing fees before filing the TDS return.

Please note that Rs. 200 per day is not a penalty but it is a late filing fee.

Also Read: Comprehensive Guide On Consequences Of Non TDS Deduction Compliances

Illustration 1: TDS Return Filing Fees under Section 234E

The quarterly statement of TDS i.e. TDS return for the first quarter of the year 2021-22 is filed by Mr. Sharma on 4-4-2022. TDS liability of Mr. Sharma during this quarter amounts to Rs. 8,40,000. What will be the amount of late filing fees to be paid by him for the delay in filing the TDS return?

The due date for filing of TDS return for the first quarter of the year 2022-23 i.e. April 2022 to June 2022 is 31st July, 2022. The return is filed on 4th April, 2023, thus there is a delay of 247 days as computed below:

| Particulars | Days |

|---|---|

| August, 2022 | 31 |

| September, 2022 | 30 |

| October, 2022 | 31 |

| November, 2022 | 30 |

| December, 2022 | 31 |

| January, 2023 | 31 |

| February, 2023 | 28 |

| March, 2023 | 31 |

| April, 2023 | 4 |

| Total | 247 |

From the above computation, it can be observed that there is a delay of 247 days. Late filing fees under section 234E will be charged at Rs. 200 per day, thus for 247 days, the late filing fees will come to Rs. 49,400.

Illustration 2:

In the above example, the TDS filing quarter remains the same but the TDS liability is Rs. 8,400.

As per Section 234E, the TDS late filing fee is Rs. 200 for every day during which the failure continues. However, the amount of the late fee shall not exceed the amount of TDS. Here, in this case, the late filing fees on the basis of days are Rs. 49,400 which is more than the TDS liability of Rs. 8,400. Therefore, in this case, Mr. Sharma will have to pay late fees of Rs. 8,400.

Also Read: Understand TDS Deduction: If Person Is Resident In India

Penalty for late filing of TDS Return

As per section 271H, where a person fails to file the statement of TDS i.e. TDS Return on or before the due dates, then the assessing officer may direct such person to pay penalty under section 271H.

The minimum penalty under this Section is Rs. 10,000 which can go up to Rs. 1,00,000. Penalty under section 271H will be in addition to late filing fees under section 234E. Apart from the delay in filing TDS returns, section 271H also covers cases of filing incorrect TDS returns. Further, Section 271H also covers if the deductor files an incorrect TDS/TCS return. In other words, there can be a levy minimum penalty of Rs. 10,000 and a maximum penalty of up to Rs. 1,00,000, if the deductor/collector files an incorrect TDS return.

Also Read: Know Types Of TDS Certificates

Cases where there will be no penalty for late filing of TDS Return

There will be no levying of penalty under section 271H in case of delay in filing the TDS return on fulfilment of the following conditions

– Payment of TDS to the credit of the Government.

– Payment of late filing fees and interest (if any) to the credit of the Government.

– Filing of TDS return before the expiry of a period of one year from the due date.

If you want to know more about TDS or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on WhatsApp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!