We all are aware that the word “Sensex” and “Nifty” are the words related to stock market. But what do these words actually mean? Both Sensex and Nifty are the market indexes/indices that represent the market. They are the touchstones for any country’s stock market, for the outgrowth in the industry as well as for the individual investor’s portfolio.

Before explaining in detail the meaning and scope of Sensex and Nifty, one must know the meaning of Index.

What is an Index?

In simple words, an index is a measure or indicator of the overall performance of a pool of similar items. In terms of the stock market, an index is the statistical indicator of change in the performance of the securities that can reiterate a specific market area. An index is made up of securities that are chosen based on market capitalisation or any other criteria. Any change in the price of the underlying securities affects the value of the index.

These indexes can be used to used to measure economic indicators like inflation as well as interest rates. The investors can compare their investment portfolio returns against the benchmark returns and make changes to their portfolio if needed.

Also Read: How To Adjust Profit/Losses From Transfer Of Shares

What is Sensex?

The word Sensex has been derived from the word “Sensitive” and “Index”. It is the market index of Bombay Stock Exchange or BSE, also known as S&P BSE Sensex. For any company to be on Sensex, it must be listed on Bombay Stock Exchange.

Sensex comprises of 30 number of companies. These companies are chosen on the basis of:

– Liquidity,

– Market Capitalisation,

– Revenue, and

– Diversification of company

An increase in the value of Sensex is due to an increase in the price of most of the securities. While a decrease in the value of the index is due to the fall in the price of most of the underlying securities.

What is Nifty?

The word Nifty stands for National Stock Exchange Fifty. It is the equity benchmark index of the National Stock Exchange or NSE. It was introduced by NSE in 1996, and its other aliases are Nifty 50 and CNX Nifty.

Nifty is a variation of the terms “National” and “Fifty”. Therefore, as the meaning of the term suggests, it consists of the top 50 stocks listed on the National Stock Exchange. The top 50 stocks that comprise the Nifty 50 are from 12 different sectors. Some of these include information technology, consumer goods, financial services, automobiles, telecommunications, etc.

The factors which are considered for a company to be listed on Nifty 50 are:

– Liquidity – The stock should have been traded at an average cost of 0.50% or less in the last six months.

– Float Adjustment: The float-adjusted market capitalisation of the company must be at least twice that of the current smallest index composition.

– Domicile i.e., the company must be registered on NSE and be an Indian company.

Also Read: Taxability Of Intraday Trading

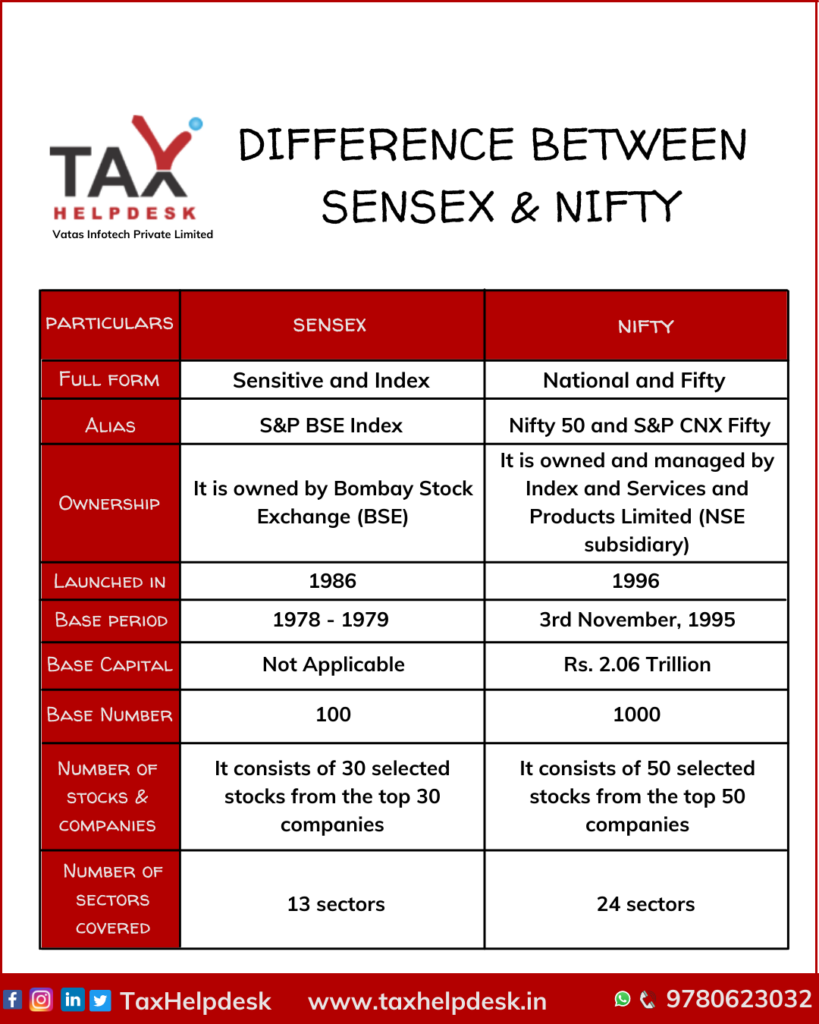

Now that you are aware of the meaning and scope of the Sensex and Nifty. The differences between the two are as following:

Difference between Sensex and Nifty

Pingback: Know About Repo Rate & Reverse Repo Rate | TaxHelpdesk

Pingback: How is Nifty and Sensex Calculated? | TaxHelpdesk

Pingback: Taxability of Capital Assets in India | TaxHelpdesk