Income from transfer of any virtual digital asset shall be charged to income tax @30%. Further, the tax is required to be deducted at source on transfer of the digital asset.

Also Read: Know Taxability Of Capital Assets In India

What is virtual digital asset?

Virtual digital asset has been defined through insertion of new clause (47A) in Section 2 of the Finance Act, which is as follows:

“It means:

(a) Any information or code or number or token (not being Indian currency or foreign currency), generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value exchanged with or without consideration, with the promise or representation of having inherent value, or functions as a store of value or a unit of account including its use in any financial transaction or investment, but not limited to investment scheme; and can be transferred, stored or traded electronically;

(b) Non-fungible Token (NFT) or any other token of similar nature, by whatever name called;

(c) Any other digital asset, as the Central Government may, by notification in the Official Gazette specify.”

In simple words, the virtual digital currency shall mean cryptocurrency, NFT or another virtual digital currency as notified by the Central Government. Further, just like other currency, these assets in the form of currency can be used to buy or procure any goods and services.

Note:

These digital asset does not cover subscriptions to any OTT platform, mobile applications, e-commerce platforms, etc.

Classification of Virtual Digital Asset

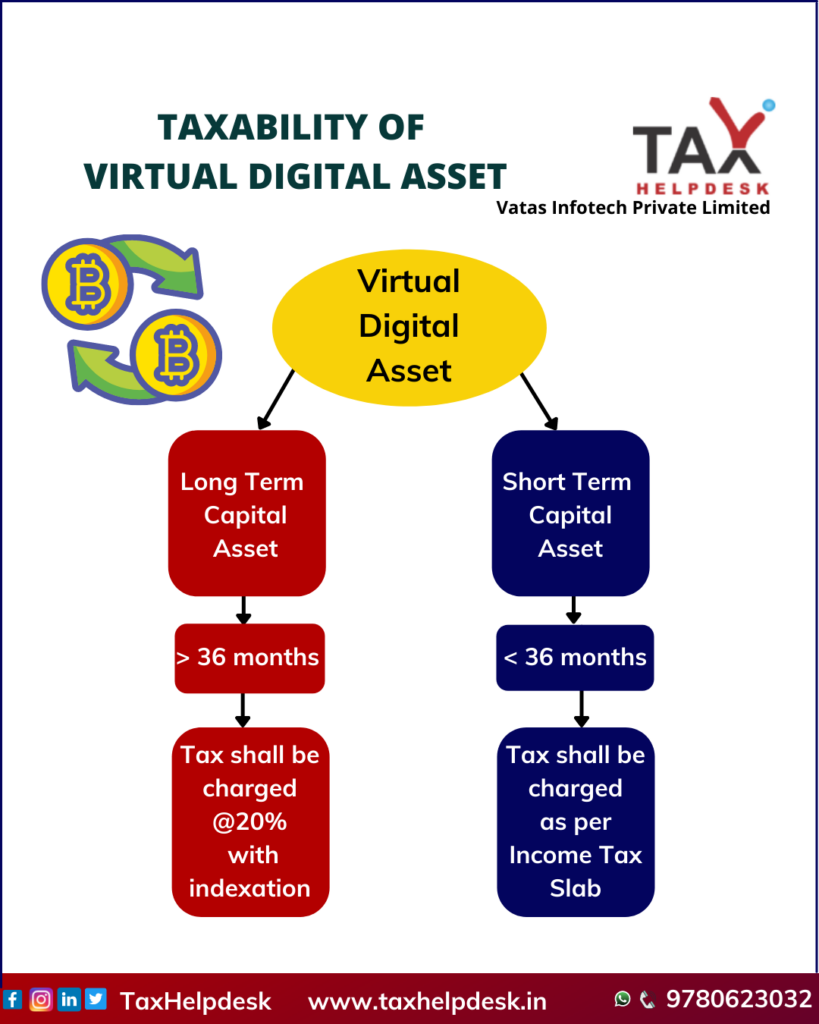

Till date, the Government or India has not clarified if the virtual digital currency will be a currency, commodity, or security. In the absence of any such clarification, the virtual digital asset should be classified as a deemed capital asset.

The capital asset is defined under Section 2(14) of the Income-tax Act. According to this section, a capital asset means property of any kind held by a person, whether or not connected with his business or profession. The term ‘property’ has no statutory meaning, yet it signifies every possible interest that a person can acquire, hold, or enjoy.

Therefore, cryptocurrencies or NFTs should be deemed capital assets, if purchased for investments by the taxpayers. Therefore, any gain arising on the transfer of such assets shall be taxable as capital gains.

The income from virtual digital currency can be treated either income from “income from business or profession” or “income from other sources”. If the transactions in such assets are substantial and frequent, it should be held that the taxpayer is trading in such assets. In this case, income from the sale of such assets should be taxable as business income. On the other hand, if the virtual digital currency has been held for non trading purposes, then it will be treated as income from other sources.

Also Read: Taxation on income from transfer of shares

Taxability of digital asset before 1st April, 2022

Before the Union Budget, 2022 there was no clarity on taxation of virtual digital currency and therefore, they were taxed like capital assets. The taxation rates of these assets are as follows:

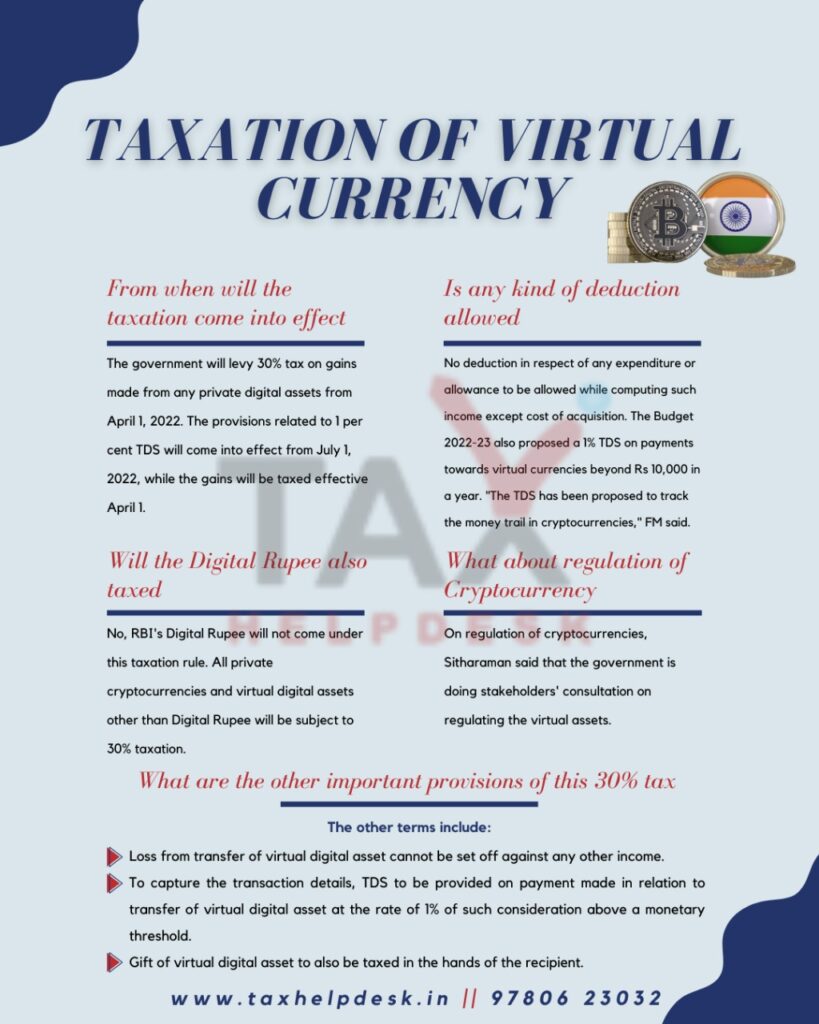

Virtual digital asset taxability after 1st April, 2022

After the Union Budget, 2022, the Finance Minister announced that the income arising from the transfer of virtual digital asset shall be taxed at the rate of 30%. Thereby, a new section namely Section 115BBH(1) was inserted in the Income Tax Act.

Furthermore, post April 1, 2022, both short term and long term virtual digital currency will be taxed at flat 30%. This is applicable even if the income from digital asset is treated under the head income from business or profession or income from other sources.

Also Read: Know Types & Taxability Of Mutual Funds SIP

Setting off and carrying forwarding of losses

No set-off of loss from the transfer of the virtual digital currency computed shall be allowed against income computed under any other provision of this Act to the assessee, and such loss shall not be allowed to be carried forward to succeeding assessment years.

In other words, the short-term capital loss from the sale of a virtual digital currency cannot be set-off against the short-term capital gains from the sale of shares or any other capital asset. Similarly, the long-term capital loss from the sale of virtual digital currency cannot be set-off against the long-term capital gains from the sale of any other capital asset.

Illustration

Example 1: Priya has purchased 60,000 USDT (cryptocurrency) at Rs. 67 each on 9 July, 2018. He transferred 20,000 USDT in the previous year 2021-22, and the remaining 40,000 in 2022-23. The capital gains from the transfer of USDT shall be computed as under:

Qty. | Sold on | Consideration | Brokerage | Net Profit or (Loss) | Taxable Profit or (Loss) | Tax Rate |

20,000 | 01-03-2022 | 18,00,000 | 3,140 | 456,860 | 2,79,789* | 20% |

20,000 | 01-04-2022 | 8,00,000 | 2,140 | (5,42,140) | (5,40,000)† | 30% |

20,000 | 31-03-2023 | 30,00,000 | 4,360 | 16,55,640 | 16,60,000‡ | 30% |

* The benefit of indexation shall be allowed because Section 115BBH shall be applicable from the assessment year 2023-24. † No deduction shall be allowed for the brokerage or indexation of the cost of the acquisition. Sales consideration less cost of acquisition shall be taxable under the head capital gains. ‡ The total income of Rs. 11,20,000 from the sale of the virtual digital asset shall be taxable at the rate of 30%. The total income has been computed after adjustment of the loss arising from the sale done on 01-04-2022 with the gains arising from the sale done on 31-03-2023. | ||||||

TDS on Virtual Digital Asset

Apart from the income tax on transfer of virtual digital asset, TDS will be also deducted. For this, a new Section 194S has been proposed to be inserted in Income-tax Act for the deduction of tax from the payment of consideration on the transfer of virtual digital currency. This provision is applicable from 01-07-2022.

Also Read: TDS on dividend income

Rate of TDS on Virtual Digital Asset

Tax is required to be deducted at the rate of 1% of the consideration. This is however, subject to certain conditions.

If the deductee does not furnish his PAN to the deductor, the tax shall be deducted at the rate of 20% as prescribed under Section 206AA.

Gift of virtual digital asset

The gifts of virtual digital currency is to be taxed in the hands of recipient.

If you want to know more about taxation of virtual digital asset or take TaxHelpdesk’s experts consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!