The income tax in India is calculated by applying distinctive tax rates to various yearly income gatherings, which are called Income Tax Slabs. For ascertaining income tax, as a matter of first importance, actual yearly taxable income is determined according to the provisions of various sections of the governing Act, accommodating distinctive income incorporations and avoidances for the equivalent.

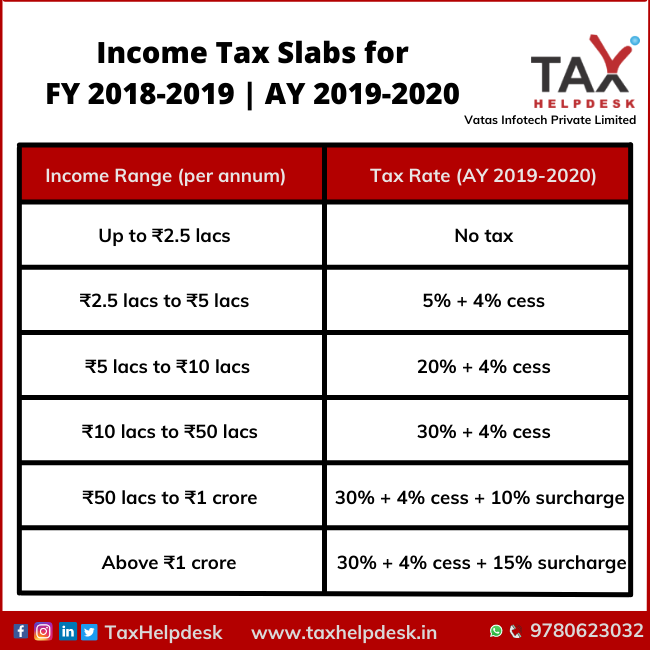

Income Tax Slabs for Individuals aged less than 60 years

| Income Range | Tax Rate |

|---|---|

| Up to Rs. 2.5 lakh | Nil |

| Rs. 2.5 lakh – Rs. 5 lakh | 5% of income exceeding Rs. 2.5 lakh |

| Rs. 5 lakh – Rs. 10 lakh | 20% of income exceeding Rs. 5 lakh |

| Above Rs. 10 lakh | 30% of income exceeding Rs. 10 lakh |

NOTE:

Taxpayer is entitled for rebate under Section 87A of the Income Tax Act, if his income does not exceed Rs. 3.50 lacs in a financial year. The amount of rebate shall be 100% of income tax or Rs. 2500, whichever is less.

Tax Slabs For Taxpayers Aged More Than 60 Years But Less Than 80 Years

| Income Range | Tax Rate |

|---|---|

| Up to Rs. 3 lakh | Nil |

| Rs. 3 lakh – Rs. 5 lakh | 5% of income exceeding Rs. 3 lakh |

| Rs. 5 lakh – Rs. 10 lakh | 20% of income exceeding Rs. 5 lakh |

| Above Rs. 10 lakh | 30% of income exceeding Rs. 10 lakh |

NOTE:

Taxpayer is entitled for rebate under Section 87A of the Income Tax Act, if his income does not exceed Rs. 3.50 lacs in a financial year. The amount of rebate shall be 100% of income tax or Rs. 2500, whichever is less.

Income Tax Slabs For Taxpayers Aged More Than 80 Years

| Income Range | Tax Rate |

|---|---|

| Up to Rs. 5 lakh | Nil |

| Rs. 5 lakh - Rs. 10 lakh | 20% of income exceeding Rs. 5 lakh |

| Above Rs. 10 lakh | 30% of income exceeding Rs. 10 lakh |

Tax Slabs for AOP/BOI/Any other Artificial Juridical Persons

| Income Range | Tax Rate |

|---|---|

| Up to Rs. 2.5 lakh | Nil |

| Rs. 2.5 lakh - Rs. 5 lakh | 5% of income exceeding Rs. 2.5 lakh |

| Rs. 5 lakh - Rs. 10 lakh | 20% of income exceeding Rs. 5 lakh |

| Above Rs. 10 lakh | 30% of income exceeding Rs. 10 lakh |

Income Tax slabs for domestic companies

- A domestic company is taxable at 30%. However, tax rate is 25% if turnover or gross receipt of the company does not exceed Rs. 50 crore.

- Surcharge of 7% is applicable, if the income is more than Rs. 1 crore but less than Rs. 10 crores.

- Surcharge of 12% is applicable, if the income is more than Rs. 10 crores.

tax slabs for partnership firms - General and Limited Liability

| Income Range | Tax Rate |

|---|---|

| Up to Rs. 2.5 lakh | Nil |

| Rs. 2.5 lakh - Rs. 5 lakh | 30% of income exceeding Rs. 2.5 lakh |

| Above Rs. 5 lakh | 30% of total income |

Tax slabs for local authority

All income earned by local authorities is subject to a flat tax rate of 30% for the financial year 2018-19. There is no specific income range or slab rates applicable for local authorities.