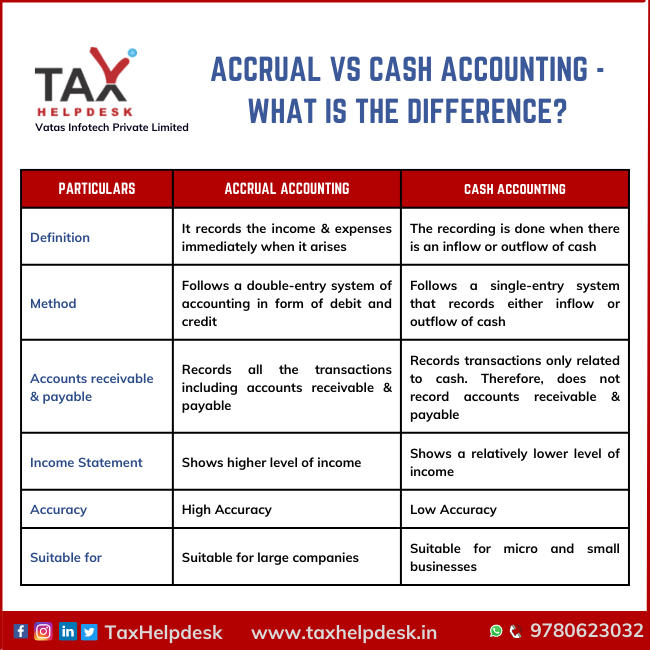

Accrual vs Cash Accounting are two different methods that are useful in recording transactions. Further, knowing the difference between these two can help you in understanding their effects on your business.

Accrual vs Cash Accounting: Differences

1. Meaning

Accrual accounting is an accounting where any income or expense is recognised as and when it is earned. In addition to this, it has no concern with the time of payment or collection of income. Whereas, the cash accounting, as the name suggests is a type of accounting where any income or expense is recognised only when there is an inflow or outflow of cash.

Also Read: Types Of Golden Rules Of Accounting

2. Single and double entry accounting transactions

Mostly people use single entry and double entry accounting type of transactions for their business. And under the accrual accounting, people use the double entry system. In this system, there is recording of each transaction under a minimum of two accounts. While one relates to the debit account, the other one relates to the credit account.

Also Read: Fundamentals Accounting Assumptions: An Overview

On the contrary, the cash accounting uses the single entry system. Under this system, people record transactions as single entries in their cash book or a journal. Moreover, this type of accounting only records the transactions wrt cash coming in as payments or cash going out as expenses.

3. Recording of Accounts Receivable and Accounts Payable

The next major difference of Accrual vs Cash Accounting is in relation to recording of accounts receivable and accounts payable. To understand this difference, we need to know first the meaning of accounts receivable and accounts payable.

Accounts receivable is the sum of money that the debtors owe to your company. Therefore, it is a credit transaction in which there is earning of revenue before receiving of cash. It is so because it is an asset for your company for it indicates a pending payment which will come to your company.

Also Read: How to remain financially sound in 2022?

On the other hand, accounts payable is the opposite of the accounts receivable. That is to say, accounts payable is the total money that you owe to the vendors for buying supplies on credit and payment is still pending. Therefore, it is a liability for you because it indicates a payment that you have to make to your vendor/seller.

The accrual accounting records both accounts receivable and accounts payable transactions but it is not the case in cash accounting. The cash accounting does not record these transactions because there is neither inflow nor outflow of cash.

4. Income Statement

Under the accrual accounting, the income levels are relatively higher than the cash accounting. This is so because under the accrual accounting, there is recording of all the transactions. That is to say, even if the payment has not been made by the debtor but is due, then the same is considered as income under the accrual accounting. However, under the cash accounting, there is recording of transactions only when there is actual inflow of cash.

5. Accuracy

Accuracy is the most important difference of cash vs accrual accounting. Since, accrual accounting system records all the entries wrt assets, liabilities and equity, it is considered to be more accurate than the cash accounting. Moreover, the cash accounting does not record the accounts receivables and payables, the balance sheet does not reflect assets or liabilities. Hence, cash accounting is less accurate than accrual accounting.

Also Read: All You Need To Understand About Mutual Fund Taxation SIP

6. Suitable for persons

At last but not the least, the big corporations having various assets, liabilities and equities make use of the accrual accounting. Whereas, micro and small businesses prefer cash accounting.

Now that you know differences between accrual vs cash accounting, choose the accounting method most suitable for your business. If you still have doubts, then click here to take TaxHelpdesk’s expert consultation.

Join our Telegram channel for regular updates on Income Tax, GST, Finance and Law.

Views of the author in this blog are personal. Please take help of expert before taking any decision.