With a vision of Atma Nirbhar Bharat, our Prime Minister Narendra Modi had announced the Faceless Assessment Scheme – Honouring the Honest last year in August. Through this scheme, all the income tax appeals including e-allocation of appeals, e-communication of notices, e-verification, e-enquiry and e-hearing shall take place online.

The Income Tax Department started rolling down with this scheme from August, 13, 2020 and over a lakh of cases have been already assigned. The Faceless Assessment Scheme is different from the Current Scheme in many ways. The differences between the two are as follows:

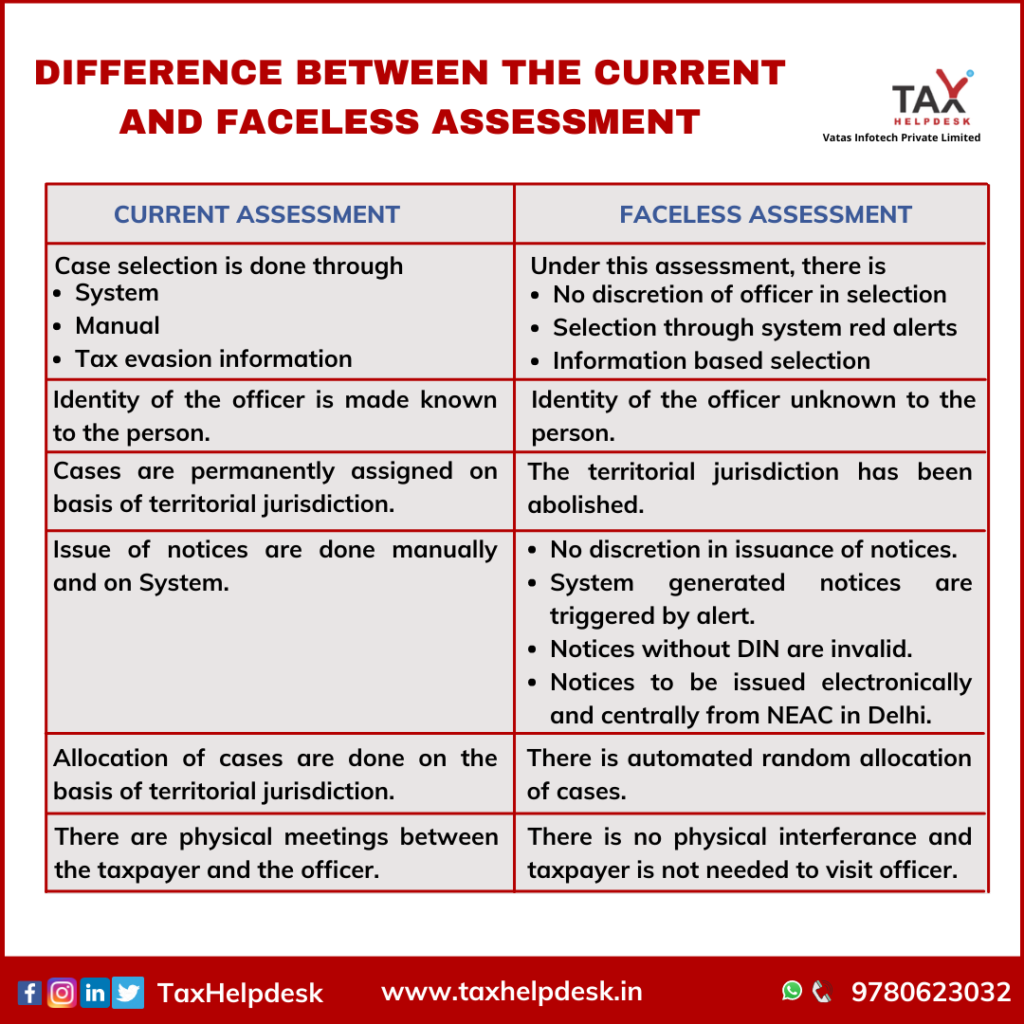

- Under the current assessment system, the case selection is done through system, manually and on the basis of tax evasion information. While on the other hand, under the faceless assessment, there is no discretion of the office in selection, selection is done through system red alerts and is selected on the basis of information.

- Under the current assessment scheme, since the taxpayer has to visit the officer in person, the identity of the officer is made known to him. While in the case of faceless assessment, identity of the officer is unknown to the taxpayer.

- The territorial jurisdiction plays a key role in assigning cases under the current assessment. The faceless assessment scheme abolishes such territorial jurisdiction.

- The issuance of notices are done manually and on system under the current scheme whereas under the faceless assessment, there is no discretion in issuance of notices. The system generated notices are triggered by alert. Notices under the faceless assessment are required to have Document Identification Number(DIN). Without DIN the notices are invalid. Notices under this scheme are to be issued electronically and centrally from NEAC in Delhi.

- Under the current assessment scheme, the allocation of cases are done through territorial jurisdiction. Whereas, under the faceless assessment scheme, there is automated random allocation of cases.

- Current assessment scheme requires physical meetings between the taxpayer and the officer but the faceless assessment scheme requires no physical interference and taxpayer is not needed to visit the office.