The Government has extended due dates for financial 2019-20, keeping in view the COVID-19 pandemic.

List of extended due dates

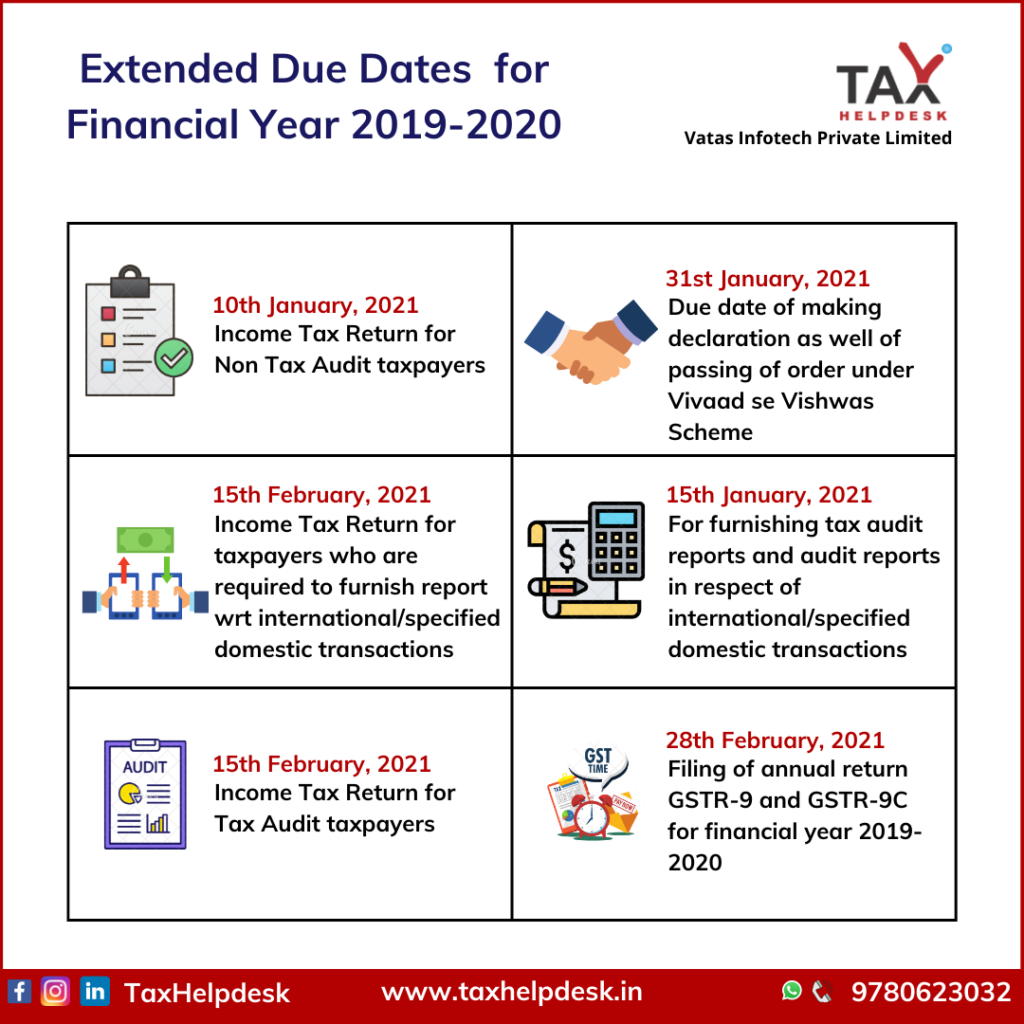

The list of extended due dates for various compliances are as follows:

Extended due date for Income Tax Return for Non-Tax Audit taxpayers

Firstly, due date for filing of ITR for individuals not requiring audit of books of accounts is 31st July. However, due to the pandemic disease coronavirus, there was an extension of due date to 31st December, 2020. The Government has now given more time to taxpayers to file their Income Tax. Therefore, the due date for filing of ITR for Non-Tax Audit taxpayers now stands as 10th January, 2021.

Also Read: Do I Need to File Income Tax Return?

Income Tax Return for tax audit taxpayers

Secondly, the earlier due date for furnishing of ITR for the taxpayers (including their partners) who require auditing of their books of account was earlier 31st October, 2020. Further, now the extended due date is 15th February, 2021.

Also Read: Know Penalty Related to Late Filing of Income Tax Return

Income Tax Return for Transfer Pricing

Thirdly, the due date for filing of ITR for Transfer Pricing was 30th November, 2020. There was further extension of due date to 31st January, 2021. In addition to this, the government has further extended due dates to 15th February, 2021.

Note:

Transfer pricing ITR contains the transactions in relation to international/specified domestic transactions.

Also Read: Ways to Save Tax Other Than Section 80C

Furnishing of Tax Audit Reports

Fourthly, earlier the due date of furnishing the tax audit reports and report wrt international/domestic specified transactions earlier was 31 December, 2020. As a result of pandemic, this due date has been extended to 15th January, 2021.

Note:

Tax audit is a provision under Section 44AB of the Income Tax Act. It is mandatory in the cases where

- The businessman’s total sales, turnover or gross receipt exceeds ₹1 crore in the preceding financial year or

- Where the businessman carrying on business eligible for presumptive taxation under Section 44AD declares taxable income below the limits prescribed limits and

- Has income exceeding the basic threshold limit.

Settlement under Vivad Se Vishwas scheme

Fifthly, the extended due date for making declaration under Vivad Se Vishwas is 31st January, 2021. Consequently, the due date for passing orders is also 31st January, 2021.

Issuance of notice under Direct Taxes & Benami Acts

Sixthly, the due date for passing orders or issuing notice by the authorities under the Direct Taxes & Benami Acts is 31st March, 2021.

Payment of Self Assessment Tax

Seventhly, for taxpayers, having Self Assessment Tax liability of up to ₹1 lac, the due date for the payment of the tax is now 15th February, 2021. Previously, this due date was 30th November, 2020.

Also Read: All About Advance Tax Under Income Tax Act

Annual GST Return For Financial Year 2019-2020

Lastly, the extended due date for filing of annual return, GSTR-9 and GSTR-9C is now 28th February, 2021.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin!