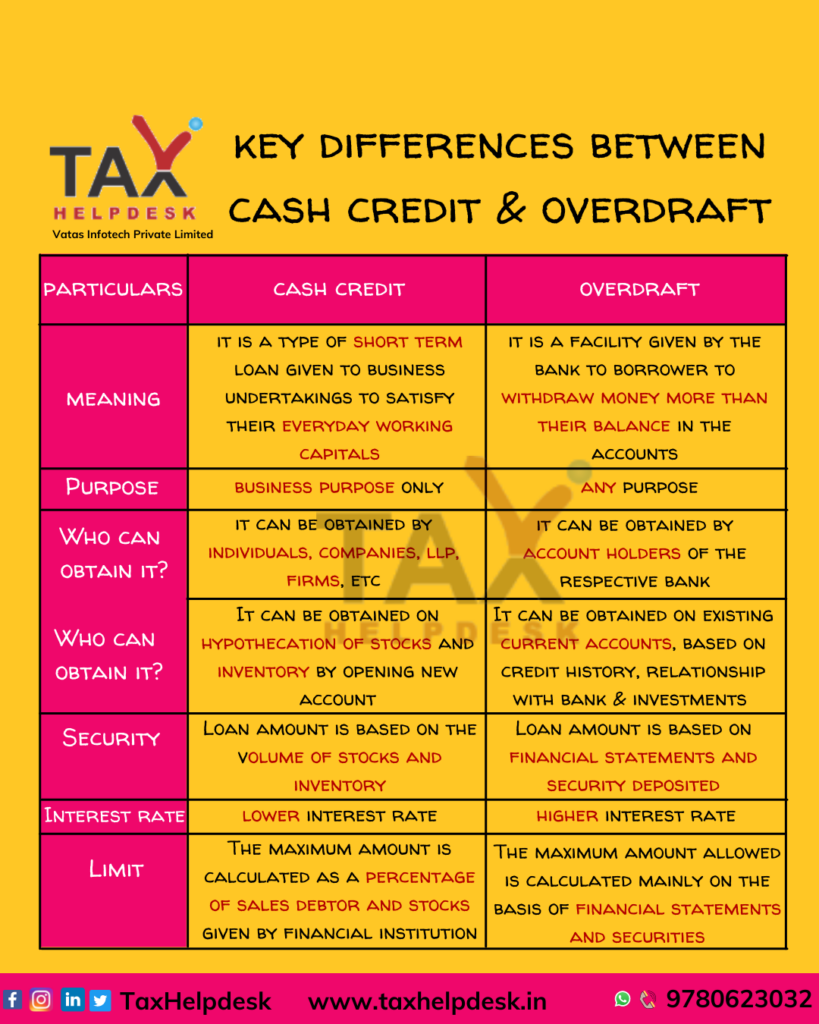

The major difference between Cash Credit & Overdraft is dependent on various factors like

– Purpose

– Who can obtain it

– How can it be obtained

– Security,

– Interest Rate,

– Limit

Cash Credit is a type of short term loan given to business undertakings to satisfy their everyday working capitals and on the other hand, Overdraft is a facility given by the bank to borrower (individuals, firms, companies or others) to withdraw money from the banks even if balance in his bank account is low, zero or below the amount to be drawn.

Difference between Cash Credit and Overdraft

The Cash Credit and Overdraft, both of these instruments are used to borrow funds. Following are the differences between the two:

| Aspect | Cash Credit | Overdraft |

|---|---|---|

| Nature | A running account facility | A borrowing facility |

| Purpose | To meet working capital needs | To cover short-term cash shortages |

| Type of Facility | Revolving credit facility | Credit line facility |

| Limit | Generally higher limit | Usually lower limit |

| Collateral | Requires collateral | May or may not require collateral |

| Interest | Charged only on the utilized amount | Charged on the overdrawn amount |

| Withdrawal | By drawing against the credit limit | By over-withdrawing from the account |

| Repayment | Periodic repayments required | Flexible; can be repaid at any time |

| Renewal | Requires periodic renewals | Generally renewed annually |

| Usage | Commonly used by businesses | Used by individuals and businesses |

| Applicability | Mostly for business finance | Used for personal or business emergencies |

| Bank’s Discretion | Bank may decide the credit limit | Overdraft limit is decided by the bank |

Also Read: TDS On Cash Withdrawal From Bank In A Financial Year

Eligibility & Document Requirements for Cash Credit and Overdraft

| Document Type | Cash Credit | Overdraft |

|---|---|---|

| Application Form | Filled application form for the facility | Filled application form for the facility |

| Business Details | Business registration certificate | For businesses: Business registration documents |

| Memorandum and Articles of Association (if applicable) | For individuals: Proof of identity and address | |

| Financial Statements | Audited financial statements (last 2-3 years) | Financial statements (last 2-3 years) |

| Bank Statements | Recent bank statements (6-12 months) | Recent bank statements (6-12 months) |

| Income Proof | Income tax returns (for businesses and individuals) | Income tax returns (for individuals) |

| Collateral Details | Details of collateral offered (if required) | Details of collateral offered (if required) |

| Project Report | Business plan or project report (for new projects) | Business plan or project report (if applicable) |

| KYC Documents | Know Your Customer (KYC) documents for the business and its promoters or individuals applying | KYC documents for individuals applying |

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram, Twitter and Linkedin!

Pingback: How to determine your Net Worth? | TaxHelpdesk