The Income Tax Return extended due dates are due to the pandemic COVID-19. Having stating that, the Central Board of Direct Taxes has extended the due date for the third time for filing of Income Tax Return. Now the due date for AY 2020-21 is 10th January, 2021. The extension of due dates comes because of the continued challenges faced by taxpayers in meeting statutory compliances.

Income Tax Return extended due dates

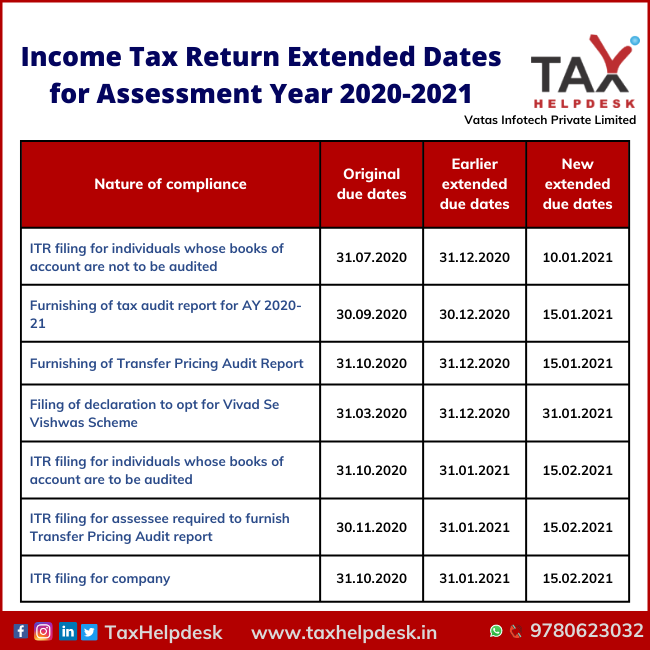

The extension of the deadline till January 10 is for filing ITR for 2019-20 fiscal year (2020-21 assessment year). Further, the Income Tax Return extended due dates are for those individuals who do not require audit of their books of accounts and who usually file their income tax return using ITR-1 or ITR-4 forms, as applicable.

Also Read: Know all about Presumptive Taxation Scheme

In addition to this, the deadline for other taxpayers whose accounts are required to be audited (including partners of a firm) is now 15th February, 2021. Consequently, the due date for submitting the report in respect to international financial transactions is also February 15, 2021.

Possible reasons for extended Income Tax Return

The possible reasons for the extended due dates of Income Tax Return are as follows:

1. Difficulties in filing due to the pandemic COVID-19

2. Filing of less number of Income Tax Returns than last year till December 30, 2019.

3. Requests made by various Chartered Accountants and tax practitioners for extension of due dates

4. Pandemic has made it difficult for people to collect all the information for filing of ITR.

5. For taxpayers who cannot use net banking to update their passbooks and get details of interest on their savings account.

Also Read: Everything you need to know about tax saving Fixed Deposits

Other Extended due dates related to ITR

Following are the other due dates in relation to Income Tax Return:

Firstly, ITR filing if assessee is required to furnish a report of transfer pricing (TP) Audit in Form No. 3CEB – 15th February, 2021

Secondly, filing of ITR for a company assessee – 15th February, 2021

Thirdly, ITR filing for any assessee who is required to get its accounts audited under the Income-tax Act or under any other law – 15th February, 2021

Fourthly, Income Tax Return filing for an assessee who is a partner in a firm whose accounts are required to be audited – 15th February, 2021

Fifthly, tax audit report for the assessment year 2020-21 – 15th February, 2021

Sixthly, Transfer Pricing Audit Report – 15th February, 2021

Lastly, declaration to opt for Vivad Se Vishwas Scheme – 30th January, 2021

Penalty for non filing of ITR

Non-filing of Income Tax Return can have severe consequences like interest, fine, no carrying forward of losses, penalties up to ₹10,000/- and even arrest. Therefore, filing of Income Tax Returns becomes necessary! File Income Tax Returns online in India before 10 January, 2021 with few easy steps.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin!