Composite supply is a new concept which has been introduced through GST. Further, the taxable event under GST is supply of goods or services or both.

What is composite supply?

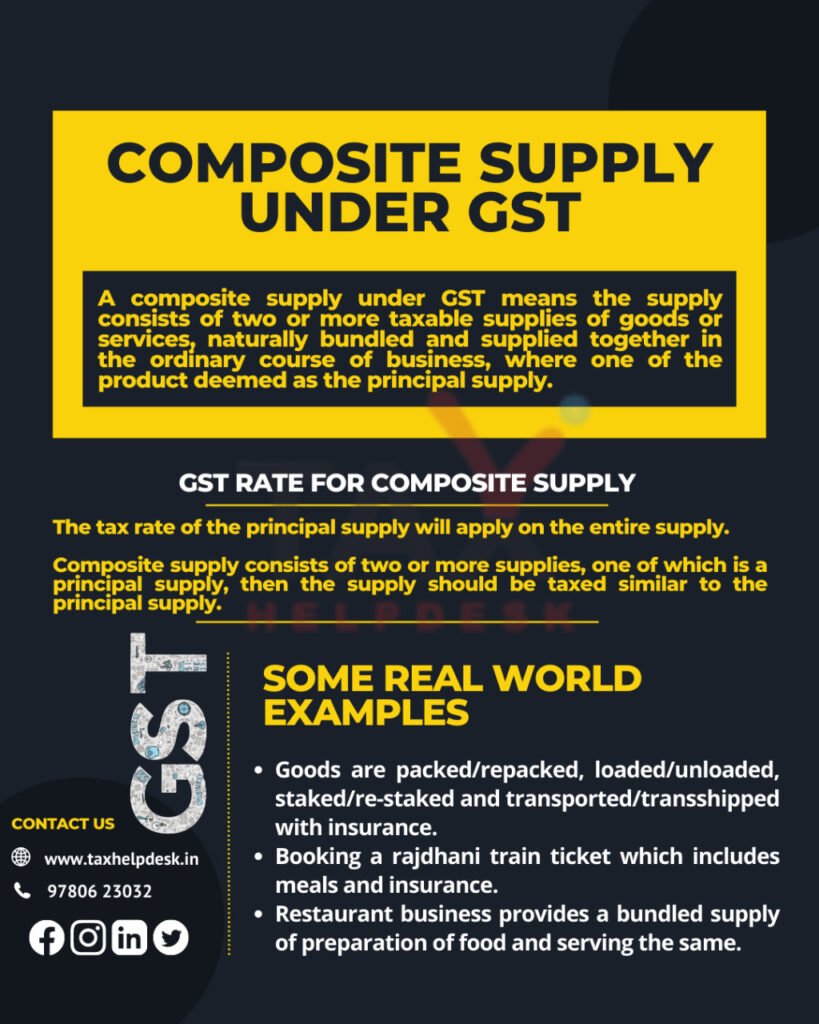

Under GST, a composite supply would mean a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

Also Read: Types of supply under GST

Characteristics

For any supply to be composite supply under GST, it should have the following characteristics:

– Firstly, supply should consist of two or more supplies.

– Secondly, both supplies should be taxable supplies under Goods and services tax in India.

– Thirdly, supply can be either of goods or services or a combination of both.

– Fourthly, the combination of supplies made should conjunctive to each other, that is, should be made together at the same time.

– Fifthly, supplies should be naturally bundled.

– Sixthly, it is possible to bundle two or more supplies in the ordinary course of business.

– Lastly, out of the combination of supplies made, one should be a principal supply.

Also Read: Relevance of supply under GST

Illustration

Examples of composite and principal supply are as follows:

– Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply.

– A works contracts and restaurant services

Naturally blended supplies: Meaning

For the purposes of composite supply, goods and services (GST) has not defined the term ‘naturally blended’ specifically. But according to CBEC, the term ‘Bundled Service’ means:

‘Bundled service’ means a bundle of provision of various services wherein an element of provision of one service is combined with an element or elements of provision of any other service or services. An example of ‘bundled service’ would be air transport services provided by airlines wherein an element of transportation of passenger by air is combined with an element of provision of catering service on board. Each service involves differential treatment as a manner of determination of value of two services for the purpose of charging service tax is different.

The rule is – ‘If various elements of a bundled service are naturally bundled in the ordinary course of business, it shall be treated as provision of a single service which gives such bundle its essential character

Also Read: Qualifications for GST Registration

Illustration

– A hotel offering a 5 Days, 4 Nights package including breakfast is a natural bundling of services in the ordinary course of business. In addition, the hotel accommodation service is giving the whole bundle its essential character. Therefore, the entire bundle would treat as service of providing hotel accommodation.

– A 5 star hotel booked for a conference of 100 delegates on a lump sum package offers following facilities:

– Accommodation for the delegates

– Breakfast for the delegates

– Tea and coffee during conference

– Access to fitness room for the delegates

– Availability of conference room

– Business center

Meaning of Principal Supply

Principal supply is a supply of goods or services and most importantly, constitutes the predominant element of a composite supply.

The GST Act defines principal supply as:

“Principal supply means the supply of goods or services which constitutes the predominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary.”

How to determine composite supply is naturally bundled in ordinary course of business?

Whether services are bundled in the ordinary course of business would depend upon the normal or frequent practices followed in the area of business to which services relate. Such normal and frequent practices adopted in a business can be ascertained from several indicators some of which are listed below –

– The perception of the consumer or the service receiver. If large number of service receivers of such bundle of services reasonably expect such services to be provided as a package, then such a package could be treated as naturally bundled in the ordinary course of business.

Also Read: GST Rates on Travel

– Majority of service providers in a particular area of business provide similar bundle of services. For example, bundle of catering on board and transport by air is a bundle offered by a majority of airlines.

If the nature of services is such that one of the services is the main service and the other services. It combine with such service are in the nature of incidental or ancillary services. These services help in better enjoyment of a main service. For example, service of stay in a hotel is often combine with a service. Moreover, it is laundering of 3-4 items of clothing free of cost per day. Such service is an ancillary service to the provision of hotel accommodation. In addition, resultant package treat as services naturally bundled in the ordinary course of business.

Having stated that, no straight jacket formula can be laid down to determine whether a service is naturally bundled in the ordinary course of business. Each case individually examine in the backdrop of several factors. Some of which are outlined above.

Conclusion

The following table can help you in determining whether the supply is a composite supply or not:

| Scenario | Factors to Consider | Illustration |

|---|---|---|

| Scenario 1: Multiple Components | Two or more identifiable components or elements being supplied together. | A laptop (hardware) with pre-installed software. |

| Scenario 2: Interdependence | Components are dependent on each other to fulfill their intended purpose. | A printer and its accompanying ink cartridges. |

| Scenario 3: Principal Supply | A principal supply determines the nature of the composite supply. | A mobile phone (principal supply) sold with a free phone case. |

| Scenario 4: Bundled Pricing | Supply is priced or invoiced as a single unit or individually priced components. | A restaurant meal that includes a main dish, side dish, and dessert, all priced separately. |

| Scenario 5: Customer Perception | How the customer perceives the supply. | A travel package that includes flights, accommodation, and local transportation, perceived as a single package by the customer. |

| Scenario 6: Nature of Components | Components typically provided together or can be acquired separately. | A computer system that includes a CPU, monitor, keyboard, and mouse, commonly sold as a complete package. |

| Scenario 7: Regulatory Definitions | Specific definitions or provisions within GST laws. | Medical services provided by a hospital, which may be defined as a composite supply under healthcare regulations. |

If you want to know more about GST supply or take TaxHelpdesk’s GST consultation, then drop a message below in the comment box or DM us on Whatsapp, Facebook, Instagram, LinkedIn and Twitter. For more updates on tax, financial and legal matters, join our group on WhatsApp and Telegram!

Disclaimer: The views are personal of the author and TaxHelpdesk shall not be held liable for any matter whatsoever!