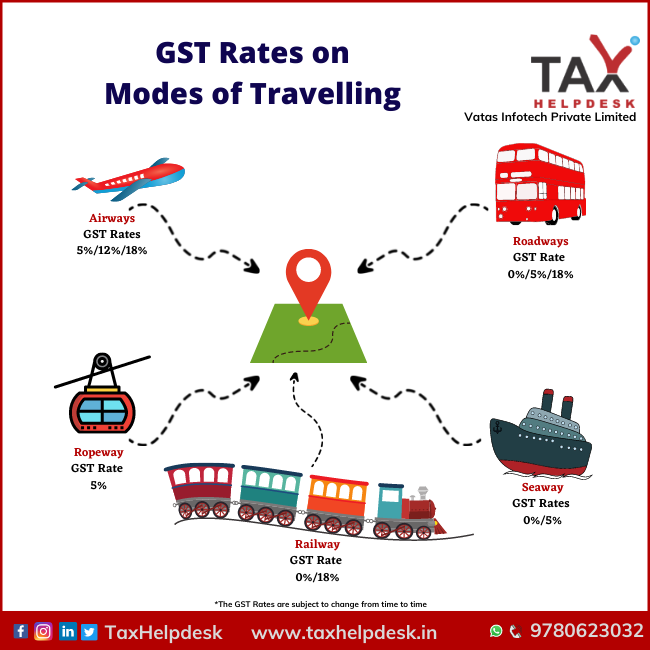

GST is charged on traveling depending upon the mode of transport that has been used by the person

Traveling is perpetually on our mind and given the current situation caused due to the pandemic coronavirus, our movements have been restricted. However, if given an opportunity to travel safely, we will be happily grab it. In India, travel is majorly done by four modes of travel – railways, airways, seaway and roadways. GST is applicable on all these four modes of travel. The detailed bifurcation is as follows:

i) GST on travel through Railways:

| Particulars | GST Rate |

|---|---|

| AC and First Class train tickets | 18% |

| Sleeper and General Class train tickets | 0% |

| Metro train token/card | 0% |

ii) GST on travel through Airways:

| Particulars | GST Rate |

|---|---|

| Economy Class air tickets | 5% |

| Business Class air tickets | 12% |

| Chartered flights tickets for the purpose of pilgrimage | 5% |

| Rental services of aircraft (with or without operator)/chartered flights | 18% |

NOTE:

– If you’re traveling for business purposes, then you can claim Input Tax Credit on goods and services tax of air tickets

– Airlines, in case of economy class air tickets, can claim Input Tax Credit on services.

– Airlines, in case of business class air tickets, can claim Input Tax Credit on food items, spare parts and other inputs apart from fuel.

iii) GST on travel through Roadways:

| Particulars | GST Rate |

|---|---|

| Traveling by public transport | 0% |

| Traveling by metered taxi/auto rickshaw/e-rickshaw | 0% |

| Traveling by non AC/contract carriage/stagecoach | 0% |

| Traveling by radio taxi and other similar services | 5% |

| Traveling by rented road vehicles – cars, buses, coaches (with or without operator) | 18% |

iv) GST on travel through Seaways:

| Particulars | GST Rate |

| Travel via inland waterways | Exempted |

| Travel by vessel used for public transport | Exempted |

| Travel by vessel used for tourism | 5% |

Apart from these four modes of travel, there is another mode of travel – Travel by Ropeway/Cable, which is though not a popular mode of transport in India but the following GST rate is applicable:

| Particulars | GST Rate |

|---|---|

| Travel by ropeway | 5% |

Please note that the above goods and services tax rates are only indicative and are subject to change as and when Government amends these rates.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin