Taxes are a major source of revenue for any government in a country. The taxes paid by us collectively helps the nation to grow, prosper and remain independent. Income Tax is a Direct Tax which is regulated and collected by Central Board of Direct Taxes, Income Tax Department, Government of India.

Before we understand, what is Income Tax and how does it work, one should not know what is direct tax. It is as follows:

Direct Income Tax

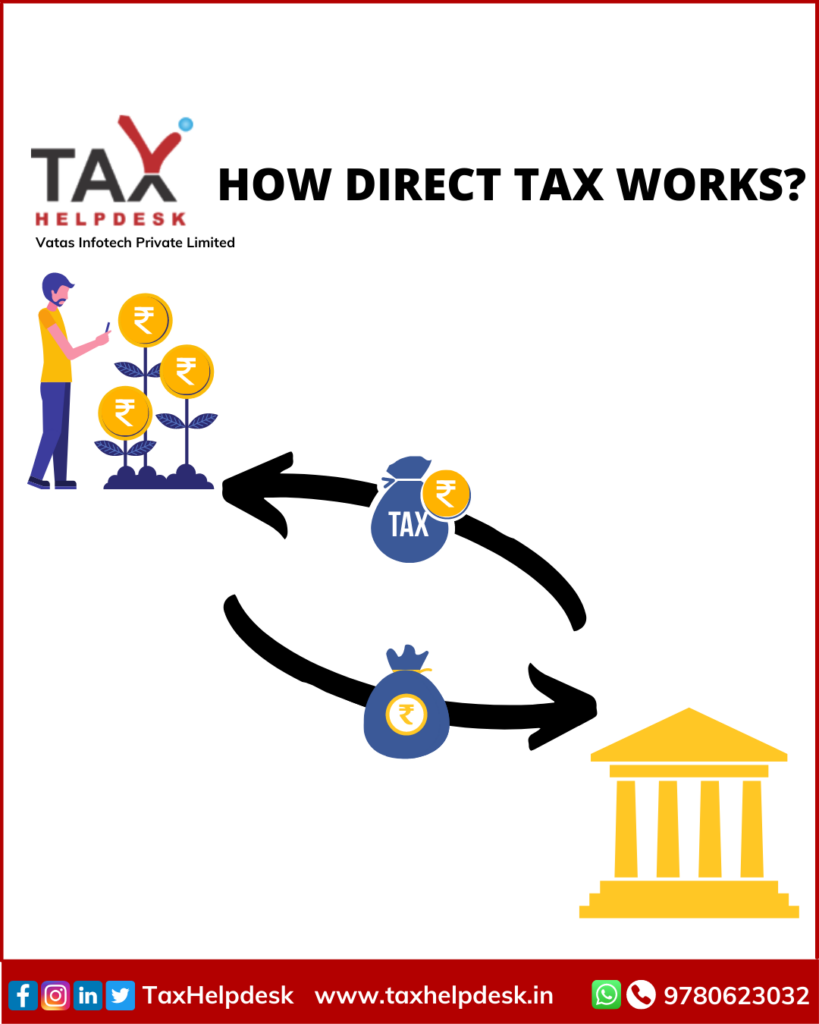

Direct Tax is a one on one tax. It is paid on the salary or wages of the individual directly to the government. Having stated that, the direct tax is paid only to the government and not to anybody else.

Categories of Direct Tax

Direct Tax can be broadly classified into two categories:

– Income Tax

– Corporate Tax

– Wealth Tax

– Real Estate Tax

– Capital Gains Tax

Income Tax: It is a tax imposed on individuals, Hindu Undivided Families, firms including LLPs, or any other taxpayers excluding companies. This tax is to be paid on the income received. The rate of taxes applicable are different for different category of taxpayers. Further, the taxpayers are required to file annual Tax Return and report their income to Tax Department.

Corporate Tax: Corporate Tax is a tax which is to be paid by the companies on the profit they make from their businesses. The rate of corporate taxes are prescribed by law from time to time.

Wealth Tax: Wealth tax is a tax which is paid on the properties owned by the person. The taxation is dependent of the value of the property and is to be paid even if the property does not generate any income. Please note that the payment of wealth tax is exempted for assets like gold deposit bonds, house property etc that have been given on rent for more than 300 days and the house property is being owned for business or professional use.

Real Estate Tax: Real estate tax is an inheritance tax. It is paid on the value of the estate or money that the individual has left after his/her death.

Capital Gains Tax: The profit on sale of capital assets is know as capital gains. Therefore, capital gains tax is a tax which is levied on sale of capital assets. The capital assets could be investments in shares, mutual funds, jewelery etc. Further, the capital gains are taxed on the basis of duration and type of capital asset.

How does Income Tax work?

Every income that is earned by anyone in India is subject to tax. If any income has been earned by an individual, whether he be a resident of India or a non resident, he will have to pay tax on income earned. It also to be noted that income can be from any legitimate source, for eg., salary, wages, income from quiz competitions including Kaun Banega Crorepati, income earned by professionals and many more.

Income Tax Rules

The legislature of India introduced the Income Tax Act, 1961, to govern and administer the tax. After the passing of the Act, the Tax Rules, 1962 were enforced in order to help in the enforcement and applicability of the law stated in the Act. Tax Rules are to be read with the Tax Act.

Who are the Taxpayers?

The income tax slab for taxpayers is passed by legislature from time to time. Apart from individuals and Hindu Undivided Families(HUFs), following entities are liable to pay Tax:

– Body of individuals

– Association of persons

– Local authorities

– Corporate firms

– Companies

– All Artificial Judicial Persons

Tax Calculator

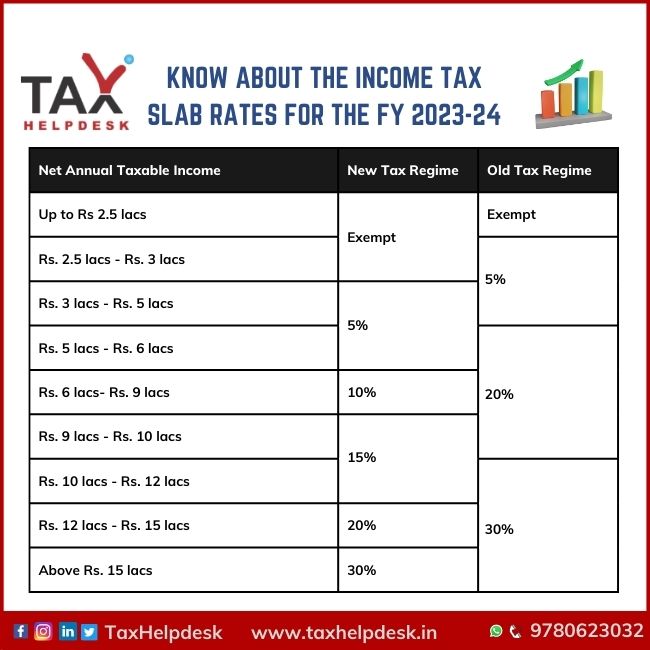

One can do the computation of the tax either manually or by using an income tax calculator. The tax rate applicable for an individual depends on the tax slab under which they fall.

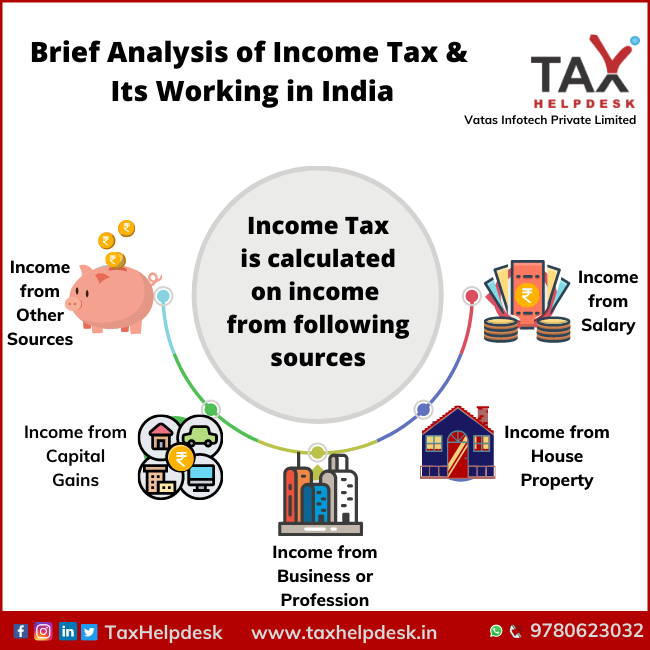

For calculation of Tax, the income from all the sources are calculated, which may include:

– Income from salary (income paid by the employer)

– Income from house property (rent income, interest paid on home loan)

– Income from capital gains (profit on sale of capital asset like shares, mutual funds, etc)

– Income from business/profession (including freelancing)

– Inc0me from any other sources (FD interest, saving account bank interest, etc)

For instance, for a salaried individual, the income from salary includes

Basic Income + House Rent Allowance (HRA) + Transportation Allowance + Special Allowance, if any.

Besides, the income earned being taxed, there are specific components of the salary which are tax exempted such as Leave Travel Allowance(LTA), reimbursement of telephone bills, water bills, etc.

Apart from the above exemptions mentioned, the employees get a standard deduction of Rs. 50,000 (Rs. 40,000 till FY 2018-19) under the Old Tax Regime as well as the New Tax Regime (applicable from FY 2023-24).

Also Read: Comparison of Exemptions & Deductions under Old & New Tax Regime

Illustration

Raju is a salaried employee and receives a salary of Rs. 2,00,000 per month. Further, he receives the following allowances for the FY 2023-24:

HRA = Rs. 50,000

LTA = Rs. 10,000

Special Allowances = Rs. 20,000/month

Note:

He has a Savings Account Interest of Rs. 8,000

The calculation of the gross total income of Raju under the Old and New Tax Regimes are as follows:

| Particulars | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income from Salary | Rs. 24,00,000 | Rs. 24,00,000 |

| Standard Deduction | (Rs. 50,000) | (Rs. 50,000) |

| House Rent Allowance | (Rs. 50,000) | N/A |

| Leave Travel Allowance | (Rs. 10,000) | N/A |

| Special Allowances | (Rs. 20,000) | N/A |

| Income from Savings Account | Rs. 8,000 | Rs. 8,000 |

| Net Income | Rs. 22,78,000 | Rs. 23,58,000 |

Now, the details of investments made by Raju are as follows:

– LIC = Rs. 70,000

– PPF = Rs. 50,000

– Tax Saving FD = Rs. 40,000

– Savings Account Interest = Rs. 8,000

He has also paid medical insurance of Rs. 10,000

The calculation of deductions under the Old and New Tax Regime are as follows:

| Deductions | Old Tax Regime | New Tax Regime |

|---|---|---|

| Section 80C (LIC, PPF, etc) | Rs. 1,50,000 | N/A |

| Section 80D (Medical policy premium) | Rs. 10,000 | N/A |

| Section 80TTA (Savings account interest) | Rs. 10,000 | N/A |

| Total Deductions | Rs. 1,70,000 | Rs. 0 |

| Net Taxable Income | Rs. 21,10,000 | Rs. 23,58,000 |

The Income Tax Calculation of Raju is as follows:

| Particulars | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income Liable to Tax | Rs. 4,45,500 | Rs. 4,07,400 |

| Health and Education Cess | Rs. 17,820 | Rs. 16,296 |

| Total Tax Liability | Rs. 4,63,320 | Rs. 4,23,696 |

Frequently Asked Queries

The income that is earned by the person within a year starting from 1st April to 31st March is taken into account for the calculation of income tax.

The taxes are collected by Government of India through:

There are five heads of income: